Cryptocurrencies such as Bitcoin or Ethereum are a novelty that fascinates some while putting off others. The former people are driven by cryptos’ massive increase in value in recent years, while the latter people consider their large price fluctuations, which can turn a portfolio into a small one. However, I believe that the real novelty lies not in this category of virtual currencies but instead in the technology that makes them possible: the Blockchain.

I am by no means the only investor with experience in the financial markets who is convinced of crypto’s revolutionary potential. That is why I wanted to publish a series of articles explaining a series of terms and concepts that are not exactly accessible for the less initiated.

How Bitcoin works

The easiest way to start these explanations is to talk about the most well-known example of Blockchain put to good use: cryptocurrencies. For any currency to function as it should, a consensus had to be made that a certain thing, such as Bitcoin, has a specific value. A specific amount of coins is still required, hence the need for an issuing authority, such as central banks in classical currencies. Coins cannot function correctly without accurate and secure records (preventing theft) of the volumes held by individuals or institutions and the transactions that occur.

Cryptocurrencies are a disruptive version of fiat currencies because of Blockchain. First of all, the issuing authority

is no longer a central one, making some people happy for political reasons. In any case, the money circulation does not occur due to possible subjective decisions of some people, but through an automatic process called mining. In addition, the record is kept on numerous computers at the same time, making it 100% accurate. The Blockchain also allows for a seemingly paradoxical thing to occur: the transactions are entirely transparent, but

the identity of their participants is undisclosed and hidden.

How is this done in terms of software architecture? The tech’s name is pretty self-explanatory: "blockchain", meaning "a chain of blocks". In other words, it refers to a database comprised of containers (blocks), which are present at the same time on several computers. For example, a classic accounting register exists in a bank's computers, possibly with one or more backups.

Distributed ledgers built on Blockchain technology are present simultaneously on several computers in two ways: firstly, there are backups and secondly, each computer stores different parts (blocks) of the database /register.

In addition, Blockchain also contains a feature that makes it extremely versatile: the so-called

timestamp, which is the time stamp that the blocks of information must include. As the database expands, the information is marked with dates and times. For cryptocurrencies, this refers to the circulation of new monetary volumes. In other applications, this means that the origin of any quantity present in the register can be traced back to its incipient phases.

So far, I talked about three main advantages of the technology:

1.

Security: decentralized data storage protects Blockchain structures from the vulnerabilities of traditional banking information systems, whose centralization makes them easy to penetrate with a single hack

2.

Confidentiality: networks do not monitor the type and purpose of the transaction, even if cryptocurrencies are used on the Dark Web. It is challenging for a transaction to be associated with a person.

3.

Low costs for users: very low, for example, compared to bank fees.

4.

Timestamping: although very secure and confidential, the technology allows monitoring up to the source of all data (financial or non-financial) included in the databases.

Some other Blockchain characteristics:

• The Blockchain is "

permanently open", 24 hours a day.

• Almost

instantaneous transactions (up to a maximum of 10-15 minutes), way less than the classic 48 hours in the banking environment

• “

Banking the unbanked”: the technology can be available to any Internet and mobile owner, regardless of the country in which he lives, if banks impose various restrictive conditions for opening accounts. The World Bank says there are currently about two billion adults worldwide without access to banking.

Multiple uses for Blockchain and Decentralized Finance

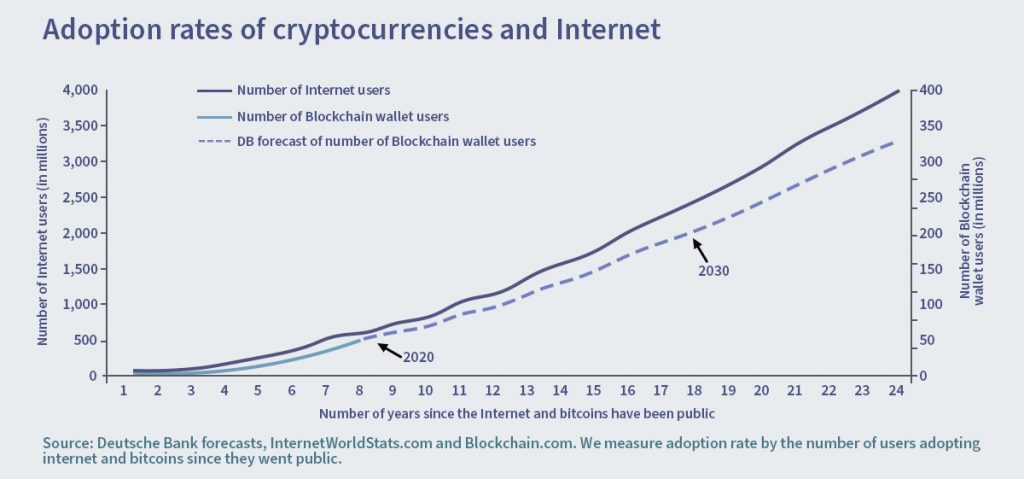

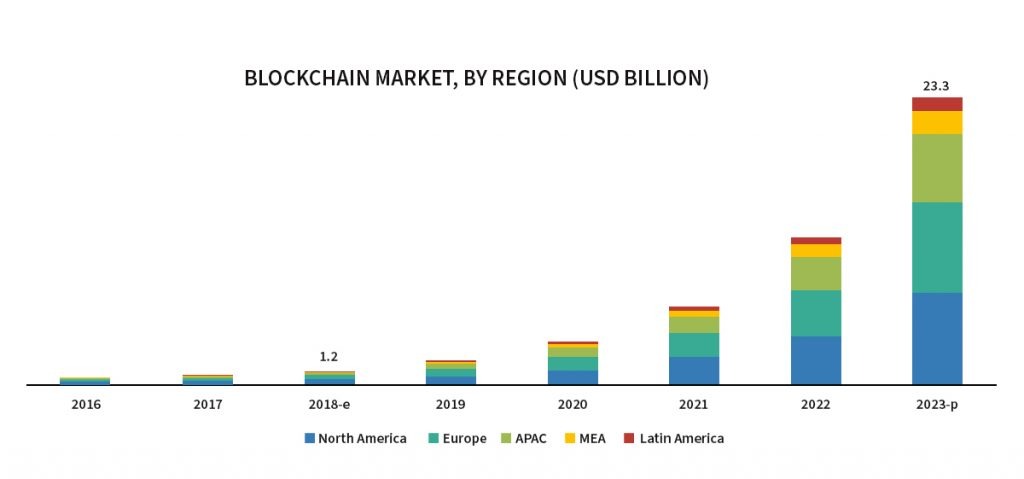

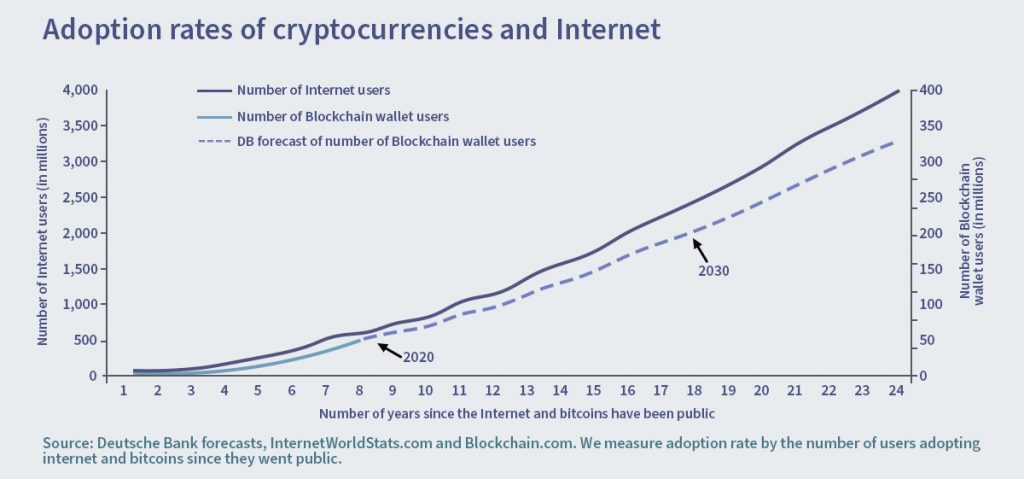

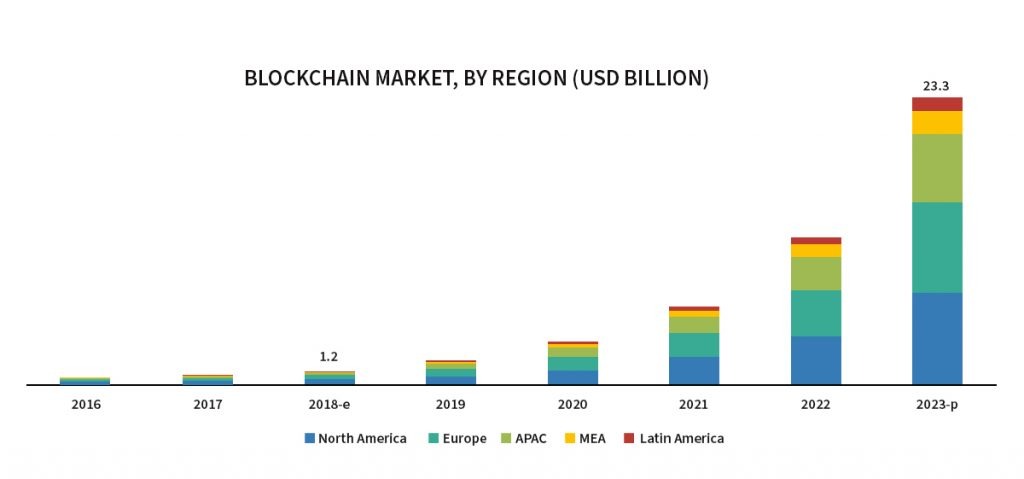

Cryptocurrencies appeared on the market in 2009. Since then, Blockchain and related technologies have started to be used, effectively and not experimentally, in many other industries. Related to capital markets, three types of concepts are emerging:

1.

Alternative banking services: traditional banking has an ambivalent attitude towards Blockchain. Giants like UBS or Barclays have created their research labs, but central banks like the Federal Reserve don’t think that the technology is mature enough yet. Instead, some alternatives to banking services like Mojaloop, started by Bill and Melinda Gates, which provide open-source payment services for disadvantaged areas, slowly pick up speed. The concept on which Mojaloop is based is called Interledger and is related to Blockchain.

2.

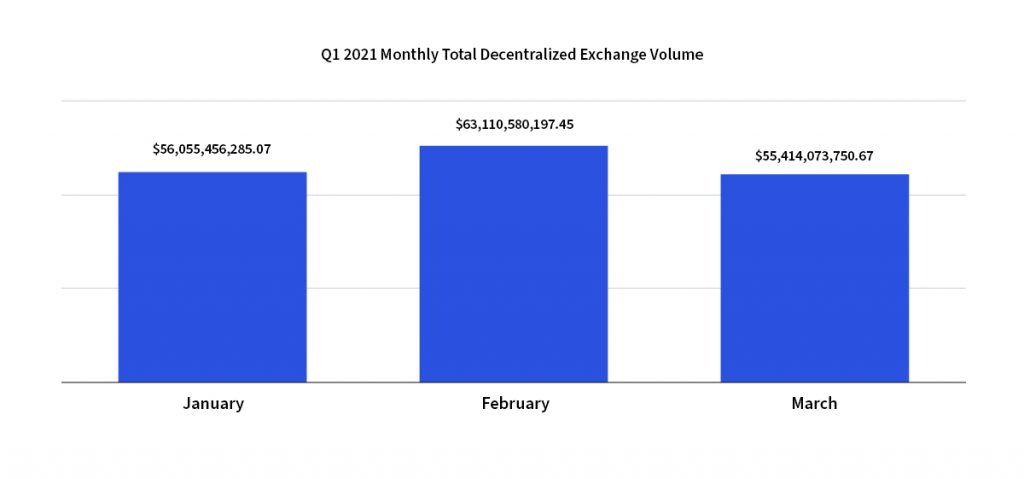

Automated Market Makers (AMM): an industry currently experiencing a boom. These are intermediaries providing liquidity and setting up prices in asset transactions. Automated Market Makers are based on Blockchain and compete with financial giants like the New York or London Stock Exchanges.

3.

Smart contracts: software alternatives to classic contracts, functioning on the Blockchain infrastructure. Investopedia offers an example of using a smart contract when renting an apartment: like any contract, it will include a guarantee, the monthly fee to be paid and the rental period, but we can, for example, the access code to the apartment. When the tenant transfers the first established sum of money, the smart contract will automatically change the access code to the one the two parties agreed upon and will send a notification to the tenant about it, and he will be able to enter the apartment. If somehow the access code cannot be changed or modified by the owner, the smart contract will automatically return the money.

The Blockchain is proving its usefulness in other areas, as we speak:

•

Food supply: IBM has created the Food Trust, a Blockchain mechanism tracking the route of food from source to consumer. It is a medical revolution because, in the case of E. coli or salmonella infections, the source of the infection is located immediately, while in the past, expensive investigations were required which took several weeks.

•

P2P Energy Trading: new forms of energy, such as solar, are decentralized, and production is fluctuating. Within a particular time, the solar panels of a house can produce more energy than necessary so that the house owner will sell it back to the network. I do not need to go into technical details because it is evident at first glance that such a situation fits perfectly within the Blockchain universe, which was carefully assessed by a startup called WePower.

•

Mining of precious stones: as their origin is critical, the Blockchain helps to certify the source. For example, that's what Everledger does.

•

Freight transport: Walmart Canada uses Blockchain for managing highly complex supply chains, which rely on dozens of transportation companies.

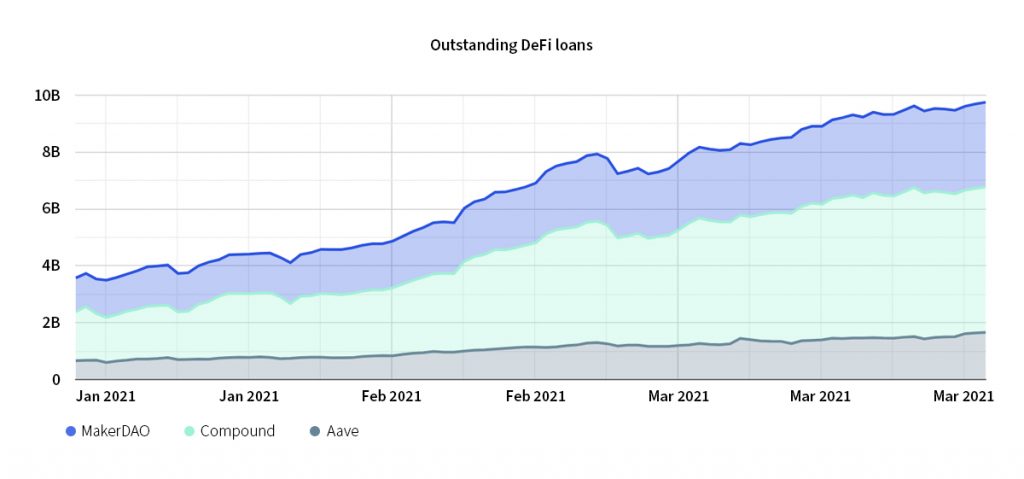

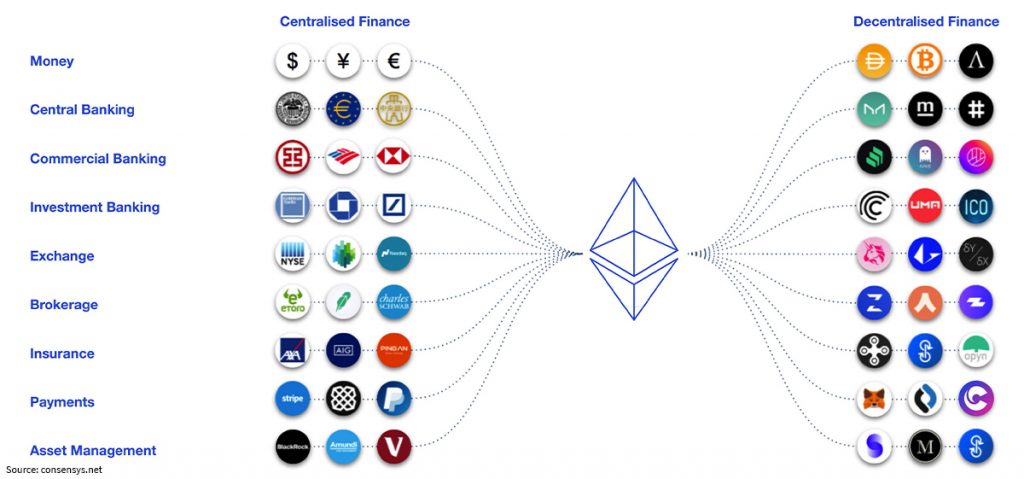

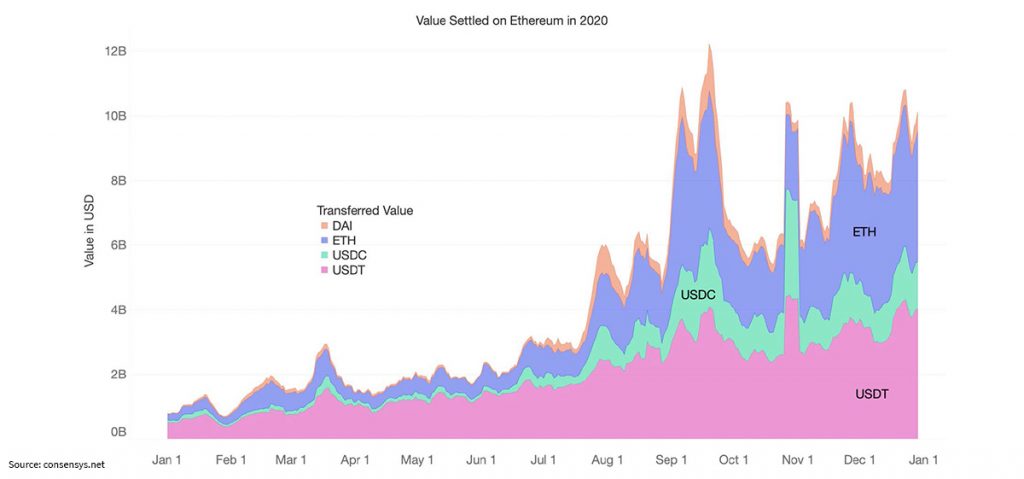

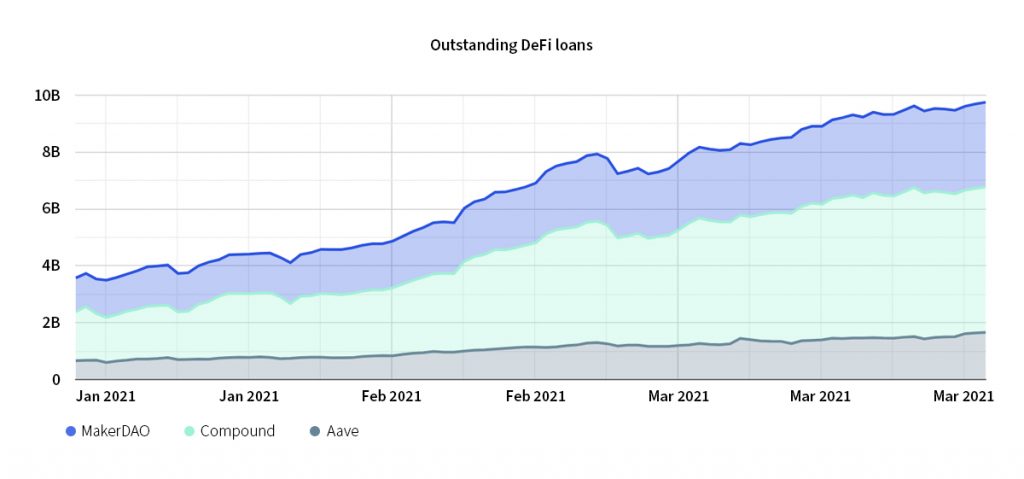

Blockchain technologies have created an ecosystem called by specialists DeFi (Decentralized Finance) in the capital markets. It includes not only cryptocurrencies but also the three segments mentioned above. Soon, the technology can be applied to loans, real estate transactions or insurance. I have already mentioned its benefits.

A bit of history

To me, the history of the Blockchain seems like clear proof that this technology boasts a vast area of applicability. Generally, Blockchain’s start date is associated with the birth of Bitcoin. This may be due to the mysterious character Satoshi Nakamoto, who proposed the Bitcoin architecture in 2008 on a specialized forum, and who is said to be a pseudonym, a real person or a group of people. But Nakamoto only gave the name of the technology. The concern for a secure, timestamped database is much older than that. Among others, Scott Stornetta, a Bell researcher, was concerned in the late 1980s with an unalterable database, starting with a scandal in the scientific world, in which another researcher had modified the data on which a study was based. To understand what it is about, for example, the Excel file fields are straightforward to alter because this is an intrinsic feature of the program. Together with Stuart Haber, also a cryptographer at Bell, Stornetta developed a theoretical proposal based on which such databases could be integrated into a computer, focused on timestamping and published in 1991. The idea would be used by Satoshi Nakamoto when he created the first cryptocurrency some 18 years later.

Key terms recap

At this point, a small recap dictionary will help you better understand the structure of a blockchain-based capital market. I have prepared fewer academic definitions, opting instead for easier-to-understand explanations.

•

Automated Market Makers (AMM): automated players from the financial markets, having the role of ensuring liquidity (assets required for transactions) and setting sell and buy prices, just like stock exchanges do in the case of traditional shares.

•

Assets (assets): a broad category of properties with financial value, which includes anything that can be converted at some point into money, from shares to the actual money existing in the accounts. The difference between assets (assets) and securities (securities) is that the former instead reflect the property, and the latter, its convertible aspect in cash (liquidity).

•

Blockchain: Decentralized database, distributed on several computers connected to the Internet (nodes), in the form of blocks of information. Compared to classic databases, this architecture is redundant (blocks are replicated in several places), almost impossible to falsify and has timestamps (timestamping: date, day, time etc.) on all its blocks, meaning that the records implicitly contain their provenance. Cryptocurrencies are not the only application of Blockchain.

•

Cryptocurrency (crypto, cryptocurrency): digital asset / alternative currency (virtual), quoted, traded and distributed based on Blockchain. It is also called an altcoin. Cryptocurrencies differ from traditional currencies by decentralized management (there is no central bank to issue them) and the absolute confidentiality of the owners’ names. The prefix "crypto" comes from "cryptography" or encryption of owners’ names and other sensitive data.

•

Decentralized finance (DeFi): the new decentralized, global and cross-border architecture of financial markets, based on the exact characteristics of the Blockchain.

•

Distributed ledger: a term that includes Blockchain but is not identical to it, referring to an accounting register distributed in several electronic sources.

•

Fork: a software term characteristic for the open-source/free software movement. At a given moment, a program or operating system is divided into two distinct pieces, at the initiative of a part of the developers working. Because cryptocurrencies are based mainly on software and an open-source philosophy, they also split, at different times, into different variants. One of the most famous forks is the one in which Bitcoin Cash split in 2017 from Bitcoin.

•

Liquidity: the characteristic of a market/segment referring to the ease of trading. Two categories of valuable shares can have very different liquidity on the same stock exchange, meaning that some are traded much more than others.

•

P2P (Peer-to-Peer or P2P): feature of a network architecture that has influenced the Blockchain architecture. In peer-to-peer, transfers take place between peers and not between a server and a user/client. The category includes Blockchain, but also Bittorent class technologies, which refer to simply transferring files.

•

Securities: class of convertible assets - and converted into money. These can be participation in companies (equities - of which the shares are part), tradable debts (debts) or derivatives (values resulting from different assets, such as futures contracts or stock options).

The future of Blockchain

In the following episodes of this series, I intend to detail more aspects of the technology that I consider revolutionary. I will review, for example, Automated Market Makers, a growing market, and the specifics of millennial consumers, for whom the idea of Blockchain seems - and is - explicitly created. I will also talk about the uses from the stage of proof of concept or in development. Even if they might not have an immediate practical use, I consider the information about these things as a matter of general culture, without which the future will catch us unprepared.

You can follow me on

Twitter and

LinkedIn!

You probably have a clear vision about your core business, most likely with a powerful technological component. For example, you already know you need, let's say, more developers - and what type of developers. But you will be less inclined to identify the so-called "support" skills that are indispensable for a company at the start of the road. You probably won't have any problems buying your toner or paper, so there's no point in hiring someone for it. But for starters, don't forget the following:

• Your business cannot work without an accountant. It is one of the mandatory legal requirements for any professional management you would like to do.

• Human resources, cleaning, logistics? In the beginning, you'll probably need to handle things without specific departments. I say this from my own experience: if you have a university education, at first it will seem a little crazy to cover all these needs, especially after you had a well-paid job in a large company. But you will quickly learn.

• Law: seems less important but is just as crucial as other departments. I know business people who experienced plenty of problems because the contract models they used were copied from the internet and had problematic clauses, especially in the last part, referring, for example, to the courtrooms where disputes are settled. If your business has an online component, you will need to make sure that you meet the legal requirements related to data protection and cookies. You will realize that this can be solved by a timely consultation with legal specialists and compliance.

• Marketing: this should be on your agenda even if you do not directly interface with individual consumers. An essential component for startups is the "corporate affairs" field implemented for big companies, which includes everything related to the company's image and communication with other firms - or with potential investors. It is natural that your revolutionary product only exists as a sketch or in the proof-of-concept stage. However, your startup needs to sell through branding.

Concerning all the above, it is best to divide the skills you need into "internal" and "external" because some specific activities can be outsourced, such as the online environment. This will help the internal organization chart become a lot clearer.

You probably have a clear vision about your core business, most likely with a powerful technological component. For example, you already know you need, let's say, more developers - and what type of developers. But you will be less inclined to identify the so-called "support" skills that are indispensable for a company at the start of the road. You probably won't have any problems buying your toner or paper, so there's no point in hiring someone for it. But for starters, don't forget the following:

• Your business cannot work without an accountant. It is one of the mandatory legal requirements for any professional management you would like to do.

• Human resources, cleaning, logistics? In the beginning, you'll probably need to handle things without specific departments. I say this from my own experience: if you have a university education, at first it will seem a little crazy to cover all these needs, especially after you had a well-paid job in a large company. But you will quickly learn.

• Law: seems less important but is just as crucial as other departments. I know business people who experienced plenty of problems because the contract models they used were copied from the internet and had problematic clauses, especially in the last part, referring, for example, to the courtrooms where disputes are settled. If your business has an online component, you will need to make sure that you meet the legal requirements related to data protection and cookies. You will realize that this can be solved by a timely consultation with legal specialists and compliance.

• Marketing: this should be on your agenda even if you do not directly interface with individual consumers. An essential component for startups is the "corporate affairs" field implemented for big companies, which includes everything related to the company's image and communication with other firms - or with potential investors. It is natural that your revolutionary product only exists as a sketch or in the proof-of-concept stage. However, your startup needs to sell through branding.

Concerning all the above, it is best to divide the skills you need into "internal" and "external" because some specific activities can be outsourced, such as the online environment. This will help the internal organization chart become a lot clearer.

Assuming that the initial organization chart is crystal clear to you, you must start identifying promising candidates. Consider the following things:

• Various job sites and LinkedIn will help you for free or at low costs for hard skills. I use LinkedIn successfully by receiving funding requests from entrepreneurs. I have thus made some promising investments.

• The CV is essential, but what should you focus on? It might be better to pay less attention to professional experience if your startup operates in a new, disruptive market. In a food company, the Sales Director must be highly connected with the big retail chains, with a significant experience. But most likely, studies and certifications are more important to you, so you need to have the know-how to check and validate them.

• Pay attention to the psychological profile of the candidates. Those who dare to join a startup will be attracted by the novelty and the possibility of developing professionally. But what you offer is neither a high salary nor stability. From a motivational point of view, it is worth looking carefully at the letters of intent of the candidates. They are called "letters de motivation" for a reason. If there are too many "challenges" in those letters, the author probably does not need many challenges.

Assuming that the initial organization chart is crystal clear to you, you must start identifying promising candidates. Consider the following things:

• Various job sites and LinkedIn will help you for free or at low costs for hard skills. I use LinkedIn successfully by receiving funding requests from entrepreneurs. I have thus made some promising investments.

• The CV is essential, but what should you focus on? It might be better to pay less attention to professional experience if your startup operates in a new, disruptive market. In a food company, the Sales Director must be highly connected with the big retail chains, with a significant experience. But most likely, studies and certifications are more important to you, so you need to have the know-how to check and validate them.

• Pay attention to the psychological profile of the candidates. Those who dare to join a startup will be attracted by the novelty and the possibility of developing professionally. But what you offer is neither a high salary nor stability. From a motivational point of view, it is worth looking carefully at the letters of intent of the candidates. They are called "letters de motivation" for a reason. If there are too many "challenges" in those letters, the author probably does not need many challenges.

Any startup needs to be creative, so you need to ensure that the brainstorming process works for your company. Brainstorming ("mental storm") has strict rules that you can easily find online. One of the essential premises of the concept is related to a critical psychological theory from recent decades. An elite team delivers good results if it relies on role distribution, apart from each member's hard skills or professional background. One of them may be the primary creator of ideas. A second one may very well be a good critic of ideas, not in the sense of rejecting them but by refining and adjusting them. A third one could translate everything very well into figures, financial or technical data. A fourth may distinguish himself through synthesizing the problem and solutions through personal insights. And so on.

This theory will make you think about your role. As a company founder, you will be tempted to oversee all your startup details, and it is excellent if you manage to do that. But disruptive innovations are the prerogative of highly skilled creative people. They will be less willing to comply with rigid hierarchies, rules and mandatory provisions. Today, a good manager uses employee motivation and the power of their example rather than authoritarian tools. A characteristic of new businesses is that no manager can exceed, in terms of competence, the knowledge of any member of the team, taken separately.

Although the startup I founded three years ago, Key Way Group, has hundreds of employees now, I still apply these rules. But it is about the young people, with many different skills, who contribute to the growth of the business through their motivations and the pleasant climate that we managed to provide for them. I think these are essential elements of my success story.

You can follow me on Twitter and LinkedIn!

Any startup needs to be creative, so you need to ensure that the brainstorming process works for your company. Brainstorming ("mental storm") has strict rules that you can easily find online. One of the essential premises of the concept is related to a critical psychological theory from recent decades. An elite team delivers good results if it relies on role distribution, apart from each member's hard skills or professional background. One of them may be the primary creator of ideas. A second one may very well be a good critic of ideas, not in the sense of rejecting them but by refining and adjusting them. A third one could translate everything very well into figures, financial or technical data. A fourth may distinguish himself through synthesizing the problem and solutions through personal insights. And so on.

This theory will make you think about your role. As a company founder, you will be tempted to oversee all your startup details, and it is excellent if you manage to do that. But disruptive innovations are the prerogative of highly skilled creative people. They will be less willing to comply with rigid hierarchies, rules and mandatory provisions. Today, a good manager uses employee motivation and the power of their example rather than authoritarian tools. A characteristic of new businesses is that no manager can exceed, in terms of competence, the knowledge of any member of the team, taken separately.

Although the startup I founded three years ago, Key Way Group, has hundreds of employees now, I still apply these rules. But it is about the young people, with many different skills, who contribute to the growth of the business through their motivations and the pleasant climate that we managed to provide for them. I think these are essential elements of my success story.

You can follow me on Twitter and LinkedIn!

• Is it a personal problem? Good. Suppose you are horrified by the overcrowded city, and you prefer to travel by a different means than your car. The tiny vehicles move much faster than taxis or Ubers. You guessed it, we're thinking about electric scooters or scooters. Travis VanderZanden founded Bird, one of the most successful e-scooter startups, after noticing that his girls are not excited about the bikes they received for Christmas and return to the scooters they already had. This made him think, "Why not a scooter for adults?"

• Is there such a thing as bad ideas? Most certainly, yes. Paul Graham, the co-founder of the Y-Combinator business incubator, gives us an example of a social network for pet owners. The potential users of such a network are numerous. But such a network has a big problem: it does not respond to a need and does not solve a specific problem. An idea should be refined to be successful. A platform that connects pet owners with veterinarians? Pet exchange? Beauty contest for dogs? Only now can we start talking about viable startup ideas.

• Is it a personal problem? Good. Suppose you are horrified by the overcrowded city, and you prefer to travel by a different means than your car. The tiny vehicles move much faster than taxis or Ubers. You guessed it, we're thinking about electric scooters or scooters. Travis VanderZanden founded Bird, one of the most successful e-scooter startups, after noticing that his girls are not excited about the bikes they received for Christmas and return to the scooters they already had. This made him think, "Why not a scooter for adults?"

• Is there such a thing as bad ideas? Most certainly, yes. Paul Graham, the co-founder of the Y-Combinator business incubator, gives us an example of a social network for pet owners. The potential users of such a network are numerous. But such a network has a big problem: it does not respond to a need and does not solve a specific problem. An idea should be refined to be successful. A platform that connects pet owners with veterinarians? Pet exchange? Beauty contest for dogs? Only now can we start talking about viable startup ideas.

• How many types of ideas are there? "Forbes" mentions three. Spontaneous ideas, of which we have already talked about, are the ones that come out of a sudden, at the strangest of times. They can be valuable, even if they can be stimulated. There are also insider ideas, which are born from experience in a specific business. Returning to the example of VanderZanden, it is worth mentioning that the founder was successful working for Uber and Lyft in a domain of expertise close to the startup he launched, Bird. And finally, we can talk about deliberate ideas, which start from the desire to launch a startup. To give you a personal example, after several years of activity in the fintech industry, I was curious what a market with a lower yield but more constant in evolution looked like. Real estate was an obvious option, but I realized that you must behave differently than speculatively anyway to be successful in this market. In the first decade of the 2000s, the real estate craze and the sub-prime crisis were history when I decided to invest. You could not simply buy to sell for a profit the next day. We stress out the concept of added value because real estate acquisitions do not make sense if they are not followed by arrangements, related services and the creation of a portfolio of quality tenants. We have invested a lot in financial resources and working hours to get even more benefits. Without doing so, I would certainly have lost.

• How many types of ideas are there? "Forbes" mentions three. Spontaneous ideas, of which we have already talked about, are the ones that come out of a sudden, at the strangest of times. They can be valuable, even if they can be stimulated. There are also insider ideas, which are born from experience in a specific business. Returning to the example of VanderZanden, it is worth mentioning that the founder was successful working for Uber and Lyft in a domain of expertise close to the startup he launched, Bird. And finally, we can talk about deliberate ideas, which start from the desire to launch a startup. To give you a personal example, after several years of activity in the fintech industry, I was curious what a market with a lower yield but more constant in evolution looked like. Real estate was an obvious option, but I realized that you must behave differently than speculatively anyway to be successful in this market. In the first decade of the 2000s, the real estate craze and the sub-prime crisis were history when I decided to invest. You could not simply buy to sell for a profit the next day. We stress out the concept of added value because real estate acquisitions do not make sense if they are not followed by arrangements, related services and the creation of a portfolio of quality tenants. We have invested a lot in financial resources and working hours to get even more benefits. Without doing so, I would certainly have lost.

The business plan has an essential role: it turns the idea into numbers. For the usefulness of this discussion, I will put myself in the place of an entrepreneur at the start of his career. Suppose you've already found the famous idea. If you fall in love with it, that's perfect: it must mean you have the makings of an entrepreneur. Passion and energy are essential. But be careful because love can exceed certain limits. Try to split your expectations into two key areas: customers and financial projections:

• The former is usually defined through market research, which helps to shape the so-called target market, the desired or targeted market. However, start-up entrepreneurs do not have the resources for a dedicated market study. There is no reason to stop here: there is a whole series of free resources that can approximate to some degree the behaviour of potential consumers, from the National Institute of Statistics (in the case of Romania), to Google AdSense or Facebook simulations, after which you can form an idea about the demographic interests of consumers, without spending a lion or euro. These will undoubtedly be useful as arguments in conversations and presentations for investors and even for others.

• From a financial projections point of view, things might look confusing at the start of the road. But any kind of estimate, even a naive one, is preferable to the lack of data. From this point of view, the advice attributed to Warren Buffett, the great American investor, works well: "keep an eye on costs". There will be rows of Excel that you didn't think of. But you may also have pleasant surprises: for example, the fact that the monthly online presence (email addresses, and possibly a simple site) costs at Google as much as a meal in Bucharest, which you can afford without problems. Something similar happened to me when I realized that for the fintech business I founded, Key Way, I can easily afford headquarters at City Gate, in the Romexpo area – Casa Presei, with Microsoft, Alcatel and T-Mobile. We have considered the easy-to-reach destination for our 100+ employees that our group has in Romania. There are also notoriety benefits, but not as meaningful.

The business plan has an essential role: it turns the idea into numbers. For the usefulness of this discussion, I will put myself in the place of an entrepreneur at the start of his career. Suppose you've already found the famous idea. If you fall in love with it, that's perfect: it must mean you have the makings of an entrepreneur. Passion and energy are essential. But be careful because love can exceed certain limits. Try to split your expectations into two key areas: customers and financial projections:

• The former is usually defined through market research, which helps to shape the so-called target market, the desired or targeted market. However, start-up entrepreneurs do not have the resources for a dedicated market study. There is no reason to stop here: there is a whole series of free resources that can approximate to some degree the behaviour of potential consumers, from the National Institute of Statistics (in the case of Romania), to Google AdSense or Facebook simulations, after which you can form an idea about the demographic interests of consumers, without spending a lion or euro. These will undoubtedly be useful as arguments in conversations and presentations for investors and even for others.

• From a financial projections point of view, things might look confusing at the start of the road. But any kind of estimate, even a naive one, is preferable to the lack of data. From this point of view, the advice attributed to Warren Buffett, the great American investor, works well: "keep an eye on costs". There will be rows of Excel that you didn't think of. But you may also have pleasant surprises: for example, the fact that the monthly online presence (email addresses, and possibly a simple site) costs at Google as much as a meal in Bucharest, which you can afford without problems. Something similar happened to me when I realized that for the fintech business I founded, Key Way, I can easily afford headquarters at City Gate, in the Romexpo area – Casa Presei, with Microsoft, Alcatel and T-Mobile. We have considered the easy-to-reach destination for our 100+ employees that our group has in Romania. There are also notoriety benefits, but not as meaningful.

2. Medical databases. Here, the utility of Blockchain consists in maintaining the confidentiality of personal data, but also its interoperable and decentralized characteristics help. A Denver-based company, Burstiq, focuses on smart contracts in this sector.

2. Medical databases. Here, the utility of Blockchain consists in maintaining the confidentiality of personal data, but also its interoperable and decentralized characteristics help. A Denver-based company, Burstiq, focuses on smart contracts in this sector.

3. COVID vaccination. We have already talked about monitoring stocks and ingredients from the food industry and the possibility of identifying the origins of a toxic element. The idea of using the technology in stocks of COVID protection equipment and vaccines is typical, and a group of researchers in Abu Dhabi and the United States has already developed a proposal that takes into account such a thing. The scandals related to the Russian Sputnik V vaccine, of which one variant was approved, and another delivered, would be impossible through such strict monitoring, not to mention the advantages of streamlining the distribution.

4. Copyright. The evidence of music broadcasts on the radio and in different spaces is hugely complicated. The artists are continuously complaining about their revenues disappearing into the void due to many broadcasts gone missing with or without intention. Blockchain is a registry available to anyone, automatically and without error. And here, the discussion leads to smart contracts, and this is handled by a New York company called Mediachain, which Spotify acquired in 2017.

3. COVID vaccination. We have already talked about monitoring stocks and ingredients from the food industry and the possibility of identifying the origins of a toxic element. The idea of using the technology in stocks of COVID protection equipment and vaccines is typical, and a group of researchers in Abu Dhabi and the United States has already developed a proposal that takes into account such a thing. The scandals related to the Russian Sputnik V vaccine, of which one variant was approved, and another delivered, would be impossible through such strict monitoring, not to mention the advantages of streamlining the distribution.

4. Copyright. The evidence of music broadcasts on the radio and in different spaces is hugely complicated. The artists are continuously complaining about their revenues disappearing into the void due to many broadcasts gone missing with or without intention. Blockchain is a registry available to anyone, automatically and without error. And here, the discussion leads to smart contracts, and this is handled by a New York company called Mediachain, which Spotify acquired in 2017.

5. Money laundering. Even if Blockchain started its career with cryptocurrencies on the Dark Web, for various illicit payments, it could be used to certify the identity of individual financial operators, along with their biometric data. Ocular, a Los Angeles startup, creates a database that makes identity theft or forgery impossible while simplifying access to legitimate users' documents.

5. Money laundering. Even if Blockchain started its career with cryptocurrencies on the Dark Web, for various illicit payments, it could be used to certify the identity of individual financial operators, along with their biometric data. Ocular, a Los Angeles startup, creates a database that makes identity theft or forgery impossible while simplifying access to legitimate users' documents.

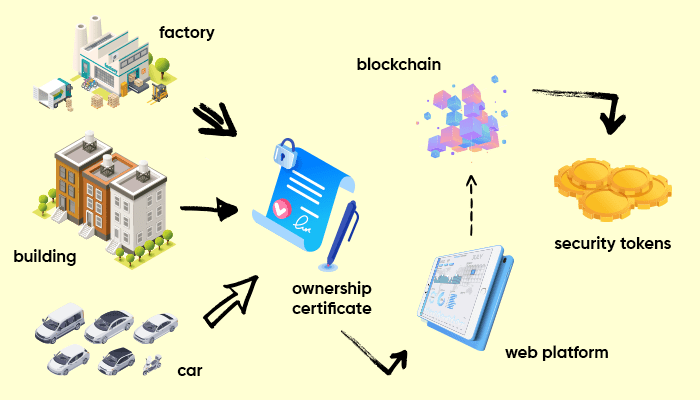

2. Democratization of investments. Nowadays, small investors generally have access to promising companies only after making their initial listing on a stock exchange (when they tend to mature and produce a steady but low profit). Venture Capital firms involved in this tend to delay the listing time to reap higher yields (profit or return of investment) as possible. This barrier tends to be removed by converting securities (shares, unlisted shares) into the same tokens, which can be accessed through "unicorn funds". This is precisely the structure proposed by ADDX (previously iSTOX), a blockchain company in which the state of Singapore and its stock exchange are involved. Access to unlisted companies can be granted starting from $20,000, a relatively large amount for beginners but insignificant compared to the millions circulating in the area of investment funds. What I said at the beginning, that Blockchain would produce the next unicorns, is also verified, meaning that it will contribute to their financing, irrespective of the industry.

2. Democratization of investments. Nowadays, small investors generally have access to promising companies only after making their initial listing on a stock exchange (when they tend to mature and produce a steady but low profit). Venture Capital firms involved in this tend to delay the listing time to reap higher yields (profit or return of investment) as possible. This barrier tends to be removed by converting securities (shares, unlisted shares) into the same tokens, which can be accessed through "unicorn funds". This is precisely the structure proposed by ADDX (previously iSTOX), a blockchain company in which the state of Singapore and its stock exchange are involved. Access to unlisted companies can be granted starting from $20,000, a relatively large amount for beginners but insignificant compared to the millions circulating in the area of investment funds. What I said at the beginning, that Blockchain would produce the next unicorns, is also verified, meaning that it will contribute to their financing, irrespective of the industry.

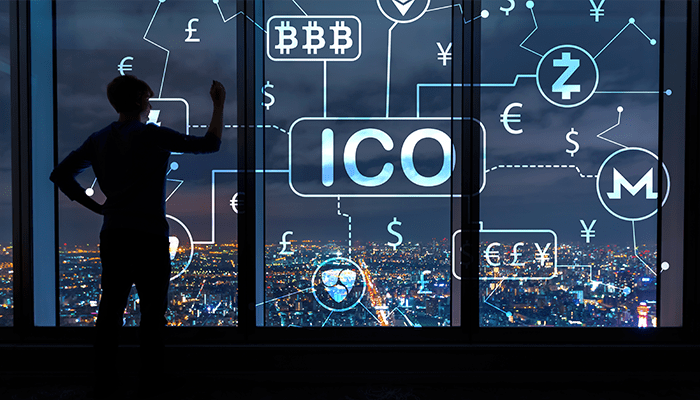

3. Ease of financing. From the entrepreneur's point of view, the mechanism described above translates into money from several sources, available on more advantageous terms, faster and more on-time than now. Peer-to-peer lending platforms increasingly benefit from the input of Blockchain technology and are just a marginal example, as the lender will only expect interest. But an entrepreneur who seeks to co-opt mini-angel investors in the longer term will usually place on the market many tokens that can be accessed by those interested, who expect benefits like those of angel investors but proportional to the much smaller amounts. The process is called ICO (Initial Coin Offering) because the idea of cryptocurrency is applicable here, but not in the sense of "virtual money bag". But, as the name suggests, in a sense, close to IPO (Initial Public Offering), ownership of a part of a startup. Bureaucracy, late access, high access thresholds and all other barriers related to traditional finance are missing entirely.

3. Ease of financing. From the entrepreneur's point of view, the mechanism described above translates into money from several sources, available on more advantageous terms, faster and more on-time than now. Peer-to-peer lending platforms increasingly benefit from the input of Blockchain technology and are just a marginal example, as the lender will only expect interest. But an entrepreneur who seeks to co-opt mini-angel investors in the longer term will usually place on the market many tokens that can be accessed by those interested, who expect benefits like those of angel investors but proportional to the much smaller amounts. The process is called ICO (Initial Coin Offering) because the idea of cryptocurrency is applicable here, but not in the sense of "virtual money bag". But, as the name suggests, in a sense, close to IPO (Initial Public Offering), ownership of a part of a startup. Bureaucracy, late access, high access thresholds and all other barriers related to traditional finance are missing entirely.

By granting access to the capital markets for many young, economically active investors from the Millennials segment, the Blockchain makes all this money productive, which would otherwise generate actual negative interest rates in bank accounts or simply be spent on entertainment. And the beneficiaries of the financing are exactly the entrepreneurs of the same age category, characterized by creativity and special business skills. I don't think that in 10 years, the global economy will be similar to the one we have today.

The regulation and refinement of technologies that today may seem exotic or risky will lead to a world in which prosperity will be even more accessible to any informed and initiative-driven person, regardless of his starting capital. And this prosperity will impact the entire society.

By granting access to the capital markets for many young, economically active investors from the Millennials segment, the Blockchain makes all this money productive, which would otherwise generate actual negative interest rates in bank accounts or simply be spent on entertainment. And the beneficiaries of the financing are exactly the entrepreneurs of the same age category, characterized by creativity and special business skills. I don't think that in 10 years, the global economy will be similar to the one we have today.

The regulation and refinement of technologies that today may seem exotic or risky will lead to a world in which prosperity will be even more accessible to any informed and initiative-driven person, regardless of his starting capital. And this prosperity will impact the entire society.

You can follow me on

You can follow me on  As the concept of Automated Market Makers is a modification of the traditional trading system, we will start with a definition of so-called non-automated market makers.

Beginner investors find out fairly quickly that brokers (or trading companies) are not the only trading intermediaries. Market makers are the second link in the seller-buyer chain. They have two primary responsibilities:

1. Ensuring the market's liquidity, in other words providing the necessary asset volume needed to carry out extensive transactions.

2. Establishing the bid and ask price, with the difference being the spread. Market makers ensure that an investor (or, as a rule, the broker designated by him) can trade within these limits. The profit comes, predictably, especially from the difference between these prices and is shared with the brokers.

As the concept of Automated Market Makers is a modification of the traditional trading system, we will start with a definition of so-called non-automated market makers.

Beginner investors find out fairly quickly that brokers (or trading companies) are not the only trading intermediaries. Market makers are the second link in the seller-buyer chain. They have two primary responsibilities:

1. Ensuring the market's liquidity, in other words providing the necessary asset volume needed to carry out extensive transactions.

2. Establishing the bid and ask price, with the difference being the spread. Market makers ensure that an investor (or, as a rule, the broker designated by him) can trade within these limits. The profit comes, predictably, especially from the difference between these prices and is shared with the brokers.

It is easy to understand why traditional market makers must be massive financial institutions to assume such a status. Depending on the asset class/classes in which it operates, the role falls in the hands of several types of institutions:

• Stock Exchanges: for shares and other similar assets. The role is mainly assumed by famous stock exchanges such as the New York Stock Exchange or the London Stock Exchange.

• Banks: trading fiat currencies.

• Specialized market makers: for example, these are used by exchanges like NASDAQ.

Regarding the difference between market makers and brokers, Investopedia offers a relevant and easy-to-understand comparison: the former resembles wholesalers, while the latter has similar characteristics to retailers.

I know from personal experience that some brokerage firms can turn into market makers over time, just as a delicatessen can launch its gourmet brands for distribution in other stores.

However, I can confirm that the two businesses remain conceptually different when referring to department structure and functionalities.

It is easy to understand why traditional market makers must be massive financial institutions to assume such a status. Depending on the asset class/classes in which it operates, the role falls in the hands of several types of institutions:

• Stock Exchanges: for shares and other similar assets. The role is mainly assumed by famous stock exchanges such as the New York Stock Exchange or the London Stock Exchange.

• Banks: trading fiat currencies.

• Specialized market makers: for example, these are used by exchanges like NASDAQ.

Regarding the difference between market makers and brokers, Investopedia offers a relevant and easy-to-understand comparison: the former resembles wholesalers, while the latter has similar characteristics to retailers.

I know from personal experience that some brokerage firms can turn into market makers over time, just as a delicatessen can launch its gourmet brands for distribution in other stores.

However, I can confirm that the two businesses remain conceptually different when referring to department structure and functionalities.

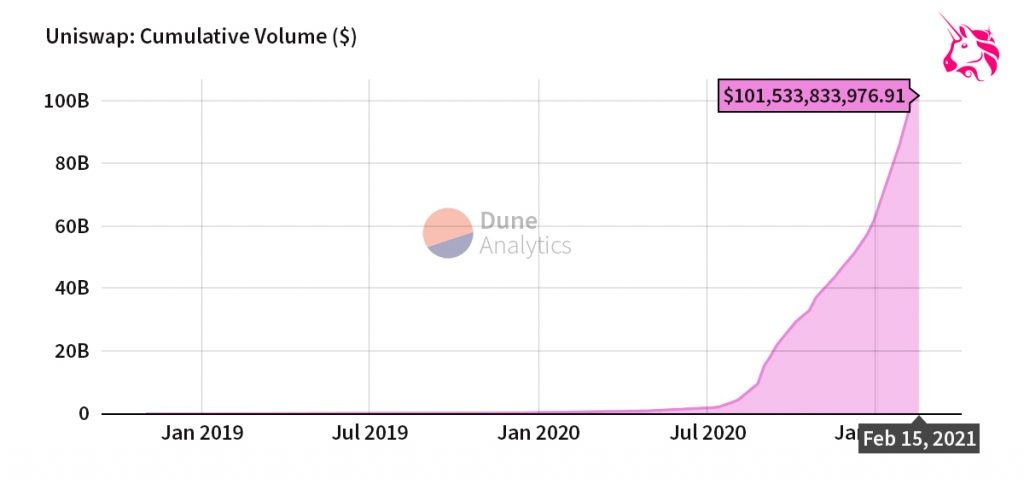

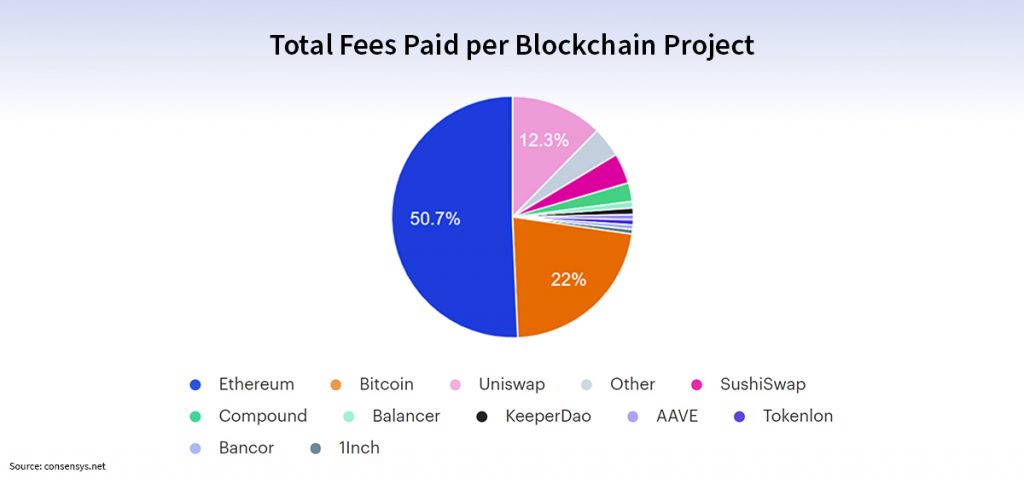

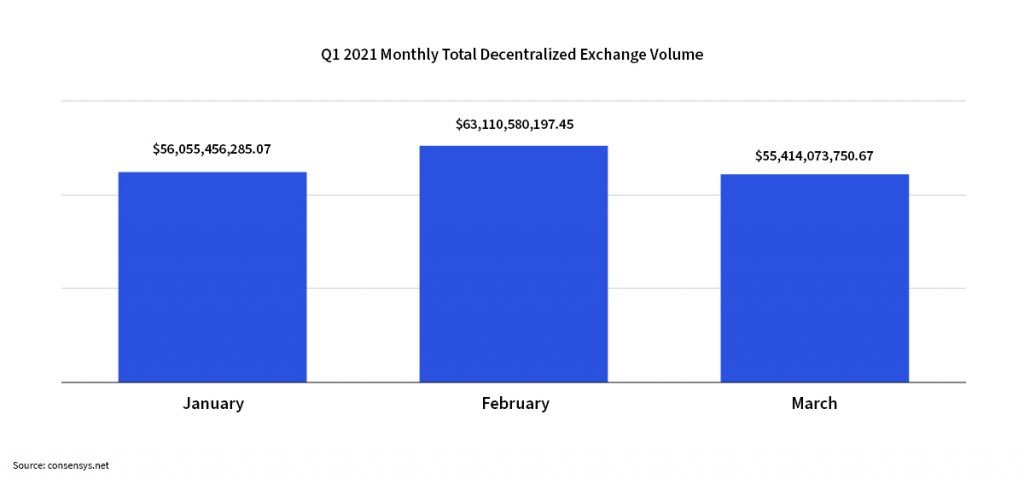

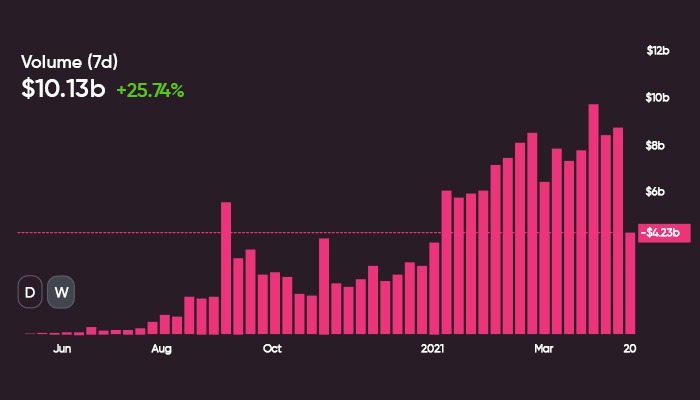

Because I talked more in-depth about Blockchain in one of my previous articles, I will not insist on technical aspects. Through Automated Market Makers, I will only say that it makes the leap from the actual cryptocurrencies to the markets where these are traded, and this leap is currently taking place right before our eyes.

This is one of the first manifestations of the ecosystem called by specialists DeFi (Decentralized Finance). In the market maker segment, the Blockchain breaks the monopoly of large financial institutions through automation. The walls, the offices, the employees and especially their massive liquidity are replaced by something that looks more like a software structure.

Because I talked more in-depth about Blockchain in one of my previous articles, I will not insist on technical aspects. Through Automated Market Makers, I will only say that it makes the leap from the actual cryptocurrencies to the markets where these are traded, and this leap is currently taking place right before our eyes.

This is one of the first manifestations of the ecosystem called by specialists DeFi (Decentralized Finance). In the market maker segment, the Blockchain breaks the monopoly of large financial institutions through automation. The walls, the offices, the employees and especially their massive liquidity are replaced by something that looks more like a software structure.

In short, the term Automated Market Makers (AMM) defines:

• A software architecture based on Blockchain, digitally connecting liquidity providers with brokers and trading companies. In turn, these will interact with investors, most likely through online platforms.

• A mathematical formula that sets the maximum liquidity in a given area.

• At the moment, Automated Market Makers make transactions between cryptocurrencies and fiat currencies or tokens (value symbols derived from them) possible. However, the technology applies to any asset transaction, and I do not doubt that it will be used in the future.

• Very low commissions (these can even go to zero, but in this case software creators can no longer turn in a profit).

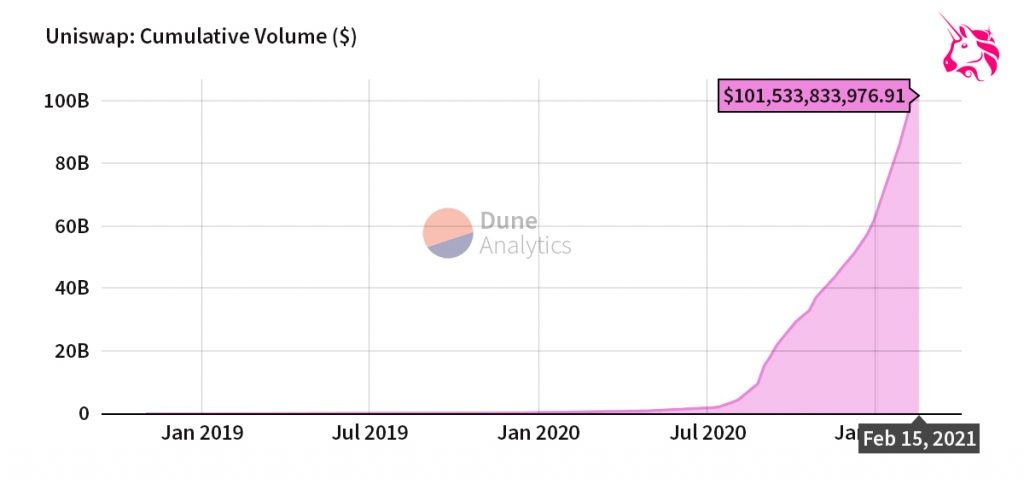

Since 2018, Uniswap, Sushiswap, Curve, Balancer or Kyber Network have entered this new market. In the case of Uniswap, the AMM with the highest volume, the operating formula is straightforward: x * y = k, where x and y represent assets, and k stands for the total liquidity in a specific area. One of the working principles here is that the liquidity in the respective area does not change for the symmetry of the transactions.

Other Automated Market Makers use more complicated mathematical devices. However, it is clear that the Blockchain brings clear advantages here, such as:

• Very low costs for users, between 0.1% and 0.3% for large Automated Market Makers.

• Secure, decentralized processes.

• A competitive market, with clear benefits for customers, because anyone can create a segment / become a market maker, even if it does not automatically entice success for that market.

In short, the term Automated Market Makers (AMM) defines:

• A software architecture based on Blockchain, digitally connecting liquidity providers with brokers and trading companies. In turn, these will interact with investors, most likely through online platforms.

• A mathematical formula that sets the maximum liquidity in a given area.

• At the moment, Automated Market Makers make transactions between cryptocurrencies and fiat currencies or tokens (value symbols derived from them) possible. However, the technology applies to any asset transaction, and I do not doubt that it will be used in the future.

• Very low commissions (these can even go to zero, but in this case software creators can no longer turn in a profit).

Since 2018, Uniswap, Sushiswap, Curve, Balancer or Kyber Network have entered this new market. In the case of Uniswap, the AMM with the highest volume, the operating formula is straightforward: x * y = k, where x and y represent assets, and k stands for the total liquidity in a specific area. One of the working principles here is that the liquidity in the respective area does not change for the symmetry of the transactions.

Other Automated Market Makers use more complicated mathematical devices. However, it is clear that the Blockchain brings clear advantages here, such as:

• Very low costs for users, between 0.1% and 0.3% for large Automated Market Makers.

• Secure, decentralized processes.

• A competitive market, with clear benefits for customers, because anyone can create a segment / become a market maker, even if it does not automatically entice success for that market.

For that market to function, the Automated Market Maker must attract so-called Liquidity Providers, who charge commissions because they provide the necessary volume of assets. This way, the so-called Liquidity Pools are created for each pair of assets. Formulas such as the one mentioned for Uniswap help adjust the price according to demand and supply.

Automated Market Makers also have another significant advantage: the so-called smart contracts, created from computer codes. These contracts are impossible to break because they extend the software architecture represented by the market and the respective pools.

For that market to function, the Automated Market Maker must attract so-called Liquidity Providers, who charge commissions because they provide the necessary volume of assets. This way, the so-called Liquidity Pools are created for each pair of assets. Formulas such as the one mentioned for Uniswap help adjust the price according to demand and supply.

Automated Market Makers also have another significant advantage: the so-called smart contracts, created from computer codes. These contracts are impossible to break because they extend the software architecture represented by the market and the respective pools.

Automated Market Makers are an explosive market, but it is only at the beginning of its evolution. At the moment, it suffers from a series of inherent disadvantages, such as the possibility of error (even if it is not the market maker who makes them, but the user because the latter can cause errors when finalizing the aforementioned smart contracts). Also, because the markets created often touch on cryptocurrency trading, Automated Market Makers inherit their reliability. In other words, they will have problems when a new cryptocurrency also has functional issues.

Specialists also noted the relatively limited number of functionalities currently available on this type of platform, compared to more mature areas of the fintech industry, which are in the process of accelerated diversification.

Ultimately, the future of Automated Market Makers will be dictated by the general requirements of the fintech area. In my view, they are by no means limited to technology, but to the following things:

• Transparency/trend towards financial and technological education.

• Regulation and good practices.

• Shallow entry threshold: in the case of AMM, investors and Liquidity Providers can enter the market with minimal amounts. In the latter case, the necessary amount can start from $50k, which is low compared to the financial strength of traditional market makers.

• Usability/reliability/facilities from the user's point of view.

Automated Market Makers are an explosive market, but it is only at the beginning of its evolution. At the moment, it suffers from a series of inherent disadvantages, such as the possibility of error (even if it is not the market maker who makes them, but the user because the latter can cause errors when finalizing the aforementioned smart contracts). Also, because the markets created often touch on cryptocurrency trading, Automated Market Makers inherit their reliability. In other words, they will have problems when a new cryptocurrency also has functional issues.

Specialists also noted the relatively limited number of functionalities currently available on this type of platform, compared to more mature areas of the fintech industry, which are in the process of accelerated diversification.

Ultimately, the future of Automated Market Makers will be dictated by the general requirements of the fintech area. In my view, they are by no means limited to technology, but to the following things:

• Transparency/trend towards financial and technological education.

• Regulation and good practices.

• Shallow entry threshold: in the case of AMM, investors and Liquidity Providers can enter the market with minimal amounts. In the latter case, the necessary amount can start from $50k, which is low compared to the financial strength of traditional market makers.

• Usability/reliability/facilities from the user's point of view.

Whatever the current shortcomings, I believe that Blockchain-based markets and tools will undoubtedly evolve in this direction, as is the case with the first such market, the cryptocurrencies market. The technology is far too valuable and versatile for such initiatives to stall, even if we might witness some bubbles and crashes. And that is precisely why I considered this introduction to be necessary.

You can follow me on

Whatever the current shortcomings, I believe that Blockchain-based markets and tools will undoubtedly evolve in this direction, as is the case with the first such market, the cryptocurrencies market. The technology is far too valuable and versatile for such initiatives to stall, even if we might witness some bubbles and crashes. And that is precisely why I considered this introduction to be necessary.

You can follow me on

So far, I talked about three main advantages of the technology:

1. Security: decentralized data storage protects Blockchain structures from the vulnerabilities of traditional banking information systems, whose centralization makes them easy to penetrate with a single hack

2. Confidentiality: networks do not monitor the type and purpose of the transaction, even if cryptocurrencies are used on the Dark Web. It is challenging for a transaction to be associated with a person.

3. Low costs for users: very low, for example, compared to bank fees.

4. Timestamping: although very secure and confidential, the technology allows monitoring up to the source of all data (financial or non-financial) included in the databases.

So far, I talked about three main advantages of the technology:

1. Security: decentralized data storage protects Blockchain structures from the vulnerabilities of traditional banking information systems, whose centralization makes them easy to penetrate with a single hack

2. Confidentiality: networks do not monitor the type and purpose of the transaction, even if cryptocurrencies are used on the Dark Web. It is challenging for a transaction to be associated with a person.

3. Low costs for users: very low, for example, compared to bank fees.

4. Timestamping: although very secure and confidential, the technology allows monitoring up to the source of all data (financial or non-financial) included in the databases.

Some other Blockchain characteristics:

• The Blockchain is "permanently open", 24 hours a day.

• Almost instantaneous transactions (up to a maximum of 10-15 minutes), way less than the classic 48 hours in the banking environment

• “Banking the unbanked”: the technology can be available to any Internet and mobile owner, regardless of the country in which he lives, if banks impose various restrictive conditions for opening accounts. The World Bank says there are currently about two billion adults worldwide without access to banking.

Some other Blockchain characteristics:

• The Blockchain is "permanently open", 24 hours a day.

• Almost instantaneous transactions (up to a maximum of 10-15 minutes), way less than the classic 48 hours in the banking environment

• “Banking the unbanked”: the technology can be available to any Internet and mobile owner, regardless of the country in which he lives, if banks impose various restrictive conditions for opening accounts. The World Bank says there are currently about two billion adults worldwide without access to banking.

The Blockchain is proving its usefulness in other areas, as we speak:

• Food supply: IBM has created the Food Trust, a Blockchain mechanism tracking the route of food from source to consumer. It is a medical revolution because, in the case of E. coli or salmonella infections, the source of the infection is located immediately, while in the past, expensive investigations were required which took several weeks.

• P2P Energy Trading: new forms of energy, such as solar, are decentralized, and production is fluctuating. Within a particular time, the solar panels of a house can produce more energy than necessary so that the house owner will sell it back to the network. I do not need to go into technical details because it is evident at first glance that such a situation fits perfectly within the Blockchain universe, which was carefully assessed by a startup called WePower.

• Mining of precious stones: as their origin is critical, the Blockchain helps to certify the source. For example, that's what Everledger does.

• Freight transport: Walmart Canada uses Blockchain for managing highly complex supply chains, which rely on dozens of transportation companies.

Blockchain technologies have created an ecosystem called by specialists DeFi (Decentralized Finance) in the capital markets. It includes not only cryptocurrencies but also the three segments mentioned above. Soon, the technology can be applied to loans, real estate transactions or insurance. I have already mentioned its benefits.

The Blockchain is proving its usefulness in other areas, as we speak:

• Food supply: IBM has created the Food Trust, a Blockchain mechanism tracking the route of food from source to consumer. It is a medical revolution because, in the case of E. coli or salmonella infections, the source of the infection is located immediately, while in the past, expensive investigations were required which took several weeks.

• P2P Energy Trading: new forms of energy, such as solar, are decentralized, and production is fluctuating. Within a particular time, the solar panels of a house can produce more energy than necessary so that the house owner will sell it back to the network. I do not need to go into technical details because it is evident at first glance that such a situation fits perfectly within the Blockchain universe, which was carefully assessed by a startup called WePower.

• Mining of precious stones: as their origin is critical, the Blockchain helps to certify the source. For example, that's what Everledger does.

• Freight transport: Walmart Canada uses Blockchain for managing highly complex supply chains, which rely on dozens of transportation companies.

Blockchain technologies have created an ecosystem called by specialists DeFi (Decentralized Finance) in the capital markets. It includes not only cryptocurrencies but also the three segments mentioned above. Soon, the technology can be applied to loans, real estate transactions or insurance. I have already mentioned its benefits.

• Automated Market Makers (AMM): automated players from the financial markets, having the role of ensuring liquidity (assets required for transactions) and setting sell and buy prices, just like stock exchanges do in the case of traditional shares.

• Assets (assets): a broad category of properties with financial value, which includes anything that can be converted at some point into money, from shares to the actual money existing in the accounts. The difference between assets (assets) and securities (securities) is that the former instead reflect the property, and the latter, its convertible aspect in cash (liquidity).

• Blockchain: Decentralized database, distributed on several computers connected to the Internet (nodes), in the form of blocks of information. Compared to classic databases, this architecture is redundant (blocks are replicated in several places), almost impossible to falsify and has timestamps (timestamping: date, day, time etc.) on all its blocks, meaning that the records implicitly contain their provenance. Cryptocurrencies are not the only application of Blockchain.

• Cryptocurrency (crypto, cryptocurrency): digital asset / alternative currency (virtual), quoted, traded and distributed based on Blockchain. It is also called an altcoin. Cryptocurrencies differ from traditional currencies by decentralized management (there is no central bank to issue them) and the absolute confidentiality of the owners’ names. The prefix "crypto" comes from "cryptography" or encryption of owners’ names and other sensitive data.

• Automated Market Makers (AMM): automated players from the financial markets, having the role of ensuring liquidity (assets required for transactions) and setting sell and buy prices, just like stock exchanges do in the case of traditional shares.

• Assets (assets): a broad category of properties with financial value, which includes anything that can be converted at some point into money, from shares to the actual money existing in the accounts. The difference between assets (assets) and securities (securities) is that the former instead reflect the property, and the latter, its convertible aspect in cash (liquidity).

• Blockchain: Decentralized database, distributed on several computers connected to the Internet (nodes), in the form of blocks of information. Compared to classic databases, this architecture is redundant (blocks are replicated in several places), almost impossible to falsify and has timestamps (timestamping: date, day, time etc.) on all its blocks, meaning that the records implicitly contain their provenance. Cryptocurrencies are not the only application of Blockchain.

• Cryptocurrency (crypto, cryptocurrency): digital asset / alternative currency (virtual), quoted, traded and distributed based on Blockchain. It is also called an altcoin. Cryptocurrencies differ from traditional currencies by decentralized management (there is no central bank to issue them) and the absolute confidentiality of the owners’ names. The prefix "crypto" comes from "cryptography" or encryption of owners’ names and other sensitive data.

• Decentralized finance (DeFi): the new decentralized, global and cross-border architecture of financial markets, based on the exact characteristics of the Blockchain.

• Distributed ledger: a term that includes Blockchain but is not identical to it, referring to an accounting register distributed in several electronic sources.

• Fork: a software term characteristic for the open-source/free software movement. At a given moment, a program or operating system is divided into two distinct pieces, at the initiative of a part of the developers working. Because cryptocurrencies are based mainly on software and an open-source philosophy, they also split, at different times, into different variants. One of the most famous forks is the one in which Bitcoin Cash split in 2017 from Bitcoin.

• Liquidity: the characteristic of a market/segment referring to the ease of trading. Two categories of valuable shares can have very different liquidity on the same stock exchange, meaning that some are traded much more than others.

• Decentralized finance (DeFi): the new decentralized, global and cross-border architecture of financial markets, based on the exact characteristics of the Blockchain.

• Distributed ledger: a term that includes Blockchain but is not identical to it, referring to an accounting register distributed in several electronic sources.

• Fork: a software term characteristic for the open-source/free software movement. At a given moment, a program or operating system is divided into two distinct pieces, at the initiative of a part of the developers working. Because cryptocurrencies are based mainly on software and an open-source philosophy, they also split, at different times, into different variants. One of the most famous forks is the one in which Bitcoin Cash split in 2017 from Bitcoin.

• Liquidity: the characteristic of a market/segment referring to the ease of trading. Two categories of valuable shares can have very different liquidity on the same stock exchange, meaning that some are traded much more than others.

• P2P (Peer-to-Peer or P2P): feature of a network architecture that has influenced the Blockchain architecture. In peer-to-peer, transfers take place between peers and not between a server and a user/client. The category includes Blockchain, but also Bittorent class technologies, which refer to simply transferring files.

• Securities: class of convertible assets - and converted into money. These can be participation in companies (equities - of which the shares are part), tradable debts (debts) or derivatives (values resulting from different assets, such as futures contracts or stock options).

• P2P (Peer-to-Peer or P2P): feature of a network architecture that has influenced the Blockchain architecture. In peer-to-peer, transfers take place between peers and not between a server and a user/client. The category includes Blockchain, but also Bittorent class technologies, which refer to simply transferring files.

• Securities: class of convertible assets - and converted into money. These can be participation in companies (equities - of which the shares are part), tradable debts (debts) or derivatives (values resulting from different assets, such as futures contracts or stock options).

On several other occasions, I've mentioned the tremendous professional abilities of Romanian Millennials (people under 40). In many cases, they took advantage of multinational giants' experience and organizational culture that also operate in Romania. I would only mention two soft skills these people possess: fluency in multiple foreign languages and solid digital literacy (computer use), but there are many others.

On several other occasions, I've mentioned the tremendous professional abilities of Romanian Millennials (people under 40). In many cases, they took advantage of multinational giants' experience and organizational culture that also operate in Romania. I would only mention two soft skills these people possess: fluency in multiple foreign languages and solid digital literacy (computer use), but there are many others.

The bureaucracy is an old problem in Romania, but things appear to have improved. Strangely, it seems that bureaucracy was also one of the first victims of COVID. For example, the Trade Register discovered to its amazement that it could function excellent online, as well as other institutions with which companies and entrepreneurs interact. In the private sector, banks, which in any case had already started to eliminate their physical presence, have increased the pace of diversifying and updating their online platforms. The same thing is taking place in countless other public and private segments.

The bureaucracy is an old problem in Romania, but things appear to have improved. Strangely, it seems that bureaucracy was also one of the first victims of COVID. For example, the Trade Register discovered to its amazement that it could function excellent online, as well as other institutions with which companies and entrepreneurs interact. In the private sector, banks, which in any case had already started to eliminate their physical presence, have increased the pace of diversifying and updating their online platforms. The same thing is taking place in countless other public and private segments.