This is the third post in the

Building a Brokerage House series. The first article sketched the business’s general layout, helping you define your services, product package, and target audience, while the

second article put the intricate regulation side in perspective.

I’m about to go deeper into the subject and reveal the next moves you need to make to see your business take off and adjust your strategies as you go along.

Every broker-dealer is different, but calibrating technology to your business model follows the same pattern, so I’ll share a breakdown of

costs,

skills,

technology &

payment providers,

connection to exchanges, and everything else I find useful for you to know.

Internal vs. Outsourced Development

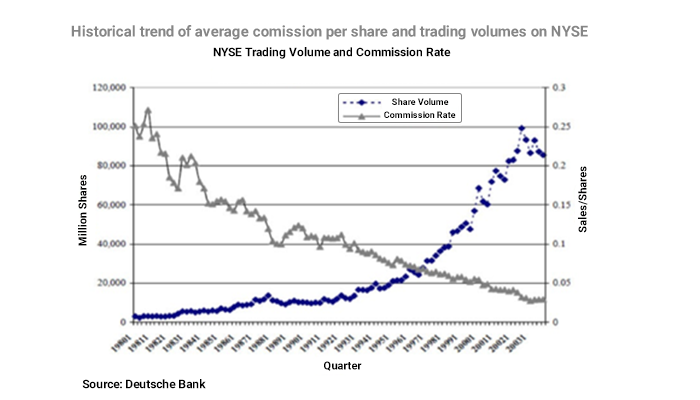

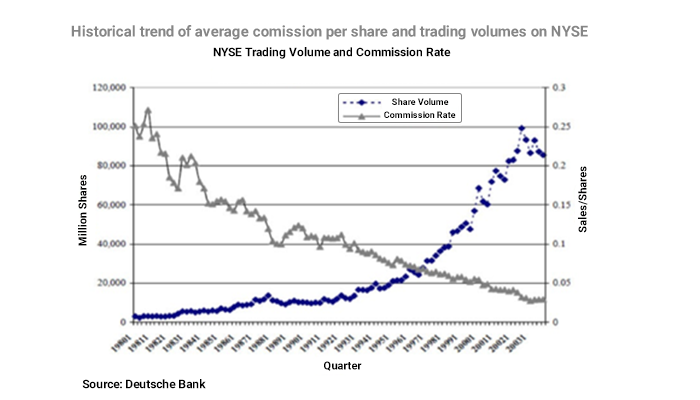

Between 2000-2005 trading was the prerogative of informed and institutional investors. However, with the growing internet and smartphone spike, technology has rewired the trading infrastructure, allowing retail clients to access the markets and use derivative instruments, increasing trading volumes and liquidity.

Because everyone is now focusing on technology, your startup needs to constantly advance the backend & frontend and automate most of the processes, but first, you’ll have to choose between:

1. Internal Development

2. Outsourced Development

3. A mix between Internal and Outsourced

Internal Development

Most of us dream of becoming the architects of our vision, but it’s paramount to understand that doing everything in-house may involve not only huge costs but teams of highly-skilled professionals. You may

spend hundreds, if not millions of euros a year and gain an advantage of nanoseconds over your competitors.

Pros:

- You build everything from scratch and get total freedom over design, features, integration, and functionalities.

- You adjust along the way and save time by not waiting for outsourced developers to start working on your requests.

- You manage your own teams, which gives you a free hand in picking them out and leading them towards your goals.

Cons:

- The overall costs are massive and could cripple your business from the start.

- It’s not cheap to have Dev-Ops Engineers, considering they rank in the top five of all tech salaries, commanding an average pay of €106,000.

- It’s unrealistic to claim that the entire technology ecosystem can be developed internally, so you’ll have to reach deep into your pocket and pay for extra services and integrations as well.

Outsourced Development

This approach may be sensible for a brokerage house just starting out. Paying for already-developed services, such as a

Whitelabel, with rule-based automation can spare you the nuisance of doing everything yourself. You’ll be able to focus on improving the customer experience, create partnerships to sustain your cash flow needs, and strategize for better and faster ROIs.

Pros:

- The start-off is cheaper, ranging from €250,000 to €500,000, and it gives you extra space to funnel your funds into other areas of your business.

- You get a determined product package accompanied by a support network.

- Apart from the platform and features, they provide API for all your other integration processes.

Cons:

- Most of the 3rd party services you pay for are pre-built with little room for development or customization.

- You still have to make a lot of additional integrations and pay tens of thousands per month for hosting, technical support, maintenance & change requests, feed, liquidity, and Back Office.

- Depending on the business plan you acquire and the technology provider’s availability and priorities, all your development tickets will take time.

- You just rent the technology, you don’t own it, which means that every additional request will pile up as an extra cost for you.

A mix between Internal and Outsourced

In my experience,

paying for a Whitelabel and

adding internal developments might be what you’re looking for at this point.

You can buy the platform & features, brand them, negotiate as much as you can for extended permissions to customize, then proceed with the CRM, payments, and liquidity processors integrations yourself. Basically, you need a predefined structure that you can fashion to your necessities.

Essential Integrations to Get the Ball Rolling

You now have a functional platform with various features. But there’s no business without clients, and you’re not going to have them unless you start receiving online payments.

Choose the Best Payment Provider for Your Business

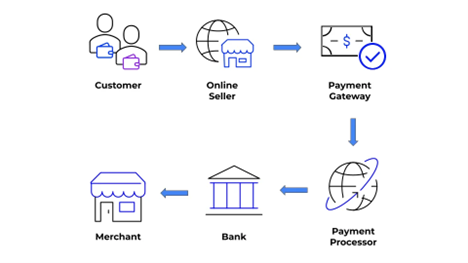

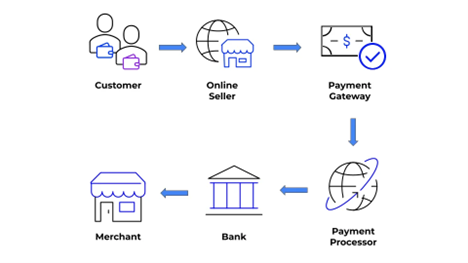

If you want to smoothly run your customer payment process and set up your cash flow, online payments via payment gateways are the best way to go. You need a well-built system to handle sensitive information when charging clients’ debit/credit cards.

The gateway transfers the transaction data and approves or declines the payment. This is when the payment processor comes in and acts as a mediator between the cardholder, merchant, acquiring bank, gateway, and issuing bank. It groups and manages all clients in one big merchant account, with almost the same rate and fee for all clients.

Choose your PSP based on:

1.

Overall reputation: focus on longevity, quality, and level of support.

2.

Service package: international coverage and multiple payment methods (debit cards, e-wallets, prepaid cards, mobile payments).

3.

Technical requirements: API & iFrame connections.

4.

Security protocols: the PSP must adhere to worldwide security standards, such as Payment Card Industry Data Security Standard (PCI DSS).

5.

Account opening process: find out if it’s lengthy, time-consuming, or straightforward and less complicated.

6.

Support services: a large number of payment rejection rates can lead to reduced profits. You’ll have to pay additional costs by 3–4.5% of direct debit payments for collections and warnings. Most PSPs can provide risk protection services to eliminate these additional charges.

7.

Costs: PSPs usually have a one-time setup fee and a fixed monthly cost that could start as low as €475.

As a brokerage firm, you’ll also need to store customers’ funds in separate bank accounts, to ensure that they will never be misappropriated.

Segregated accounts mean that the company cannot use the funds to conduct business operations. The money is secure in case the company goes bankrupt. Traders are more likely to trust brokers that offer segregated bank accounts, so it’s a win-win situation.

Liquidity Providers & Connection to Exchanges

A liquid market translates into smoother transaction flows and competitive pricing, so liquidity provision is essential for effective trading. The main purpose of a liquidity provider is to ensure an uninterrupted flow between demand and supply and provide the best buy and sell prices.

If you choose an

Electronic Communications Network/Straight Through Processing (ECN/STP) network to execute your clients’ trades, make sure to connect to multiple

Tier 1 liquidity providers to secure the best spreads and dealing rates.

When brokers connect to the exchanges, they typically use the

FIX Protocol (Financial Information eXchange.) Most trading systems have

FIX API connections available.

To find the best liquidity provider, you’ll have to analyze several factors:

1.

Overall package: should provide multi-asset liquidity, nominated account in different currencies, and access to the FIX protocol and historical data.

2.

Market depth: a high number of buy and sell at each price suggests a higher market depth, indicating market liquidity.

3.

Fast execution: with re-quotes or slippage.

4.

Pricing: competitive spreads and low commissions.

5.

Data feeds: stable & reliable with feeds reflecting real-time prices from various exchanges.

6.

Regulation: for best practices, the liquidity provider should adhere to strict rules and comply with regulations the same way a broker does.

7.

Reporting: automated and compliant reporting system: trades, FIX bridge, swaps & rollovers, order book access.

8.

Software: FIX protocol and other APIs, MT5 bridge connections, FIX bridges.

Cost Estimates and How Brokers Make Money

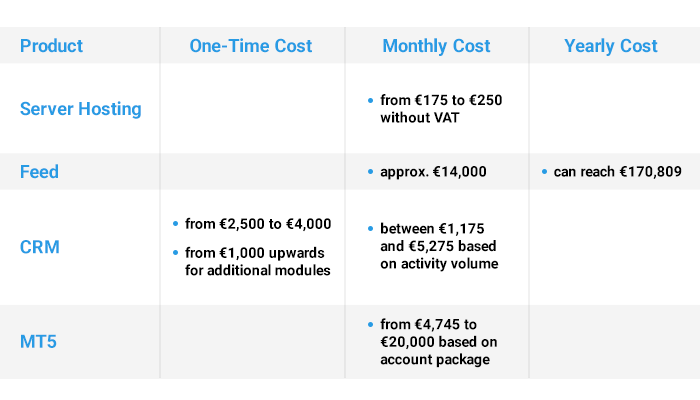

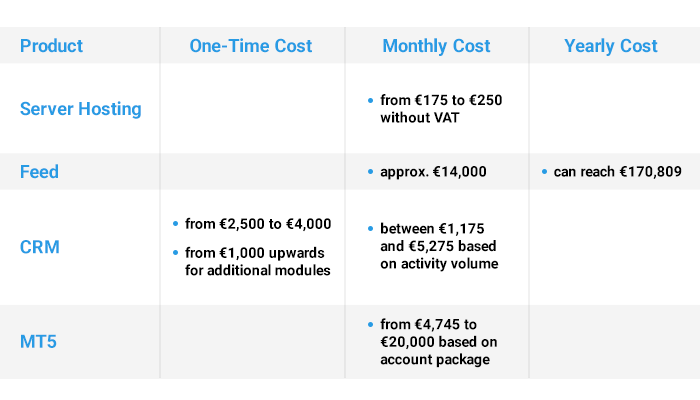

Apart from the core technology, there are additional costs for all integrations you need. You want extra features - you need to pay. You want constant developments - it adds up to your monthly bill. All service providers have various business plans you can choose from, and most of them leave room for negotiation, so write down your necessities and start searching for the ideal setup.

I’ve rounded up some of the most important integrations you’ll have to make and the average costs of covering them.

As for

profits, you need to understand that commissions on trades are now a relic of the past since Robinhood disruptively eliminated them. You can still apply

deposits/

withdrawals,

inactivity, and

overnight fees. Like most players in the industry, you can choose the

bid-ask spread as a

key source of revenue.

Conclusion

Nothing is as easy as it seems, especially when you want to go the entrepreneurial way.

Building a Brokerage House takes more than just basic knowledge about the financial markets. It requires a large capital and in-depth research, high technology with key people, a great deal of willpower on your part, negotiation skills, and a trained eye for innovation opportunities. Expect the worst, but aim for the best and be prepared for a lengthy process. Even so, the rewards will definitely outmatch the obstacles and difficulties along the way. There are still some important sides of the business you need to be aware of, but I’ll leave it for the following articles in the series.

You can follow me on

Twitter and

LinkedIn!

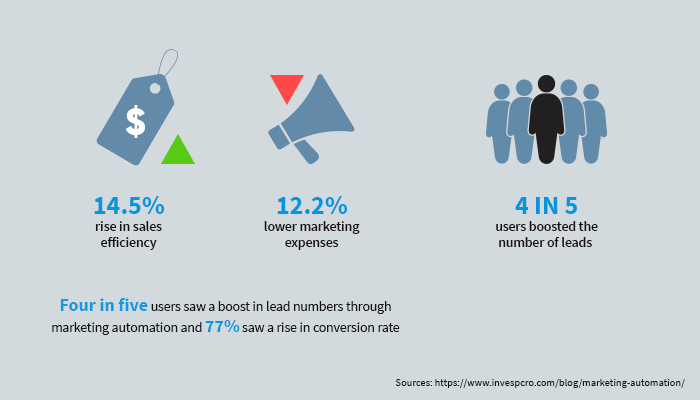

Worldwide there are 4.9 billion internet users with purchasing power and specific consumer behavior. The main questions you need to ask yourself in this early stage are related to your target audience and communication channels. In a later stage, you’ll have to focus on a multi-channel approach, but, for the moment, the secret is to keep it lean and have minimum requirements from your marketing department.

Worldwide there are 4.9 billion internet users with purchasing power and specific consumer behavior. The main questions you need to ask yourself in this early stage are related to your target audience and communication channels. In a later stage, you’ll have to focus on a multi-channel approach, but, for the moment, the secret is to keep it lean and have minimum requirements from your marketing department.

III. On the affiliate side, make sure you have competitive payouts (do some research to see what others are paying), a robust tracking system that allows affiliates to check their performance, and fast & professional assistance for them. Taking care of affiliates guarantees your product receives the necessary exposure to efficiently attract new clients.

IV. You’ll need at least 1 Front-End Developer, also known as a client-side developer, to produce HTML, CSS, and JavaScript for your website or Web Application. He’s at the crossroads of design and engineering, blending personas, pixels, and polish with the realm of logic and loops.

V. As for Design & Content, you can outsource the services at this stage. Most agencies charge between $80 and $200 per hour for digital marketing. Just make sure your briefs are thorough enough and can generate content and creatives to match your projections.

III. On the affiliate side, make sure you have competitive payouts (do some research to see what others are paying), a robust tracking system that allows affiliates to check their performance, and fast & professional assistance for them. Taking care of affiliates guarantees your product receives the necessary exposure to efficiently attract new clients.

IV. You’ll need at least 1 Front-End Developer, also known as a client-side developer, to produce HTML, CSS, and JavaScript for your website or Web Application. He’s at the crossroads of design and engineering, blending personas, pixels, and polish with the realm of logic and loops.

V. As for Design & Content, you can outsource the services at this stage. Most agencies charge between $80 and $200 per hour for digital marketing. Just make sure your briefs are thorough enough and can generate content and creatives to match your projections.

Usually, it's not a matter of if but when your brokerage house hits the mid-range threshold. Most players in the market dwell in this juicy phase, where a lot of change is happening, and you start to get traction. You've just come out of the simmering stage and need to ramp up your marketing efforts for advanced brand recognition. You'll start focusing on how you rank in your client's preferences and your overall ratings, so here is a breakdown of what's next:

Usually, it's not a matter of if but when your brokerage house hits the mid-range threshold. Most players in the market dwell in this juicy phase, where a lot of change is happening, and you start to get traction. You've just come out of the simmering stage and need to ramp up your marketing efforts for advanced brand recognition. You'll start focusing on how you rank in your client's preferences and your overall ratings, so here is a breakdown of what's next:

If you've reached this level, kudos to you! Few brokerages houses make it this far, so take time to breathe in the thin air, then start strategizing again. Everyone expects the world from you now, so reaching new heights gets trickier while free falling is a constant reminder.

If you've reached this level, kudos to you! Few brokerages houses make it this far, so take time to breathe in the thin air, then start strategizing again. Everyone expects the world from you now, so reaching new heights gets trickier while free falling is a constant reminder.

Between 2000-2005 trading was the prerogative of informed and institutional investors. However, with the growing internet and smartphone spike, technology has rewired the trading infrastructure, allowing retail clients to access the markets and use derivative instruments, increasing trading volumes and liquidity.

Between 2000-2005 trading was the prerogative of informed and institutional investors. However, with the growing internet and smartphone spike, technology has rewired the trading infrastructure, allowing retail clients to access the markets and use derivative instruments, increasing trading volumes and liquidity.

Because everyone is now focusing on technology, your startup needs to constantly advance the backend & frontend and automate most of the processes, but first, you’ll have to choose between:

1. Internal Development

2. Outsourced Development

3. A mix between Internal and Outsourced

Because everyone is now focusing on technology, your startup needs to constantly advance the backend & frontend and automate most of the processes, but first, you’ll have to choose between:

1. Internal Development

2. Outsourced Development

3. A mix between Internal and Outsourced

A liquid market translates into smoother transaction flows and competitive pricing, so liquidity provision is essential for effective trading. The main purpose of a liquidity provider is to ensure an uninterrupted flow between demand and supply and provide the best buy and sell prices.

If you choose an Electronic Communications Network/Straight Through Processing (ECN/STP) network to execute your clients’ trades, make sure to connect to multiple Tier 1 liquidity providers to secure the best spreads and dealing rates.

When brokers connect to the exchanges, they typically use the FIX Protocol (Financial Information eXchange.) Most trading systems have FIX API connections available.

A liquid market translates into smoother transaction flows and competitive pricing, so liquidity provision is essential for effective trading. The main purpose of a liquidity provider is to ensure an uninterrupted flow between demand and supply and provide the best buy and sell prices.

If you choose an Electronic Communications Network/Straight Through Processing (ECN/STP) network to execute your clients’ trades, make sure to connect to multiple Tier 1 liquidity providers to secure the best spreads and dealing rates.

When brokers connect to the exchanges, they typically use the FIX Protocol (Financial Information eXchange.) Most trading systems have FIX API connections available.

Apart from the core technology, there are additional costs for all integrations you need. You want extra features - you need to pay. You want constant developments - it adds up to your monthly bill. All service providers have various business plans you can choose from, and most of them leave room for negotiation, so write down your necessities and start searching for the ideal setup.

Apart from the core technology, there are additional costs for all integrations you need. You want extra features - you need to pay. You want constant developments - it adds up to your monthly bill. All service providers have various business plans you can choose from, and most of them leave room for negotiation, so write down your necessities and start searching for the ideal setup.

As for profits, you need to understand that commissions on trades are now a relic of the past since Robinhood disruptively eliminated them. You can still apply deposits/ withdrawals, inactivity, and overnight fees. Like most players in the industry, you can choose the bid-ask spread as a key source of revenue.

As for profits, you need to understand that commissions on trades are now a relic of the past since Robinhood disruptively eliminated them. You can still apply deposits/ withdrawals, inactivity, and overnight fees. Like most players in the industry, you can choose the bid-ask spread as a key source of revenue.

The brokerage license allows you to offer online trading services depending on the jurisdiction you choose and the regulatory entity covering the services you want to provide.

So, once you've done your homework and feel ready to get started, you can think about the licensing and regulatory side of the business.

Choosing the regulator helps you to:

1. Decide on the type of customers you are targeting

2. Have a clear idea of what services you can offer

3. Prepare the amount of capital you need

4. Establish the company's organizational chart

Before I get into more details, I will discuss the pros and cons of having a brokerage license.

The brokerage license allows you to offer online trading services depending on the jurisdiction you choose and the regulatory entity covering the services you want to provide.

So, once you've done your homework and feel ready to get started, you can think about the licensing and regulatory side of the business.

Choosing the regulator helps you to:

1. Decide on the type of customers you are targeting

2. Have a clear idea of what services you can offer

3. Prepare the amount of capital you need

4. Establish the company's organizational chart

Before I get into more details, I will discuss the pros and cons of having a brokerage license.

The Cyprus Securities Exchange Commission, known as CySEC, is the regulatory body for the financial industry in Cyprus. Its mission is to ensure the protection of investors and the prosperous growth of the securities market. As soon as Cyprus became a member state of the European Union (2004), CySEC's regulations and operations overlapped with the European financial regulatory framework, offering Cyprus-registered companies access to all European markets.

Most companies currently licensed under CySEC are STP brokers or Market Makers offering access to online trading of financial instruments via Contracts for Difference (CFDs). Others handle asset management or investment advice.

STP brokers and Market Makers - what are the differences?

The Cyprus Securities Exchange Commission, known as CySEC, is the regulatory body for the financial industry in Cyprus. Its mission is to ensure the protection of investors and the prosperous growth of the securities market. As soon as Cyprus became a member state of the European Union (2004), CySEC's regulations and operations overlapped with the European financial regulatory framework, offering Cyprus-registered companies access to all European markets.

Most companies currently licensed under CySEC are STP brokers or Market Makers offering access to online trading of financial instruments via Contracts for Difference (CFDs). Others handle asset management or investment advice.

STP brokers and Market Makers - what are the differences?

According to the Legal Framework, a broker must set into place or outsource the following departments and functions to receive CySEC regulation and access to the rest of the European markets:

According to the Legal Framework, a broker must set into place or outsource the following departments and functions to receive CySEC regulation and access to the rest of the European markets:

EMI

EMI

Obtaining a brokerage license involves strict rules, significant capital requirements, and time to devote to the process. A brokerage firm can provide a good return on investment if you learn to play your cards right. Not everyone in this industry can launch a successful business. Hard & soft skills could be a plus, as well as generous investment capital and a high capacity to adapt to industry changes. I will talk about all these points and more in the next parts of the series, hoping it will help you set up an online trading company.

Obtaining a brokerage license involves strict rules, significant capital requirements, and time to devote to the process. A brokerage firm can provide a good return on investment if you learn to play your cards right. Not everyone in this industry can launch a successful business. Hard & soft skills could be a plus, as well as generous investment capital and a high capacity to adapt to industry changes. I will talk about all these points and more in the next parts of the series, hoping it will help you set up an online trading company.

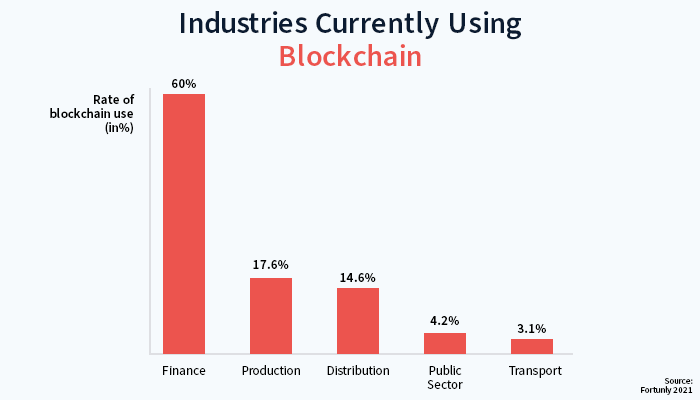

2. Medical databases. Here, the utility of Blockchain consists in maintaining the confidentiality of personal data, but also its interoperable and decentralized characteristics help. A Denver-based company, Burstiq, focuses on smart contracts in this sector.

2. Medical databases. Here, the utility of Blockchain consists in maintaining the confidentiality of personal data, but also its interoperable and decentralized characteristics help. A Denver-based company, Burstiq, focuses on smart contracts in this sector.

3. COVID vaccination. We have already talked about monitoring stocks and ingredients from the food industry and the possibility of identifying the origins of a toxic element. The idea of using the technology in stocks of COVID protection equipment and vaccines is typical, and a group of researchers in Abu Dhabi and the United States has already developed a proposal that takes into account such a thing. The scandals related to the Russian Sputnik V vaccine, of which one variant was approved, and another delivered, would be impossible through such strict monitoring, not to mention the advantages of streamlining the distribution.

4. Copyright. The evidence of music broadcasts on the radio and in different spaces is hugely complicated. The artists are continuously complaining about their revenues disappearing into the void due to many broadcasts gone missing with or without intention. Blockchain is a registry available to anyone, automatically and without error. And here, the discussion leads to smart contracts, and this is handled by a New York company called Mediachain, which Spotify acquired in 2017.

3. COVID vaccination. We have already talked about monitoring stocks and ingredients from the food industry and the possibility of identifying the origins of a toxic element. The idea of using the technology in stocks of COVID protection equipment and vaccines is typical, and a group of researchers in Abu Dhabi and the United States has already developed a proposal that takes into account such a thing. The scandals related to the Russian Sputnik V vaccine, of which one variant was approved, and another delivered, would be impossible through such strict monitoring, not to mention the advantages of streamlining the distribution.

4. Copyright. The evidence of music broadcasts on the radio and in different spaces is hugely complicated. The artists are continuously complaining about their revenues disappearing into the void due to many broadcasts gone missing with or without intention. Blockchain is a registry available to anyone, automatically and without error. And here, the discussion leads to smart contracts, and this is handled by a New York company called Mediachain, which Spotify acquired in 2017.

5. Money laundering. Even if Blockchain started its career with cryptocurrencies on the Dark Web, for various illicit payments, it could be used to certify the identity of individual financial operators, along with their biometric data. Ocular, a Los Angeles startup, creates a database that makes identity theft or forgery impossible while simplifying access to legitimate users' documents.

5. Money laundering. Even if Blockchain started its career with cryptocurrencies on the Dark Web, for various illicit payments, it could be used to certify the identity of individual financial operators, along with their biometric data. Ocular, a Los Angeles startup, creates a database that makes identity theft or forgery impossible while simplifying access to legitimate users' documents.

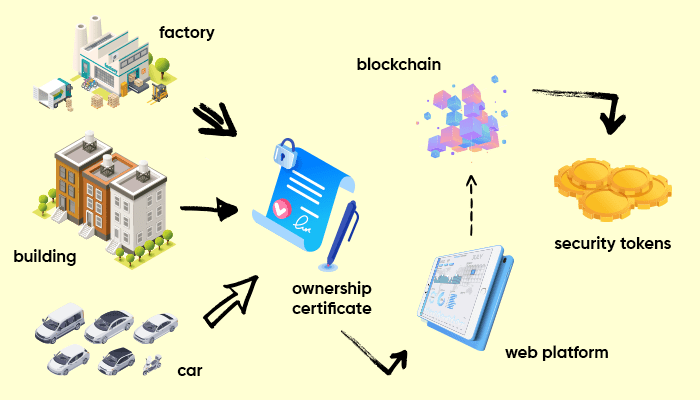

2. Democratization of investments. Nowadays, small investors generally have access to promising companies only after making their initial listing on a stock exchange (when they tend to mature and produce a steady but low profit). Venture Capital firms involved in this tend to delay the listing time to reap higher yields (profit or return of investment) as possible. This barrier tends to be removed by converting securities (shares, unlisted shares) into the same tokens, which can be accessed through "unicorn funds". This is precisely the structure proposed by ADDX (previously iSTOX), a blockchain company in which the state of Singapore and its stock exchange are involved. Access to unlisted companies can be granted starting from $20,000, a relatively large amount for beginners but insignificant compared to the millions circulating in the area of investment funds. What I said at the beginning, that Blockchain would produce the next unicorns, is also verified, meaning that it will contribute to their financing, irrespective of the industry.

2. Democratization of investments. Nowadays, small investors generally have access to promising companies only after making their initial listing on a stock exchange (when they tend to mature and produce a steady but low profit). Venture Capital firms involved in this tend to delay the listing time to reap higher yields (profit or return of investment) as possible. This barrier tends to be removed by converting securities (shares, unlisted shares) into the same tokens, which can be accessed through "unicorn funds". This is precisely the structure proposed by ADDX (previously iSTOX), a blockchain company in which the state of Singapore and its stock exchange are involved. Access to unlisted companies can be granted starting from $20,000, a relatively large amount for beginners but insignificant compared to the millions circulating in the area of investment funds. What I said at the beginning, that Blockchain would produce the next unicorns, is also verified, meaning that it will contribute to their financing, irrespective of the industry.

3. Ease of financing. From the entrepreneur's point of view, the mechanism described above translates into money from several sources, available on more advantageous terms, faster and more on-time than now. Peer-to-peer lending platforms increasingly benefit from the input of Blockchain technology and are just a marginal example, as the lender will only expect interest. But an entrepreneur who seeks to co-opt mini-angel investors in the longer term will usually place on the market many tokens that can be accessed by those interested, who expect benefits like those of angel investors but proportional to the much smaller amounts. The process is called ICO (Initial Coin Offering) because the idea of cryptocurrency is applicable here, but not in the sense of "virtual money bag". But, as the name suggests, in a sense, close to IPO (Initial Public Offering), ownership of a part of a startup. Bureaucracy, late access, high access thresholds and all other barriers related to traditional finance are missing entirely.

3. Ease of financing. From the entrepreneur's point of view, the mechanism described above translates into money from several sources, available on more advantageous terms, faster and more on-time than now. Peer-to-peer lending platforms increasingly benefit from the input of Blockchain technology and are just a marginal example, as the lender will only expect interest. But an entrepreneur who seeks to co-opt mini-angel investors in the longer term will usually place on the market many tokens that can be accessed by those interested, who expect benefits like those of angel investors but proportional to the much smaller amounts. The process is called ICO (Initial Coin Offering) because the idea of cryptocurrency is applicable here, but not in the sense of "virtual money bag". But, as the name suggests, in a sense, close to IPO (Initial Public Offering), ownership of a part of a startup. Bureaucracy, late access, high access thresholds and all other barriers related to traditional finance are missing entirely.

By granting access to the capital markets for many young, economically active investors from the Millennials segment, the Blockchain makes all this money productive, which would otherwise generate actual negative interest rates in bank accounts or simply be spent on entertainment. And the beneficiaries of the financing are exactly the entrepreneurs of the same age category, characterized by creativity and special business skills. I don't think that in 10 years, the global economy will be similar to the one we have today.

The regulation and refinement of technologies that today may seem exotic or risky will lead to a world in which prosperity will be even more accessible to any informed and initiative-driven person, regardless of his starting capital. And this prosperity will impact the entire society.

By granting access to the capital markets for many young, economically active investors from the Millennials segment, the Blockchain makes all this money productive, which would otherwise generate actual negative interest rates in bank accounts or simply be spent on entertainment. And the beneficiaries of the financing are exactly the entrepreneurs of the same age category, characterized by creativity and special business skills. I don't think that in 10 years, the global economy will be similar to the one we have today.

The regulation and refinement of technologies that today may seem exotic or risky will lead to a world in which prosperity will be even more accessible to any informed and initiative-driven person, regardless of his starting capital. And this prosperity will impact the entire society.

You can follow me on

You can follow me on

• He doesn't know or care why the cards are embossed, but he wants to be sure he can use them.

• He can avoid scams and phishing schemes, carefully comparing and choosing the most relevant offers when making a purchase.

• We will meet him less often as a couch potato, passively swallowing the brainwashing of TV programs for hours. Instead, we will see him more often on a video platform or music streaming application, where he can make his video or audio playlist. Similarly, he won't stick to a bank forever, as he will leave as soon as the application does not work or the fees and commissions get too high.

• He doesn't know or care why the cards are embossed, but he wants to be sure he can use them.

• He can avoid scams and phishing schemes, carefully comparing and choosing the most relevant offers when making a purchase.

• We will meet him less often as a couch potato, passively swallowing the brainwashing of TV programs for hours. Instead, we will see him more often on a video platform or music streaming application, where he can make his video or audio playlist. Similarly, he won't stick to a bank forever, as he will leave as soon as the application does not work or the fees and commissions get too high.

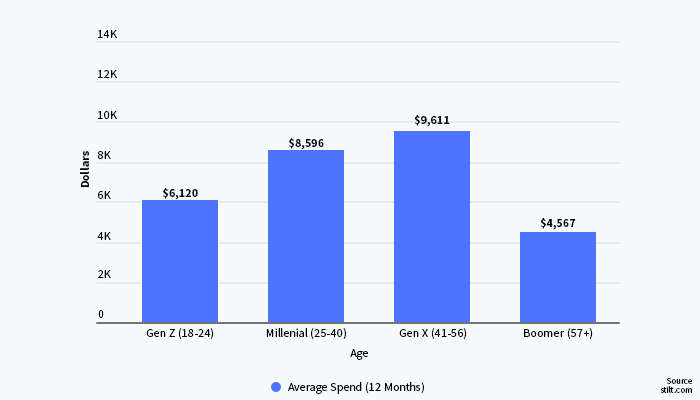

• Intuitive understanding of Blockchain, a technology related to Bittorrent. Millennials grew up in the era of illegal music downloads. And even if they abandoned them once, Steve Jobs made it possible to stream audio for more than reasonable amounts.

• Caution - or in other words, a lesser financial prowess compared to his parents, which translates into the desire to invest little, in the order of hundreds of dollars or euros, or to be able to acquire fractional shares.

• A less cautious attitude towards the volatility of cryptocurrency assets, which is since once informed, Millennials are willing to take risks, if only to learn from losses. The time for retirement is still a long way off for them, and the idea of putting money under the mattress - or in a bank account - for old age, with low yields, isn't among their priorities.

The last two features are contradictory only at first glance. Millennials are unwilling to invest much, but they are often willing to invest - much more diverse and challenging to understand, even risky asset classes.

All these needs are met by today's fintech giants, from Robinhood to Revolut. Also, with our products, such as those offered by CAPEX.com, we can promptly integrate various innovations in the market. The success of fintech and cryptocurrencies is linked to what these markets and tools offer to the abovementioned consumer.

• Intuitive understanding of Blockchain, a technology related to Bittorrent. Millennials grew up in the era of illegal music downloads. And even if they abandoned them once, Steve Jobs made it possible to stream audio for more than reasonable amounts.

• Caution - or in other words, a lesser financial prowess compared to his parents, which translates into the desire to invest little, in the order of hundreds of dollars or euros, or to be able to acquire fractional shares.

• A less cautious attitude towards the volatility of cryptocurrency assets, which is since once informed, Millennials are willing to take risks, if only to learn from losses. The time for retirement is still a long way off for them, and the idea of putting money under the mattress - or in a bank account - for old age, with low yields, isn't among their priorities.

The last two features are contradictory only at first glance. Millennials are unwilling to invest much, but they are often willing to invest - much more diverse and challenging to understand, even risky asset classes.

All these needs are met by today's fintech giants, from Robinhood to Revolut. Also, with our products, such as those offered by CAPEX.com, we can promptly integrate various innovations in the market. The success of fintech and cryptocurrencies is linked to what these markets and tools offer to the abovementioned consumer.

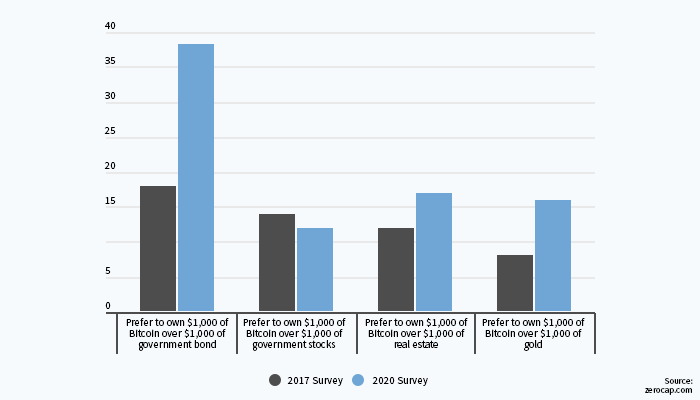

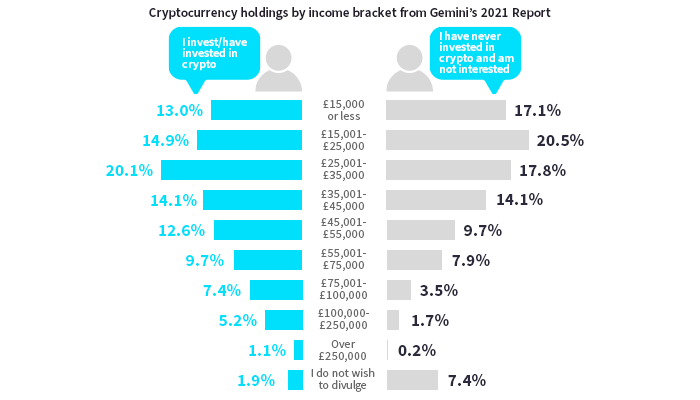

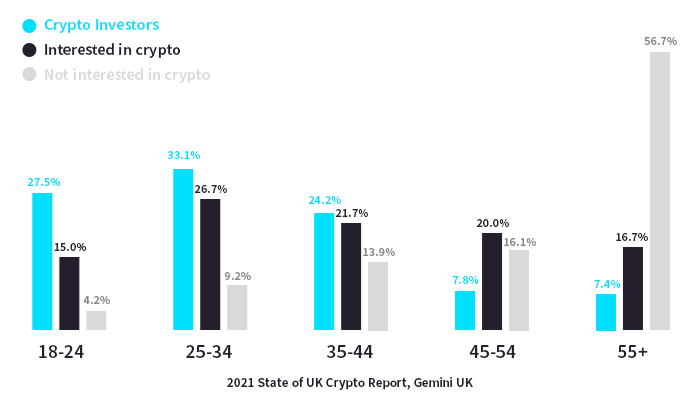

• 42% of those in the same segment, 18-34, say they could buy Bitcoin in the coming years, compared to only 25% in the 45-54 segment.

• 76% of Millennials prefer investing in cryptocurrencies to investing in gold.

• Referring to other investment opportunities also from the 18-34 age segment, 38% of respondents say they would invest in cryptocurrencies rather than government bonds, and 35% prefer stocks - higher percentages than other age groups.

• 56% of young people between the ages of 18 and 34 and 57% of adults between the ages of 35 and 44 are convinced that there is widespread adoption of cryptocurrencies.

• 42% of those in the same segment, 18-34, say they could buy Bitcoin in the coming years, compared to only 25% in the 45-54 segment.

• 76% of Millennials prefer investing in cryptocurrencies to investing in gold.

• Referring to other investment opportunities also from the 18-34 age segment, 38% of respondents say they would invest in cryptocurrencies rather than government bonds, and 35% prefer stocks - higher percentages than other age groups.

• 56% of young people between the ages of 18 and 34 and 57% of adults between the ages of 35 and 44 are convinced that there is widespread adoption of cryptocurrencies.

On top of everything, the so-called COVID crisis turned out to be quite an opportunity for fintech. We also felt it on our skin because 2020 was an excellent year for us, as we managed to obtain new trading licenses and some consistent rounds of financing.

The isolation created to a large extent by the pandemic has caused much of the investments to move online, as has shopping and business meetings, and we have been there to receive new customers. They used their available time to educate themselves financially and take the first steps in their career as investors.

Finally, the downward trend has been reversed faster than in the 2007-2009 crisis due to the massive financial aid that developed economies or supranational courts such as the European Union have thrown into the market. After all, this money is in the pockets of each of us, especially of the economically mature generation, Millennials. And here are again – this is yet another incentive for investment.

You can follow me on

On top of everything, the so-called COVID crisis turned out to be quite an opportunity for fintech. We also felt it on our skin because 2020 was an excellent year for us, as we managed to obtain new trading licenses and some consistent rounds of financing.

The isolation created to a large extent by the pandemic has caused much of the investments to move online, as has shopping and business meetings, and we have been there to receive new customers. They used their available time to educate themselves financially and take the first steps in their career as investors.

Finally, the downward trend has been reversed faster than in the 2007-2009 crisis due to the massive financial aid that developed economies or supranational courts such as the European Union have thrown into the market. After all, this money is in the pockets of each of us, especially of the economically mature generation, Millennials. And here are again – this is yet another incentive for investment.

You can follow me on  As the concept of Automated Market Makers is a modification of the traditional trading system, we will start with a definition of so-called non-automated market makers.

Beginner investors find out fairly quickly that brokers (or trading companies) are not the only trading intermediaries. Market makers are the second link in the seller-buyer chain. They have two primary responsibilities:

1. Ensuring the market's liquidity, in other words providing the necessary asset volume needed to carry out extensive transactions.

2. Establishing the bid and ask price, with the difference being the spread. Market makers ensure that an investor (or, as a rule, the broker designated by him) can trade within these limits. The profit comes, predictably, especially from the difference between these prices and is shared with the brokers.

As the concept of Automated Market Makers is a modification of the traditional trading system, we will start with a definition of so-called non-automated market makers.

Beginner investors find out fairly quickly that brokers (or trading companies) are not the only trading intermediaries. Market makers are the second link in the seller-buyer chain. They have two primary responsibilities:

1. Ensuring the market's liquidity, in other words providing the necessary asset volume needed to carry out extensive transactions.

2. Establishing the bid and ask price, with the difference being the spread. Market makers ensure that an investor (or, as a rule, the broker designated by him) can trade within these limits. The profit comes, predictably, especially from the difference between these prices and is shared with the brokers.

It is easy to understand why traditional market makers must be massive financial institutions to assume such a status. Depending on the asset class/classes in which it operates, the role falls in the hands of several types of institutions:

• Stock Exchanges: for shares and other similar assets. The role is mainly assumed by famous stock exchanges such as the New York Stock Exchange or the London Stock Exchange.

• Banks: trading fiat currencies.

• Specialized market makers: for example, these are used by exchanges like NASDAQ.

Regarding the difference between market makers and brokers, Investopedia offers a relevant and easy-to-understand comparison: the former resembles wholesalers, while the latter has similar characteristics to retailers.

I know from personal experience that some brokerage firms can turn into market makers over time, just as a delicatessen can launch its gourmet brands for distribution in other stores.

However, I can confirm that the two businesses remain conceptually different when referring to department structure and functionalities.

It is easy to understand why traditional market makers must be massive financial institutions to assume such a status. Depending on the asset class/classes in which it operates, the role falls in the hands of several types of institutions:

• Stock Exchanges: for shares and other similar assets. The role is mainly assumed by famous stock exchanges such as the New York Stock Exchange or the London Stock Exchange.

• Banks: trading fiat currencies.

• Specialized market makers: for example, these are used by exchanges like NASDAQ.

Regarding the difference between market makers and brokers, Investopedia offers a relevant and easy-to-understand comparison: the former resembles wholesalers, while the latter has similar characteristics to retailers.

I know from personal experience that some brokerage firms can turn into market makers over time, just as a delicatessen can launch its gourmet brands for distribution in other stores.

However, I can confirm that the two businesses remain conceptually different when referring to department structure and functionalities.

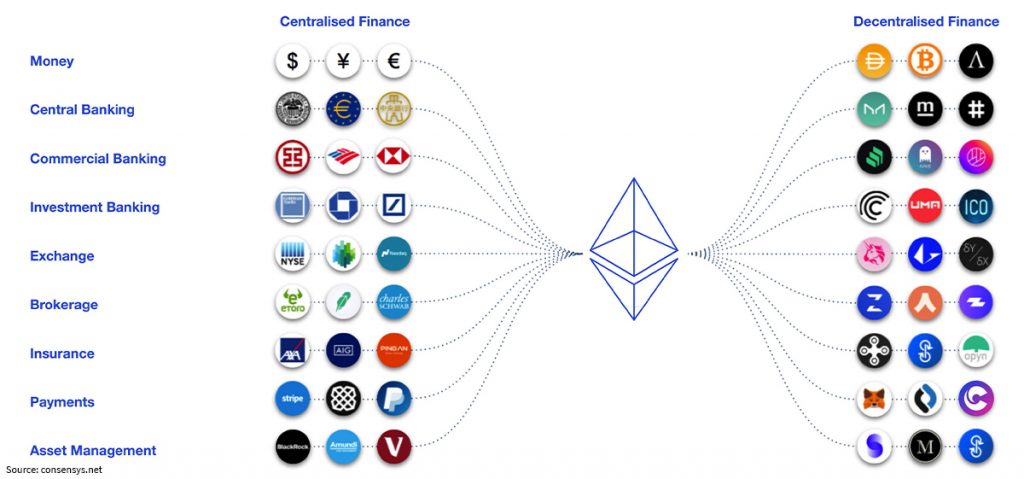

Because I talked more in-depth about Blockchain in one of my previous articles, I will not insist on technical aspects. Through Automated Market Makers, I will only say that it makes the leap from the actual cryptocurrencies to the markets where these are traded, and this leap is currently taking place right before our eyes.

This is one of the first manifestations of the ecosystem called by specialists DeFi (Decentralized Finance). In the market maker segment, the Blockchain breaks the monopoly of large financial institutions through automation. The walls, the offices, the employees and especially their massive liquidity are replaced by something that looks more like a software structure.

Because I talked more in-depth about Blockchain in one of my previous articles, I will not insist on technical aspects. Through Automated Market Makers, I will only say that it makes the leap from the actual cryptocurrencies to the markets where these are traded, and this leap is currently taking place right before our eyes.

This is one of the first manifestations of the ecosystem called by specialists DeFi (Decentralized Finance). In the market maker segment, the Blockchain breaks the monopoly of large financial institutions through automation. The walls, the offices, the employees and especially their massive liquidity are replaced by something that looks more like a software structure.

In short, the term Automated Market Makers (AMM) defines:

• A software architecture based on Blockchain, digitally connecting liquidity providers with brokers and trading companies. In turn, these will interact with investors, most likely through online platforms.

• A mathematical formula that sets the maximum liquidity in a given area.

• At the moment, Automated Market Makers make transactions between cryptocurrencies and fiat currencies or tokens (value symbols derived from them) possible. However, the technology applies to any asset transaction, and I do not doubt that it will be used in the future.

• Very low commissions (these can even go to zero, but in this case software creators can no longer turn in a profit).

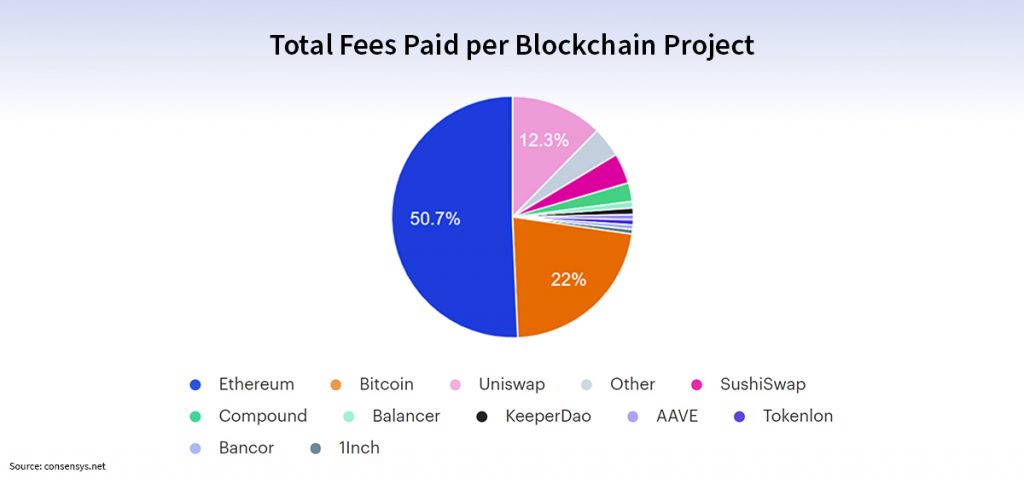

Since 2018, Uniswap, Sushiswap, Curve, Balancer or Kyber Network have entered this new market. In the case of Uniswap, the AMM with the highest volume, the operating formula is straightforward: x * y = k, where x and y represent assets, and k stands for the total liquidity in a specific area. One of the working principles here is that the liquidity in the respective area does not change for the symmetry of the transactions.

Other Automated Market Makers use more complicated mathematical devices. However, it is clear that the Blockchain brings clear advantages here, such as:

• Very low costs for users, between 0.1% and 0.3% for large Automated Market Makers.

• Secure, decentralized processes.

• A competitive market, with clear benefits for customers, because anyone can create a segment / become a market maker, even if it does not automatically entice success for that market.

In short, the term Automated Market Makers (AMM) defines:

• A software architecture based on Blockchain, digitally connecting liquidity providers with brokers and trading companies. In turn, these will interact with investors, most likely through online platforms.

• A mathematical formula that sets the maximum liquidity in a given area.

• At the moment, Automated Market Makers make transactions between cryptocurrencies and fiat currencies or tokens (value symbols derived from them) possible. However, the technology applies to any asset transaction, and I do not doubt that it will be used in the future.

• Very low commissions (these can even go to zero, but in this case software creators can no longer turn in a profit).

Since 2018, Uniswap, Sushiswap, Curve, Balancer or Kyber Network have entered this new market. In the case of Uniswap, the AMM with the highest volume, the operating formula is straightforward: x * y = k, where x and y represent assets, and k stands for the total liquidity in a specific area. One of the working principles here is that the liquidity in the respective area does not change for the symmetry of the transactions.

Other Automated Market Makers use more complicated mathematical devices. However, it is clear that the Blockchain brings clear advantages here, such as:

• Very low costs for users, between 0.1% and 0.3% for large Automated Market Makers.

• Secure, decentralized processes.

• A competitive market, with clear benefits for customers, because anyone can create a segment / become a market maker, even if it does not automatically entice success for that market.

For that market to function, the Automated Market Maker must attract so-called Liquidity Providers, who charge commissions because they provide the necessary volume of assets. This way, the so-called Liquidity Pools are created for each pair of assets. Formulas such as the one mentioned for Uniswap help adjust the price according to demand and supply.

Automated Market Makers also have another significant advantage: the so-called smart contracts, created from computer codes. These contracts are impossible to break because they extend the software architecture represented by the market and the respective pools.

For that market to function, the Automated Market Maker must attract so-called Liquidity Providers, who charge commissions because they provide the necessary volume of assets. This way, the so-called Liquidity Pools are created for each pair of assets. Formulas such as the one mentioned for Uniswap help adjust the price according to demand and supply.

Automated Market Makers also have another significant advantage: the so-called smart contracts, created from computer codes. These contracts are impossible to break because they extend the software architecture represented by the market and the respective pools.

Automated Market Makers are an explosive market, but it is only at the beginning of its evolution. At the moment, it suffers from a series of inherent disadvantages, such as the possibility of error (even if it is not the market maker who makes them, but the user because the latter can cause errors when finalizing the aforementioned smart contracts). Also, because the markets created often touch on cryptocurrency trading, Automated Market Makers inherit their reliability. In other words, they will have problems when a new cryptocurrency also has functional issues.

Specialists also noted the relatively limited number of functionalities currently available on this type of platform, compared to more mature areas of the fintech industry, which are in the process of accelerated diversification.

Ultimately, the future of Automated Market Makers will be dictated by the general requirements of the fintech area. In my view, they are by no means limited to technology, but to the following things:

• Transparency/trend towards financial and technological education.

• Regulation and good practices.

• Shallow entry threshold: in the case of AMM, investors and Liquidity Providers can enter the market with minimal amounts. In the latter case, the necessary amount can start from $50k, which is low compared to the financial strength of traditional market makers.

• Usability/reliability/facilities from the user's point of view.

Automated Market Makers are an explosive market, but it is only at the beginning of its evolution. At the moment, it suffers from a series of inherent disadvantages, such as the possibility of error (even if it is not the market maker who makes them, but the user because the latter can cause errors when finalizing the aforementioned smart contracts). Also, because the markets created often touch on cryptocurrency trading, Automated Market Makers inherit their reliability. In other words, they will have problems when a new cryptocurrency also has functional issues.

Specialists also noted the relatively limited number of functionalities currently available on this type of platform, compared to more mature areas of the fintech industry, which are in the process of accelerated diversification.

Ultimately, the future of Automated Market Makers will be dictated by the general requirements of the fintech area. In my view, they are by no means limited to technology, but to the following things:

• Transparency/trend towards financial and technological education.

• Regulation and good practices.

• Shallow entry threshold: in the case of AMM, investors and Liquidity Providers can enter the market with minimal amounts. In the latter case, the necessary amount can start from $50k, which is low compared to the financial strength of traditional market makers.

• Usability/reliability/facilities from the user's point of view.

Whatever the current shortcomings, I believe that Blockchain-based markets and tools will undoubtedly evolve in this direction, as is the case with the first such market, the cryptocurrencies market. The technology is far too valuable and versatile for such initiatives to stall, even if we might witness some bubbles and crashes. And that is precisely why I considered this introduction to be necessary.

You can follow me on

Whatever the current shortcomings, I believe that Blockchain-based markets and tools will undoubtedly evolve in this direction, as is the case with the first such market, the cryptocurrencies market. The technology is far too valuable and versatile for such initiatives to stall, even if we might witness some bubbles and crashes. And that is precisely why I considered this introduction to be necessary.

You can follow me on