On September 1, Apple (AAPL) and Tesla (TSLA) split their stocks. People who owned 1 share now find themselves holding 4 in Apple's case, and 5 in Tesla's. On Tuesday, the day of the split, Apple's stock gained as much as 3.4%, and Tesla rose 12.5%. Since the announcement of their stock splits, Apple and Tesla shares jumped 40% and 70%, respectively.

Numbers can be tiring. Normally, I wouldn't throw as many figures in your face, but they speak the truth. Everyone has been talking about Apple and Tesla for weeks already. Now investors and analysts see Apple and Tesla stocks as the hottest things on earth.

I've dealt with capital markets for more than ten years. I believe that I can recognize an opportunity when I see it. Stay with me to find out how these stock splits work and why you might want to consider these opportunities, as long as they suit your trading style and goals.

First, let me tell you a bit more about stock splits.

Why do companies split their stocks?

Companies split their stocks because such a move can make shares look more affordable to small investors. Both Tesla and Apple wanted the same thing: to attract more people into investing. If more people start putting money in, the stocks' liquidity increases and prices tend to surge.

This means it's your chance to jump aboard and invest in the long term. But the short-term gains don't look too bad either.

Keep in mind that I just analyzed the stock performance one day after the split took place, and you can see the value gains were already noticeable.

Hopefully, I have got your interest by now. I will give you even more arguments about why I think Tesla and Apple might be viable investment options in the next few lines.

Apple, at the fifth stock split

Apple is the only publicly-traded company boasting a market capitalization of over $2 trillion. September 1 marked the corporation's fifth stock split since it went public in December 1980.

Had Apple never split its stock, shares would currently sell for roughly $28,000 apiece, inaccessible to small-time investors.

Generally, the stock increased in the medium to long term after a stock split.

In one case, Apple lost 61% of its value after the 2000 stock split. But that was an exception since the DOT-COM crash affected many tech companies back then.

Following the stock split, the Dow Jones had to make some adjustments to the stocks it includes:

- Apple no longer claims the number 1 spot, occupied now by UnitedHealth Group.

- Also, Pfizer, Exxon Mobil Corp, and Raytheon Technologies Corp were kicked out from the index.

- Salesforce.com Inc, Amgen Inc., and Honeywell International Inc. were the replacements. It was only the second time in the last ten years when the Dow Jones board decided to change its lineup.

One more thing I forgot to mention: not only has Apple stock increased following stock splits but so have dividends paid to its retail investors.

Tesla steps into uncharted territory

On the other hand, Tesla split its stock for the first time when shares grew 465% this year alone, smashing 33 records on their way. In August alone, shares jumped 56%. A month prior, the company reported a fourth-consecutive profitable quarter for the first time in its history.

In the end, allow me to write a few words on the man himself, Elon Musk. On September 2, he became the third richest person on earth, surpassing Mark Zuckerberg. He's now behind Bill Gates and Jeff Bezos. Apart from Tesla, Musk also founded several other companies, including SpaceX, The Boring Company, Hyperloop, and OpenAI. His notoriety and unique approaches have boosted Tesla as a one-of-a-kind company for investors worldwide. And that feat alone accounts for several percentages from that massive stock surge in the past years.

Other notable stock splits

Microsoft

Since it first went public, Microsoft has had 9 successful stock splits with the last one occurring in 2003. For every share that an investor-owned before the first split, he would now sit on 288 shares.

The immediate short-term impact of the split on Microsoft share price is worth noting. On only 1 occasion - in September 1987 - did Microsoft's stock closed at a lower price on the day of the split than the day before. At that time, Microsoft shares closed at $114.50. Typically, the stock should have traded at $57.25 after the 2-for-1 split. However, the actual closing price hit just $53.50 per share, translating to a 6.55% drop.

Meanwhile, the remaining 8 splits showed gains, the largest one posting a 7% increase in 1996. The numbers before the split showed a $76.39 share value, yet the stock closed the next day at $81.75. Microsoft's results show that even though stock splits have no theoretical impact on a company's value, shareholders give a lot of importance to these events.

The last split so far for Microsoft stock marked the first time when the company declared it would start issuing regular dividends. Combining the stock split and dividends made Microsoft shares look more attractive to a broader range of investors, and prices gradually grew in the long term.

Chart with Microsoft stock performance following its stock splits courtesy of macrotrends.net.

Netflix

Netflix only split its stock twice. The first time in February 2004 and the second one took place in July 2015. Both splits reflected the organic growth of Netflix's business model from its early stages to the mid-2010s.

The first stock split took place almost two years after Netflix joined the stock market. The company had just hit $1 billion in market capitalization and showed hints of its broad appeal and improved finances. Revenue had surged 80% in 2003, as the company reached 1.5 million subscribers.

Between October 2002 and January 2004, Netflix saw its shares climb by more than 1,500%, approaching $80 apiece. Netflix seized the opportunity and performed a 2-for-1 split - chart courtesy of YCharts.com.

The split from July 2015 saw Netflix in an entirely different position. The 7-for-1 split made the company's stock even more appealing for small investors, with shares skyrocketing in the first 6 months, before stabilizing afterward.

In 2015, the company had introduced its streaming video service and boasted 65 million members worldwide in the second quarter of the year: 42 million domestic subscribers and 23 million international customers. Netflix added 3.28 million subscribers in the second quarter alone, double the subscriber count from 2004. That amount of success helped push shares to nearly $700, making Netflix one of the most expensive stocks in the S&P 500 index.

In the graph below, you can note the gradual growth between the two stock splits.

Amazon

Amazon performed 3 stock splits in the late '90s: in June 1998, January 1999, and in September 1999. Back then, Amazon was at its early stages in the development process.

Amazon closed its first day on the stock market in 1997, at an adjusted $23.50 per share. One year later, share prices almost tripled in value, and Amazon performed its first 2-for-1 split. The next move followed in January of 1999 after another impressive gain of 755% in seven months. This time, Amazon opted for a 3-for-1 split.

Finally, the last 2-for-1 increase occurred in September 1999. This time, the stock dropped 4% lower.

Chart with Amazon stock performance between stock splits courtesy of YCharts and The Motley Fool.

Nowadays, investors expect Amazon to stage another split if it wants to keep up with Apple's growth. The markets also predict that Amazon could get an invitation to the Dow Jones Index, but the primary condition is to split its stock. Anyway, I'll be keeping a close eye on Amazon, since it could prove the next big thing to invest in.

Chart with Amazon stock performance following its stock splits courtesy of macrotrends.net.

Next stock splits – check out these companies!

Google and Facebook are the two other FAANG group members expected to split their stocks in the coming months. Both posted important gains in 2020 and could spark renewed interest in their stocks amid traders should they decide to split.

Also, NVIDIA more than doubled its share value year-to-date and might be looking at a stock split soon.

Closing words

They say growth brings even more growth, and many investors believe the sky is the limit for both Apple and Tesla.

I would also look at what the future might have in store, and Google, Facebook, and Nvidia could be the next exciting opportunities.

If you're looking for riveting info, make sure you follow me on Twitter and LinkedIn!

This is the most basic strategy, based on price increases: to buy and keep a certain amount of a cryptocurrency. The English term comes from the phrase "buy and hold", where the last word was misspelt by a user, on a specialized forum, in the early days of Bitcoin. In the absence of a detailed analysis, this type of asset's extreme volatility makes the Buy and HODL strategy very dangerous, especially for beginners. We see why just by analyzing Bitcoin's price evolution: the first bubble (massive price surge, followed by an equally impressive fall) took place in 2017 when this cryptocurrency started trading at about $1,000, only to reach over $20,000. However, the price collapsed to around $3,400 in the next two years. After the first wave of the pandemic in 2020, Bitcoin's price sharply increased to almost $60,000.

Other cryptocurrencies, such as Ethereum or Ripple, have had similar oscillations. A straightforward analysis shows the risks of this method, which seems attractive and clear at first glance. Assuming that an investor would have wanted to build a long-term crypto portfolio, he would have been spared significant losses only if he had invested in Bitcoin before July 2017, when the price was around $ 2,700, lower than the subsequent lows. However, in July 2017, Bitcoin and cryptocurrencies, in general, were something very new and exotic, and ordinary people didn't know what to do with them.

This is the most basic strategy, based on price increases: to buy and keep a certain amount of a cryptocurrency. The English term comes from the phrase "buy and hold", where the last word was misspelt by a user, on a specialized forum, in the early days of Bitcoin. In the absence of a detailed analysis, this type of asset's extreme volatility makes the Buy and HODL strategy very dangerous, especially for beginners. We see why just by analyzing Bitcoin's price evolution: the first bubble (massive price surge, followed by an equally impressive fall) took place in 2017 when this cryptocurrency started trading at about $1,000, only to reach over $20,000. However, the price collapsed to around $3,400 in the next two years. After the first wave of the pandemic in 2020, Bitcoin's price sharply increased to almost $60,000.

Other cryptocurrencies, such as Ethereum or Ripple, have had similar oscillations. A straightforward analysis shows the risks of this method, which seems attractive and clear at first glance. Assuming that an investor would have wanted to build a long-term crypto portfolio, he would have been spared significant losses only if he had invested in Bitcoin before July 2017, when the price was around $ 2,700, lower than the subsequent lows. However, in July 2017, Bitcoin and cryptocurrencies, in general, were something very new and exotic, and ordinary people didn't know what to do with them.

2018 and 2019 were two years of decline and /or uncertainty for the crypto market. However, I’ve always been sure that Blockchain technology is revolutionary, and it will find its much-deserved place in the world of finance. Elon Musk set the tone for Bitcoin’s recovery using Tesla to invest more than $1.5 billion for an estimated profit close to one billion. By the end of 2020, this currency surpassed the 50k mark. However, I do not recommend the Bitcoin market to novice investors. The ups and downs are tough to predict. In several years, we could live in a world where cryptocurrencies would be an everyday reality, but the revolution has yet to happen.

2018 and 2019 were two years of decline and /or uncertainty for the crypto market. However, I’ve always been sure that Blockchain technology is revolutionary, and it will find its much-deserved place in the world of finance. Elon Musk set the tone for Bitcoin’s recovery using Tesla to invest more than $1.5 billion for an estimated profit close to one billion. By the end of 2020, this currency surpassed the 50k mark. However, I do not recommend the Bitcoin market to novice investors. The ups and downs are tough to predict. In several years, we could live in a world where cryptocurrencies would be an everyday reality, but the revolution has yet to happen.

Oil consumption and prices have fallen dramatically due to the pandemic. First of all, the decline occurred because of demand, but the political factor was to blame too, as OPEC drastically reduced supply. Also, the concerns of political entities such as the European Union for a green economy influenced oil’s direction on a psychological level. Be careful, as forecasts for the coming years indicate that production and consumption will not return to pre-pandemic levels.

Oil consumption and prices have fallen dramatically due to the pandemic. First of all, the decline occurred because of demand, but the political factor was to blame too, as OPEC drastically reduced supply. Also, the concerns of political entities such as the European Union for a green economy influenced oil’s direction on a psychological level. Be careful, as forecasts for the coming years indicate that production and consumption will not return to pre-pandemic levels.

You are likely reading these lines on an HP laptop or having a Hewlett-Packard printer nearby. But you are less likely to know that Bill Hewlett and Dave Packard started "the biggest company in the world" in a garage after graduating from Stanford.

Their story and the company's story are told in an extremely attractive way by Michael S. Malone. But beyond the narrative, I learned from the book about the Objective and Key Results (OKR) method, an essential part of the so-called HP Way, the way HP does things. The focus on key objectives and results is derived from so-called goal management, referring to the clarification and approval within the company of some objectives and results, which leads to the simplification and efficiency of the processes. A clear set of OKR details and operationalizes the company's mission, eliminating the costly and sometimes damaging micromanagement and empowers employees, who are no longer conditioned by the daily performance of meaningless tasks, but must focus on final goals, which they understand. Although it refers to a process of accountability, employees will feel - rightly so - that they have as much power as they have been given responsibility and appreciate the flexible work environment.

You are likely reading these lines on an HP laptop or having a Hewlett-Packard printer nearby. But you are less likely to know that Bill Hewlett and Dave Packard started "the biggest company in the world" in a garage after graduating from Stanford.

Their story and the company's story are told in an extremely attractive way by Michael S. Malone. But beyond the narrative, I learned from the book about the Objective and Key Results (OKR) method, an essential part of the so-called HP Way, the way HP does things. The focus on key objectives and results is derived from so-called goal management, referring to the clarification and approval within the company of some objectives and results, which leads to the simplification and efficiency of the processes. A clear set of OKR details and operationalizes the company's mission, eliminating the costly and sometimes damaging micromanagement and empowers employees, who are no longer conditioned by the daily performance of meaningless tasks, but must focus on final goals, which they understand. Although it refers to a process of accountability, employees will feel - rightly so - that they have as much power as they have been given responsibility and appreciate the flexible work environment.

Since its inception in 1998, Google has been growing rapidly, which has led to massive pressure from an HR perspective. And yet, the giant that changed its name to Alphabet some time ago, at the level of a parent company, has continuously ranked in the top of the most desirable companies for employees. Laszlo Bock, the head of the company's HR department, states in this book that I recommend a whole series of unconventional rules, such as:

- take the power of managers and give it to employees.

- learn from the best, but also the worst employees.

- pay unfairly; it is fairer.

- only hire people smarter than you, no matter how long it takes you to find them.

Since its inception in 1998, Google has been growing rapidly, which has led to massive pressure from an HR perspective. And yet, the giant that changed its name to Alphabet some time ago, at the level of a parent company, has continuously ranked in the top of the most desirable companies for employees. Laszlo Bock, the head of the company's HR department, states in this book that I recommend a whole series of unconventional rules, such as:

- take the power of managers and give it to employees.

- learn from the best, but also the worst employees.

- pay unfairly; it is fairer.

- only hire people smarter than you, no matter how long it takes you to find them.

We have all heard of the author of this book: Peter Thiel, co-founder of PayPal and an investor involved in a thousand Silicon Valley projects. From Thiel's point of view, startups can go "from zero to one" only by accomplishing something completely new. Doing what everyone else can do can only lead you "from one to n". For example, the next Bill Gates will create something other than operating systems, and the next Larry Brin and Sergey Page will invent something other than search engines. Thiel says that progress is possible in many more areas, and not just in those in which digital innovation has manifested itself so far.

We have all heard of the author of this book: Peter Thiel, co-founder of PayPal and an investor involved in a thousand Silicon Valley projects. From Thiel's point of view, startups can go "from zero to one" only by accomplishing something completely new. Doing what everyone else can do can only lead you "from one to n". For example, the next Bill Gates will create something other than operating systems, and the next Larry Brin and Sergey Page will invent something other than search engines. Thiel says that progress is possible in many more areas, and not just in those in which digital innovation has manifested itself so far.

An HR team needs to identify current and future trends while making recruiting more exciting and rewarding for prospective employees. Unfortunately, many recruiters still hunt for the best people in their respective activity domains when they should look for potential employees who fit the company’s culture.

If you recruit people who blend in with the team and embrace your company's values, they will most likely perform a lot better than someone who does not adapt to your way of doing things.

Hard skills vs. soft skills

Every individual possesses two different categories of skills: hard and soft. It’s the recruiters’ job to find the perfect candidates with the right mix of hard and soft skills for each position.

Hard skills are related to specific technical knowledge and training that recommend a candidate for an open position, while soft skills are personality traits. Knowledge of the Microsoft Office suite or WordPress falls into the hard skills category. Leadership, teamwork, and creativity are all soft skills.

Administration

An HR team needs to identify current and future trends while making recruiting more exciting and rewarding for prospective employees. Unfortunately, many recruiters still hunt for the best people in their respective activity domains when they should look for potential employees who fit the company’s culture.

If you recruit people who blend in with the team and embrace your company's values, they will most likely perform a lot better than someone who does not adapt to your way of doing things.

Hard skills vs. soft skills

Every individual possesses two different categories of skills: hard and soft. It’s the recruiters’ job to find the perfect candidates with the right mix of hard and soft skills for each position.

Hard skills are related to specific technical knowledge and training that recommend a candidate for an open position, while soft skills are personality traits. Knowledge of the Microsoft Office suite or WordPress falls into the hard skills category. Leadership, teamwork, and creativity are all soft skills.

Administration

A company cannot perform well if it's managed poorly. From an HR perspective, everything must be in place, from processes to procedures and documentation.

The HR admin sector includes processing payrolls, updating company policies, maintaining employee and business records, and many different tasks.

Nurturing

A company cannot perform well if it's managed poorly. From an HR perspective, everything must be in place, from processes to procedures and documentation.

The HR admin sector includes processing payrolls, updating company policies, maintaining employee and business records, and many different tasks.

Nurturing

The onboarding part of the entire process is essential, as your HR team must help employees accommodate their new jobs. Sometimes, this can last from a couple of days to several weeks or even months.

Additionally, recruiters need to continuously build their relationships with employees to nurture their development for mutual success. Communication is critical here: the more knowledgeable employees are about your business, the better work they’ll do.

Also, work towards growing their engagement while also focusing on their needs and problems. Constant assessment will help people adhere faster to all the company's values and organizational culture.

The HR department should be a bridge between employees and management. Through it, the management must have clear feedback regarding the company's strengths and weaknesses.

We live in a highly competitive business environment, and the power of your company’s organizational culture can make all the difference. Finding an edge for yourself becomes mandatory if you plan to grow.

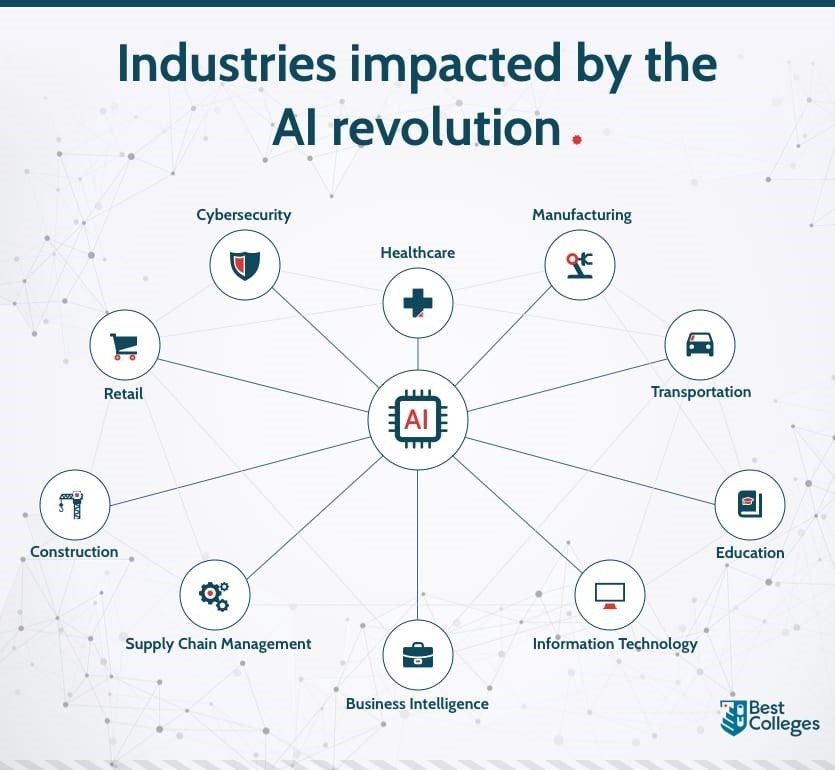

In the few words below, I will tell you about a solution I plan to implement in my company's HR department: Artificial Intelligence (AI).

A.I – the future in HR is here

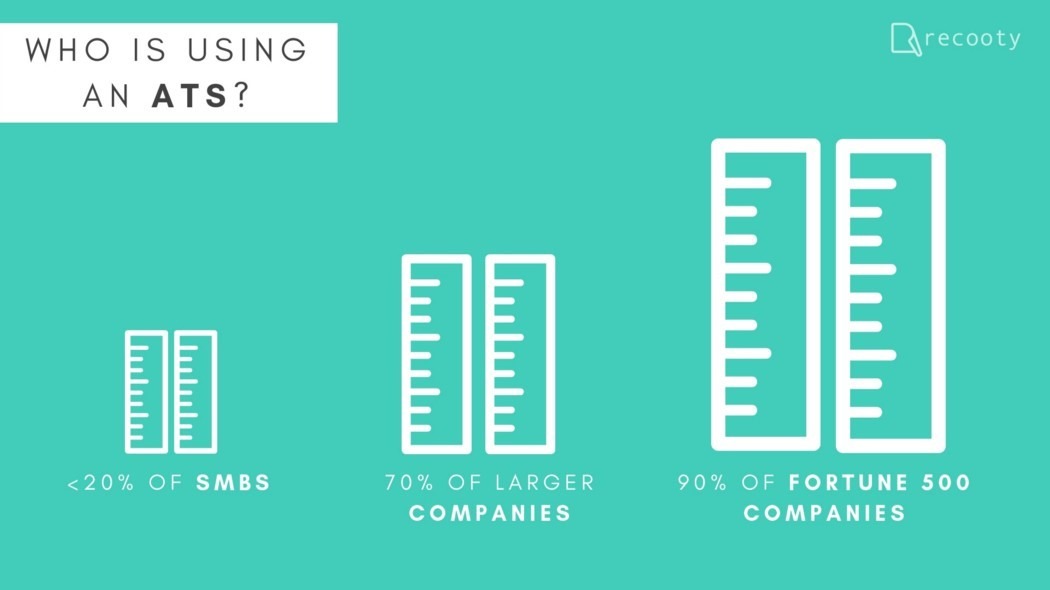

90% of Fortune 500 companies use AI in recruiting

The process of recruiting and nurturing the best people with the right skills for your business could turn out to be time-consuming, frustrating, and very challenging.

That’s why big names such as Amazon, Walmart, Facebook, or Intel use Artificial Intelligence tools and resources to hire the best candidates. 90% of Fortune 500 companies employ applicant tracking systems (ATS) to get the job done.

After learning more about ATS, I'm impressed would be an understatement, and I'm sure that more and more small and medium business enterprises will start using them.

Take a look at the graph below to see how widespread ATS currently is.

The onboarding part of the entire process is essential, as your HR team must help employees accommodate their new jobs. Sometimes, this can last from a couple of days to several weeks or even months.

Additionally, recruiters need to continuously build their relationships with employees to nurture their development for mutual success. Communication is critical here: the more knowledgeable employees are about your business, the better work they’ll do.

Also, work towards growing their engagement while also focusing on their needs and problems. Constant assessment will help people adhere faster to all the company's values and organizational culture.

The HR department should be a bridge between employees and management. Through it, the management must have clear feedback regarding the company's strengths and weaknesses.

We live in a highly competitive business environment, and the power of your company’s organizational culture can make all the difference. Finding an edge for yourself becomes mandatory if you plan to grow.

In the few words below, I will tell you about a solution I plan to implement in my company's HR department: Artificial Intelligence (AI).

A.I – the future in HR is here

90% of Fortune 500 companies use AI in recruiting

The process of recruiting and nurturing the best people with the right skills for your business could turn out to be time-consuming, frustrating, and very challenging.

That’s why big names such as Amazon, Walmart, Facebook, or Intel use Artificial Intelligence tools and resources to hire the best candidates. 90% of Fortune 500 companies employ applicant tracking systems (ATS) to get the job done.

After learning more about ATS, I'm impressed would be an understatement, and I'm sure that more and more small and medium business enterprises will start using them.

Take a look at the graph below to see how widespread ATS currently is.

What’s an ATS?

An ATS is a software application that helps HR employees recruit qualified candidates by filtering, organizing, and streamlining job applications.

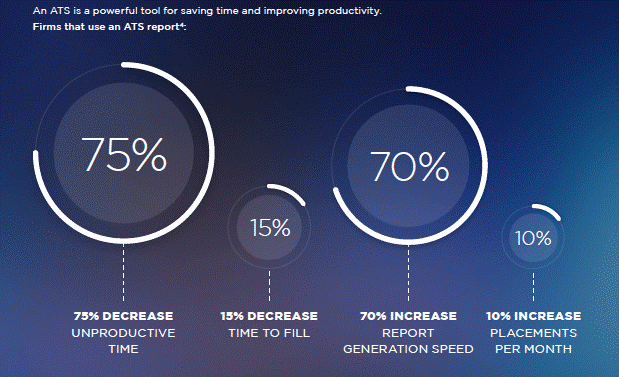

Companies already using ATS are reporting tremendous productivity increases every month. At the same time, the hiring time has shortened— you can see more similar stats in the graph I’m attaching below:

What’s an ATS?

An ATS is a software application that helps HR employees recruit qualified candidates by filtering, organizing, and streamlining job applications.

Companies already using ATS are reporting tremendous productivity increases every month. At the same time, the hiring time has shortened— you can see more similar stats in the graph I’m attaching below:

So how does the ATS tool get to such incredible results?

ATS programs automate almost everything in the recruiting process, including:

Job Posting

Posting open positions to numerous free and paid job sites such as the company's social networks, job portals, corporate employment sites, or social media pages helps organizations gain a wide range of applicants.

So how does the ATS tool get to such incredible results?

ATS programs automate almost everything in the recruiting process, including:

Job Posting

Posting open positions to numerous free and paid job sites such as the company's social networks, job portals, corporate employment sites, or social media pages helps organizations gain a wide range of applicants.

Resume screening

Resume screening refers to the process of matching candidates with job requirements based on individual skills and qualifications: work experience, education, knowledge, personality traits, and competencies.

ATS systems automatically filter applicants and list the best candidates for a specific job opening. Then, recruiters decide whether to call the candidate for the next interview or to reject the application.

Resume screening

Resume screening refers to the process of matching candidates with job requirements based on individual skills and qualifications: work experience, education, knowledge, personality traits, and competencies.

ATS systems automatically filter applicants and list the best candidates for a specific job opening. Then, recruiters decide whether to call the candidate for the next interview or to reject the application.

Matching

Interview planning and evaluation

ATS software connects to the recruiter’s email system and allows them to set up appointments with candidates without constantly exchanging emails or phone calls. Additionally, interviewers receive structured feedback forms so that evaluation becomes a lot more straightforward.

HR departments can also use the power of AI to uncover potential suitable employees in the company’s database, boosting increases by 20% in hire retention and reducing by 50% the number of interviews for the same number of hires.

Matching

Interview planning and evaluation

ATS software connects to the recruiter’s email system and allows them to set up appointments with candidates without constantly exchanging emails or phone calls. Additionally, interviewers receive structured feedback forms so that evaluation becomes a lot more straightforward.

HR departments can also use the power of AI to uncover potential suitable employees in the company’s database, boosting increases by 20% in hire retention and reducing by 50% the number of interviews for the same number of hires.

ATS and recruiting – because time is money

Due to the competitiveness in the talent market, highly qualified people are only available for a short time. Simultaneously, an opening for a corporate position receives 250 applications on average, and 88% of these resumes are unqualified.

These processes demand a high volume of resources while wasting recruiters 25% of their time for resume screening only.

With the automation of artificial intelligence, HR departments also ensure they remove bias from the hiring process, making it faster and more beneficial for all sides involved.

According to studies, ATS systems can provide your HR team with the following advantages:

ATS and recruiting – because time is money

Due to the competitiveness in the talent market, highly qualified people are only available for a short time. Simultaneously, an opening for a corporate position receives 250 applications on average, and 88% of these resumes are unqualified.

These processes demand a high volume of resources while wasting recruiters 25% of their time for resume screening only.

With the automation of artificial intelligence, HR departments also ensure they remove bias from the hiring process, making it faster and more beneficial for all sides involved.

According to studies, ATS systems can provide your HR team with the following advantages:

My conclusions regarding AI in business

I'm determined to start using AI in my recruiting system, and my suggestion for you is to consider doing it as well.

A faster and more efficient hiring process for reduced costs – we all want these benefits, don't we? The alternative would be to say no to the current big thing and failing to understand what you could be missing.

You can follow me on

My conclusions regarding AI in business

I'm determined to start using AI in my recruiting system, and my suggestion for you is to consider doing it as well.

A faster and more efficient hiring process for reduced costs – we all want these benefits, don't we? The alternative would be to say no to the current big thing and failing to understand what you could be missing.

You can follow me on  Romanian online businesses continue to flourish even after the relaxation of restrictions

According to data supplied by MerchantPro, between June and August 2020, there were 52% more transactions placed compared to the same period of 2019. For the record, MerchantPro accounts for orders placed on over 1.500 online shops in Romania.

This comes as a surprise to me since the Romanian government relaxed restrictions several months ago. Yet, online shopping performance wasn't affected at all. On the contrary, its growing trend never halted.

We have a fact: the new e-commerce dynamics from the start of the pandemic show growth in six months, similar to three years in a familiar context. And with no end in sight for the COVID-19 pandemic, this trend might as well carry on.

Before getting into studies, examples, and analysis, let's talk about what makes the e-commerce sector, such as an enticing business to invest in.

Romanian online businesses continue to flourish even after the relaxation of restrictions

According to data supplied by MerchantPro, between June and August 2020, there were 52% more transactions placed compared to the same period of 2019. For the record, MerchantPro accounts for orders placed on over 1.500 online shops in Romania.

This comes as a surprise to me since the Romanian government relaxed restrictions several months ago. Yet, online shopping performance wasn't affected at all. On the contrary, its growing trend never halted.

We have a fact: the new e-commerce dynamics from the start of the pandemic show growth in six months, similar to three years in a familiar context. And with no end in sight for the COVID-19 pandemic, this trend might as well carry on.

Before getting into studies, examples, and analysis, let's talk about what makes the e-commerce sector, such as an enticing business to invest in.

ADVANTAGES OF STARTING AN E-COMMERCE BRAND

ADVANTAGES OF STARTING AN E-COMMERCE BRAND

According to ecommercedb.com, eMag ranked first in the e-commerce sector last year, with a revenue of $682 million. dedeman.ro came in second place, scoring $80 million revenue, $3 million more than pcgarage.ro, the no.3 online shop in my beloved country.

No surprise so far. But I need to mention one incredibly exciting fact you ought to know: these three online shops account for half of the revenue generated from e-commerce businesses in Romania, or so ecommercedb.com states.

Side note: the website I cited as source bases its rankings on every store that generates Romania's revenue. These stores can either have a national focus and only sell in their primary country or operate globally. For this evaluation, it took into consideration only the revenue created in Romania.

What the past, the present, and the future tell us about e-commerce in Romania

Why should you invest in Romanian e-commerce? What's so appealing about this industry apart from the obvious things? I have not answered these questions yet, but the time has come to address them.

Revenue is expected to soar approx. 40% year-over-year, user numbers to increase by 11%

During my research into the Romanian e-commerce market, I stumbled upon some exciting data regarding this industry.

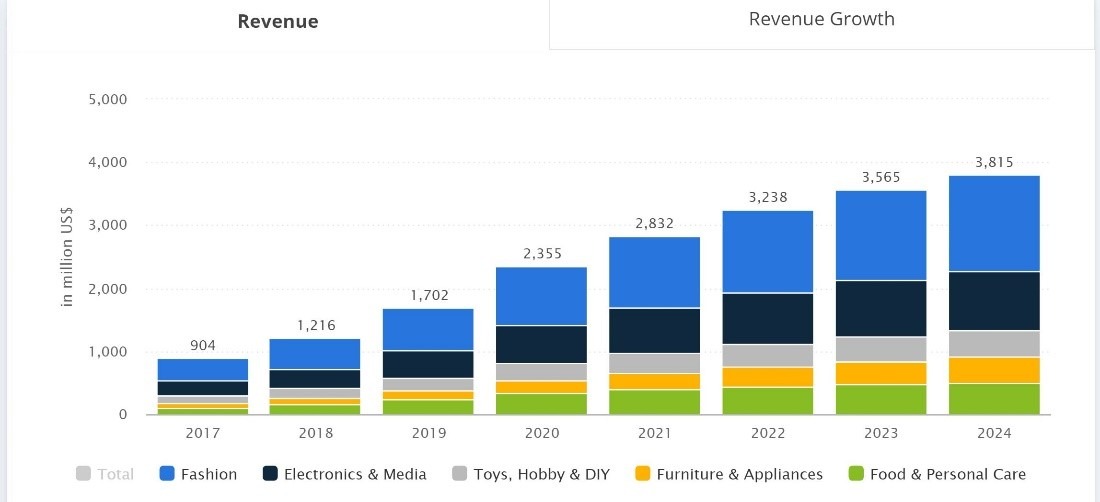

For instance, online shops could hit $2,35 billion in 2020 – a whopping 38.4% jump from $1,702 billion in 2019. Moreover, the e-commerce market could turn into a $3,815 billion industry by 2024, double the amount expected for 2020.

The market's largest segment is Fashion, with a projected market volume of $943 million in 2020. Electronics & media, toys, hobby and DIY, Furniture & Appliances, and Food & Personal Care account for the other major industries.

According to ecommercedb.com, eMag ranked first in the e-commerce sector last year, with a revenue of $682 million. dedeman.ro came in second place, scoring $80 million revenue, $3 million more than pcgarage.ro, the no.3 online shop in my beloved country.

No surprise so far. But I need to mention one incredibly exciting fact you ought to know: these three online shops account for half of the revenue generated from e-commerce businesses in Romania, or so ecommercedb.com states.

Side note: the website I cited as source bases its rankings on every store that generates Romania's revenue. These stores can either have a national focus and only sell in their primary country or operate globally. For this evaluation, it took into consideration only the revenue created in Romania.

What the past, the present, and the future tell us about e-commerce in Romania

Why should you invest in Romanian e-commerce? What's so appealing about this industry apart from the obvious things? I have not answered these questions yet, but the time has come to address them.

Revenue is expected to soar approx. 40% year-over-year, user numbers to increase by 11%

During my research into the Romanian e-commerce market, I stumbled upon some exciting data regarding this industry.

For instance, online shops could hit $2,35 billion in 2020 – a whopping 38.4% jump from $1,702 billion in 2019. Moreover, the e-commerce market could turn into a $3,815 billion industry by 2024, double the amount expected for 2020.

The market's largest segment is Fashion, with a projected market volume of $943 million in 2020. Electronics & media, toys, hobby and DIY, Furniture & Appliances, and Food & Personal Care account for the other major industries.

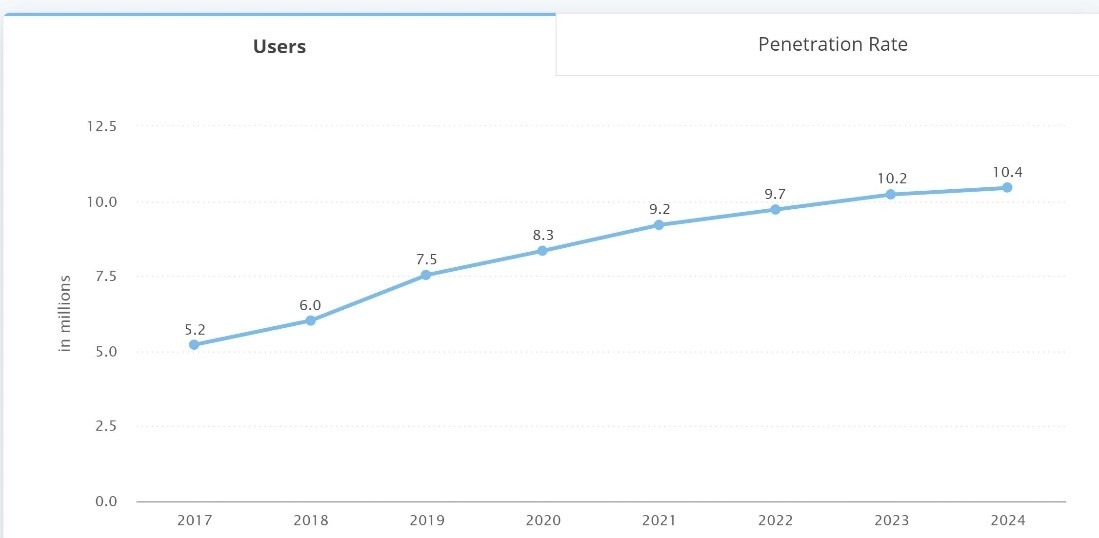

Graph showing Romania's e-commerce revenue from 2017 to 2024 (achieved and forecasted), and the most relevant industries contributing to it - statista.com

Buyers gather in increasingly larger numbers, women lead

Another growth factor for the e-commerce market in Romania is the number of users, which is expected to amount to 10.4 million by 2024. Compared to 2019, 2020 could witness a 10,7% increase in users shopping online.

Graph showing Romania's e-commerce revenue from 2017 to 2024 (achieved and forecasted), and the most relevant industries contributing to it - statista.com

Buyers gather in increasingly larger numbers, women lead

Another growth factor for the e-commerce market in Romania is the number of users, which is expected to amount to 10.4 million by 2024. Compared to 2019, 2020 could witness a 10,7% increase in users shopping online.

Graph showing Romania's e-commerce users growth from 2017 to 2024 – statista.com

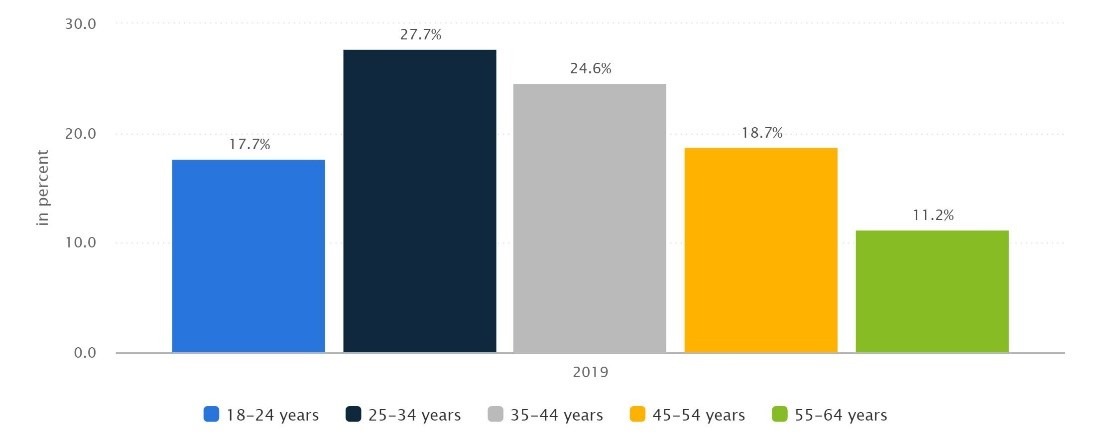

In 2019, 27.7% of e-commerce users fell into the 25-34 age category, which accounted for most online visits. Customers aged 35-44 followed, with 24.6%. Most people who buy online are women (51.4%).

Graph showing Romania's e-commerce users growth from 2017 to 2024 – statista.com

In 2019, 27.7% of e-commerce users fell into the 25-34 age category, which accounted for most online visits. Customers aged 35-44 followed, with 24.6%. Most people who buy online are women (51.4%).

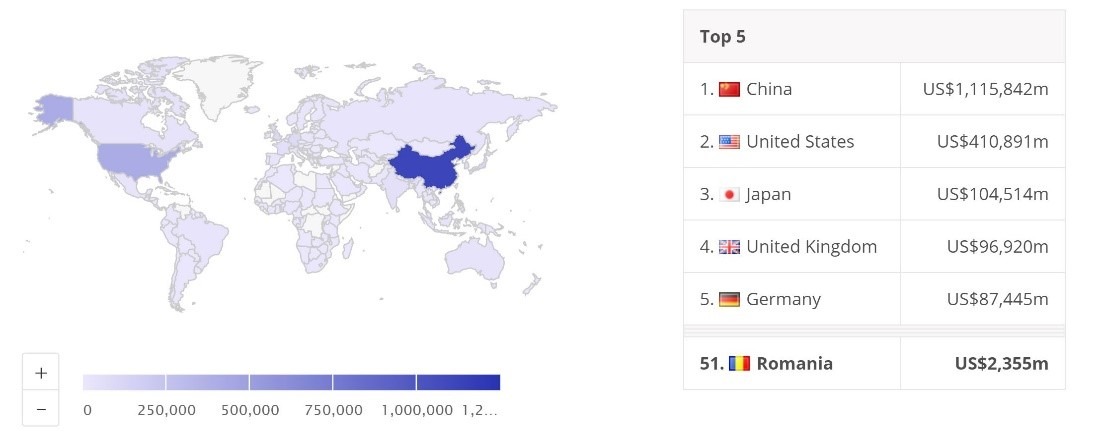

Graph: statista.com

Romania compared to the rest of the world.

With a projected market volume of $1,115 trillion in 2020, analysts expect China to generate the most revenue from e-commerce. The United States, Japan, U.K, and Germany could follow suit. Romania sits comfortably on the 51st place.

Graph: statista.com

Romania compared to the rest of the world.

With a projected market volume of $1,115 trillion in 2020, analysts expect China to generate the most revenue from e-commerce. The United States, Japan, U.K, and Germany could follow suit. Romania sits comfortably on the 51st place.

Graph: statista.com

All things point towards investing in the e-commerce market, yet...

...Eurostat points out that 23% of the Romanian population shopped online in 2019, which places us on the second to last place in the EU, only ahead of our Bulgarian neighbors. This fact might show that Romanian e-commerce has a lot of space to grow OR that we still have a long way to go to join the big names, depending on how you see things.

As for myself, I like to focus on the positives, so I'll leave you with a good stat: Romanians spent around 12 million euros/day on online shopping daily last year, compared to 9.86 million euros/day, the average of 2018. And where's potential for such growth, there's also a potential for extraordinary opportunities.

You can follow me on

Graph: statista.com

All things point towards investing in the e-commerce market, yet...

...Eurostat points out that 23% of the Romanian population shopped online in 2019, which places us on the second to last place in the EU, only ahead of our Bulgarian neighbors. This fact might show that Romanian e-commerce has a lot of space to grow OR that we still have a long way to go to join the big names, depending on how you see things.

As for myself, I like to focus on the positives, so I'll leave you with a good stat: Romanians spent around 12 million euros/day on online shopping daily last year, compared to 9.86 million euros/day, the average of 2018. And where's potential for such growth, there's also a potential for extraordinary opportunities.

You can follow me on