This is the third post in the

Building a Brokerage House series. The first article sketched the business’s general layout, helping you define your services, product package, and target audience, while the

second article put the intricate regulation side in perspective.

I’m about to go deeper into the subject and reveal the next moves you need to make to see your business take off and adjust your strategies as you go along.

Every broker-dealer is different, but calibrating technology to your business model follows the same pattern, so I’ll share a breakdown of

costs,

skills,

technology &

payment providers,

connection to exchanges, and everything else I find useful for you to know.

Internal vs. Outsourced Development

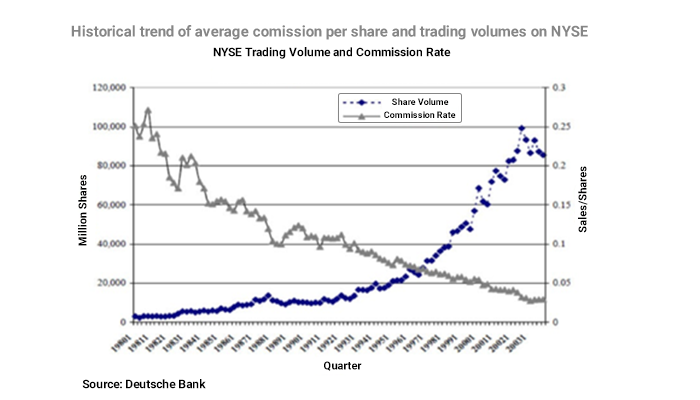

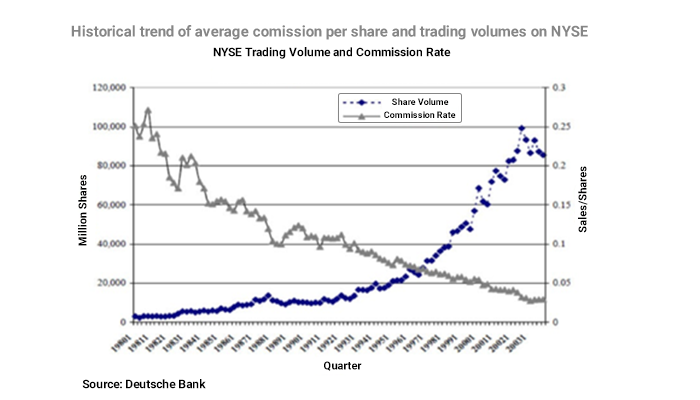

Between 2000-2005 trading was the prerogative of informed and institutional investors. However, with the growing internet and smartphone spike, technology has rewired the trading infrastructure, allowing retail clients to access the markets and use derivative instruments, increasing trading volumes and liquidity.

Because everyone is now focusing on technology, your startup needs to constantly advance the backend & frontend and automate most of the processes, but first, you’ll have to choose between:

1. Internal Development

2. Outsourced Development

3. A mix between Internal and Outsourced

Internal Development

Most of us dream of becoming the architects of our vision, but it’s paramount to understand that doing everything in-house may involve not only huge costs but teams of highly-skilled professionals. You may

spend hundreds, if not millions of euros a year and gain an advantage of nanoseconds over your competitors.

Pros:

- You build everything from scratch and get total freedom over design, features, integration, and functionalities.

- You adjust along the way and save time by not waiting for outsourced developers to start working on your requests.

- You manage your own teams, which gives you a free hand in picking them out and leading them towards your goals.

Cons:

- The overall costs are massive and could cripple your business from the start.

- It’s not cheap to have Dev-Ops Engineers, considering they rank in the top five of all tech salaries, commanding an average pay of €106,000.

- It’s unrealistic to claim that the entire technology ecosystem can be developed internally, so you’ll have to reach deep into your pocket and pay for extra services and integrations as well.

Outsourced Development

This approach may be sensible for a brokerage house just starting out. Paying for already-developed services, such as a

Whitelabel, with rule-based automation can spare you the nuisance of doing everything yourself. You’ll be able to focus on improving the customer experience, create partnerships to sustain your cash flow needs, and strategize for better and faster ROIs.

Pros:

- The start-off is cheaper, ranging from €250,000 to €500,000, and it gives you extra space to funnel your funds into other areas of your business.

- You get a determined product package accompanied by a support network.

- Apart from the platform and features, they provide API for all your other integration processes.

Cons:

- Most of the 3rd party services you pay for are pre-built with little room for development or customization.

- You still have to make a lot of additional integrations and pay tens of thousands per month for hosting, technical support, maintenance & change requests, feed, liquidity, and Back Office.

- Depending on the business plan you acquire and the technology provider’s availability and priorities, all your development tickets will take time.

- You just rent the technology, you don’t own it, which means that every additional request will pile up as an extra cost for you.

A mix between Internal and Outsourced

In my experience,

paying for a Whitelabel and

adding internal developments might be what you’re looking for at this point.

You can buy the platform & features, brand them, negotiate as much as you can for extended permissions to customize, then proceed with the CRM, payments, and liquidity processors integrations yourself. Basically, you need a predefined structure that you can fashion to your necessities.

Essential Integrations to Get the Ball Rolling

You now have a functional platform with various features. But there’s no business without clients, and you’re not going to have them unless you start receiving online payments.

Choose the Best Payment Provider for Your Business

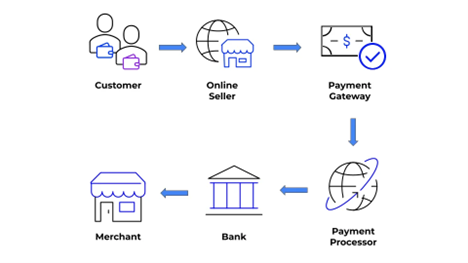

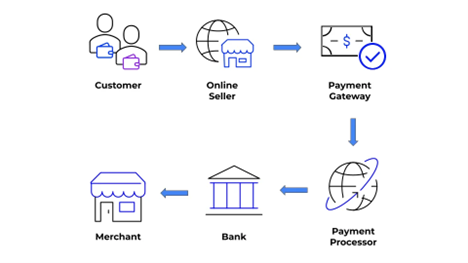

If you want to smoothly run your customer payment process and set up your cash flow, online payments via payment gateways are the best way to go. You need a well-built system to handle sensitive information when charging clients’ debit/credit cards.

The gateway transfers the transaction data and approves or declines the payment. This is when the payment processor comes in and acts as a mediator between the cardholder, merchant, acquiring bank, gateway, and issuing bank. It groups and manages all clients in one big merchant account, with almost the same rate and fee for all clients.

Choose your PSP based on:

1.

Overall reputation: focus on longevity, quality, and level of support.

2.

Service package: international coverage and multiple payment methods (debit cards, e-wallets, prepaid cards, mobile payments).

3.

Technical requirements: API & iFrame connections.

4.

Security protocols: the PSP must adhere to worldwide security standards, such as Payment Card Industry Data Security Standard (PCI DSS).

5.

Account opening process: find out if it’s lengthy, time-consuming, or straightforward and less complicated.

6.

Support services: a large number of payment rejection rates can lead to reduced profits. You’ll have to pay additional costs by 3–4.5% of direct debit payments for collections and warnings. Most PSPs can provide risk protection services to eliminate these additional charges.

7.

Costs: PSPs usually have a one-time setup fee and a fixed monthly cost that could start as low as €475.

As a brokerage firm, you’ll also need to store customers’ funds in separate bank accounts, to ensure that they will never be misappropriated.

Segregated accounts mean that the company cannot use the funds to conduct business operations. The money is secure in case the company goes bankrupt. Traders are more likely to trust brokers that offer segregated bank accounts, so it’s a win-win situation.

Liquidity Providers & Connection to Exchanges

A liquid market translates into smoother transaction flows and competitive pricing, so liquidity provision is essential for effective trading. The main purpose of a liquidity provider is to ensure an uninterrupted flow between demand and supply and provide the best buy and sell prices.

If you choose an

Electronic Communications Network/Straight Through Processing (ECN/STP) network to execute your clients’ trades, make sure to connect to multiple

Tier 1 liquidity providers to secure the best spreads and dealing rates.

When brokers connect to the exchanges, they typically use the

FIX Protocol (Financial Information eXchange.) Most trading systems have

FIX API connections available.

To find the best liquidity provider, you’ll have to analyze several factors:

1.

Overall package: should provide multi-asset liquidity, nominated account in different currencies, and access to the FIX protocol and historical data.

2.

Market depth: a high number of buy and sell at each price suggests a higher market depth, indicating market liquidity.

3.

Fast execution: with re-quotes or slippage.

4.

Pricing: competitive spreads and low commissions.

5.

Data feeds: stable & reliable with feeds reflecting real-time prices from various exchanges.

6.

Regulation: for best practices, the liquidity provider should adhere to strict rules and comply with regulations the same way a broker does.

7.

Reporting: automated and compliant reporting system: trades, FIX bridge, swaps & rollovers, order book access.

8.

Software: FIX protocol and other APIs, MT5 bridge connections, FIX bridges.

Cost Estimates and How Brokers Make Money

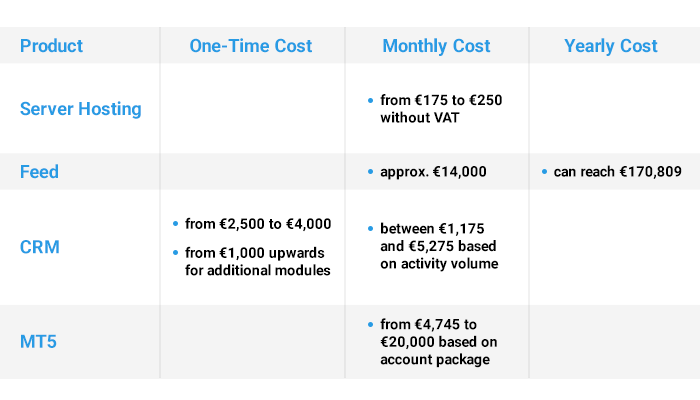

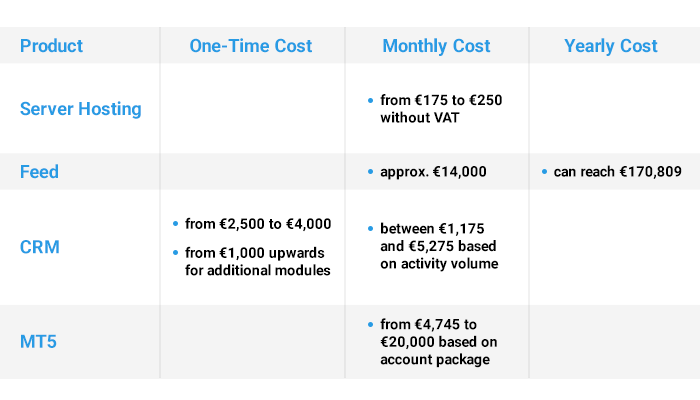

Apart from the core technology, there are additional costs for all integrations you need. You want extra features - you need to pay. You want constant developments - it adds up to your monthly bill. All service providers have various business plans you can choose from, and most of them leave room for negotiation, so write down your necessities and start searching for the ideal setup.

I’ve rounded up some of the most important integrations you’ll have to make and the average costs of covering them.

As for

profits, you need to understand that commissions on trades are now a relic of the past since Robinhood disruptively eliminated them. You can still apply

deposits/

withdrawals,

inactivity, and

overnight fees. Like most players in the industry, you can choose the

bid-ask spread as a

key source of revenue.

Conclusion

Nothing is as easy as it seems, especially when you want to go the entrepreneurial way.

Building a Brokerage House takes more than just basic knowledge about the financial markets. It requires a large capital and in-depth research, high technology with key people, a great deal of willpower on your part, negotiation skills, and a trained eye for innovation opportunities. Expect the worst, but aim for the best and be prepared for a lengthy process. Even so, the rewards will definitely outmatch the obstacles and difficulties along the way. There are still some important sides of the business you need to be aware of, but I’ll leave it for the following articles in the series.

You can follow me on

Twitter and

LinkedIn!

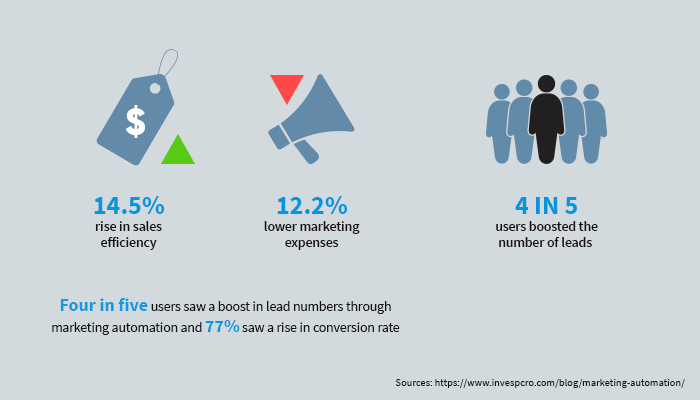

Understanding the advantages of AI is one thing; implementing it is another. Here are the steps to consider:

Understanding the advantages of AI is one thing; implementing it is another. Here are the steps to consider:

Worldwide there are 4.9 billion internet users with purchasing power and specific consumer behavior. The main questions you need to ask yourself in this early stage are related to your target audience and communication channels. In a later stage, you’ll have to focus on a multi-channel approach, but, for the moment, the secret is to keep it lean and have minimum requirements from your marketing department.

Worldwide there are 4.9 billion internet users with purchasing power and specific consumer behavior. The main questions you need to ask yourself in this early stage are related to your target audience and communication channels. In a later stage, you’ll have to focus on a multi-channel approach, but, for the moment, the secret is to keep it lean and have minimum requirements from your marketing department.

III. On the affiliate side, make sure you have competitive payouts (do some research to see what others are paying), a robust tracking system that allows affiliates to check their performance, and fast & professional assistance for them. Taking care of affiliates guarantees your product receives the necessary exposure to efficiently attract new clients.

IV. You’ll need at least 1 Front-End Developer, also known as a client-side developer, to produce HTML, CSS, and JavaScript for your website or Web Application. He’s at the crossroads of design and engineering, blending personas, pixels, and polish with the realm of logic and loops.

V. As for Design & Content, you can outsource the services at this stage. Most agencies charge between $80 and $200 per hour for digital marketing. Just make sure your briefs are thorough enough and can generate content and creatives to match your projections.

III. On the affiliate side, make sure you have competitive payouts (do some research to see what others are paying), a robust tracking system that allows affiliates to check their performance, and fast & professional assistance for them. Taking care of affiliates guarantees your product receives the necessary exposure to efficiently attract new clients.

IV. You’ll need at least 1 Front-End Developer, also known as a client-side developer, to produce HTML, CSS, and JavaScript for your website or Web Application. He’s at the crossroads of design and engineering, blending personas, pixels, and polish with the realm of logic and loops.

V. As for Design & Content, you can outsource the services at this stage. Most agencies charge between $80 and $200 per hour for digital marketing. Just make sure your briefs are thorough enough and can generate content and creatives to match your projections.

Usually, it's not a matter of if but when your brokerage house hits the mid-range threshold. Most players in the market dwell in this juicy phase, where a lot of change is happening, and you start to get traction. You've just come out of the simmering stage and need to ramp up your marketing efforts for advanced brand recognition. You'll start focusing on how you rank in your client's preferences and your overall ratings, so here is a breakdown of what's next:

Usually, it's not a matter of if but when your brokerage house hits the mid-range threshold. Most players in the market dwell in this juicy phase, where a lot of change is happening, and you start to get traction. You've just come out of the simmering stage and need to ramp up your marketing efforts for advanced brand recognition. You'll start focusing on how you rank in your client's preferences and your overall ratings, so here is a breakdown of what's next:

If you've reached this level, kudos to you! Few brokerages houses make it this far, so take time to breathe in the thin air, then start strategizing again. Everyone expects the world from you now, so reaching new heights gets trickier while free falling is a constant reminder.

If you've reached this level, kudos to you! Few brokerages houses make it this far, so take time to breathe in the thin air, then start strategizing again. Everyone expects the world from you now, so reaching new heights gets trickier while free falling is a constant reminder.

Between 2000-2005 trading was the prerogative of informed and institutional investors. However, with the growing internet and smartphone spike, technology has rewired the trading infrastructure, allowing retail clients to access the markets and use derivative instruments, increasing trading volumes and liquidity.

Between 2000-2005 trading was the prerogative of informed and institutional investors. However, with the growing internet and smartphone spike, technology has rewired the trading infrastructure, allowing retail clients to access the markets and use derivative instruments, increasing trading volumes and liquidity.

Because everyone is now focusing on technology, your startup needs to constantly advance the backend & frontend and automate most of the processes, but first, you’ll have to choose between:

1. Internal Development

2. Outsourced Development

3. A mix between Internal and Outsourced

Because everyone is now focusing on technology, your startup needs to constantly advance the backend & frontend and automate most of the processes, but first, you’ll have to choose between:

1. Internal Development

2. Outsourced Development

3. A mix between Internal and Outsourced

A liquid market translates into smoother transaction flows and competitive pricing, so liquidity provision is essential for effective trading. The main purpose of a liquidity provider is to ensure an uninterrupted flow between demand and supply and provide the best buy and sell prices.

If you choose an Electronic Communications Network/Straight Through Processing (ECN/STP) network to execute your clients’ trades, make sure to connect to multiple Tier 1 liquidity providers to secure the best spreads and dealing rates.

When brokers connect to the exchanges, they typically use the FIX Protocol (Financial Information eXchange.) Most trading systems have FIX API connections available.

A liquid market translates into smoother transaction flows and competitive pricing, so liquidity provision is essential for effective trading. The main purpose of a liquidity provider is to ensure an uninterrupted flow between demand and supply and provide the best buy and sell prices.

If you choose an Electronic Communications Network/Straight Through Processing (ECN/STP) network to execute your clients’ trades, make sure to connect to multiple Tier 1 liquidity providers to secure the best spreads and dealing rates.

When brokers connect to the exchanges, they typically use the FIX Protocol (Financial Information eXchange.) Most trading systems have FIX API connections available.

Apart from the core technology, there are additional costs for all integrations you need. You want extra features - you need to pay. You want constant developments - it adds up to your monthly bill. All service providers have various business plans you can choose from, and most of them leave room for negotiation, so write down your necessities and start searching for the ideal setup.

Apart from the core technology, there are additional costs for all integrations you need. You want extra features - you need to pay. You want constant developments - it adds up to your monthly bill. All service providers have various business plans you can choose from, and most of them leave room for negotiation, so write down your necessities and start searching for the ideal setup.

As for profits, you need to understand that commissions on trades are now a relic of the past since Robinhood disruptively eliminated them. You can still apply deposits/ withdrawals, inactivity, and overnight fees. Like most players in the industry, you can choose the bid-ask spread as a key source of revenue.

As for profits, you need to understand that commissions on trades are now a relic of the past since Robinhood disruptively eliminated them. You can still apply deposits/ withdrawals, inactivity, and overnight fees. Like most players in the industry, you can choose the bid-ask spread as a key source of revenue.

The brokerage license allows you to offer online trading services depending on the jurisdiction you choose and the regulatory entity covering the services you want to provide.

So, once you've done your homework and feel ready to get started, you can think about the licensing and regulatory side of the business.

Choosing the regulator helps you to:

1. Decide on the type of customers you are targeting

2. Have a clear idea of what services you can offer

3. Prepare the amount of capital you need

4. Establish the company's organizational chart

Before I get into more details, I will discuss the pros and cons of having a brokerage license.

The brokerage license allows you to offer online trading services depending on the jurisdiction you choose and the regulatory entity covering the services you want to provide.

So, once you've done your homework and feel ready to get started, you can think about the licensing and regulatory side of the business.

Choosing the regulator helps you to:

1. Decide on the type of customers you are targeting

2. Have a clear idea of what services you can offer

3. Prepare the amount of capital you need

4. Establish the company's organizational chart

Before I get into more details, I will discuss the pros and cons of having a brokerage license.

The Cyprus Securities Exchange Commission, known as CySEC, is the regulatory body for the financial industry in Cyprus. Its mission is to ensure the protection of investors and the prosperous growth of the securities market. As soon as Cyprus became a member state of the European Union (2004), CySEC's regulations and operations overlapped with the European financial regulatory framework, offering Cyprus-registered companies access to all European markets.

Most companies currently licensed under CySEC are STP brokers or Market Makers offering access to online trading of financial instruments via Contracts for Difference (CFDs). Others handle asset management or investment advice.

STP brokers and Market Makers - what are the differences?

The Cyprus Securities Exchange Commission, known as CySEC, is the regulatory body for the financial industry in Cyprus. Its mission is to ensure the protection of investors and the prosperous growth of the securities market. As soon as Cyprus became a member state of the European Union (2004), CySEC's regulations and operations overlapped with the European financial regulatory framework, offering Cyprus-registered companies access to all European markets.

Most companies currently licensed under CySEC are STP brokers or Market Makers offering access to online trading of financial instruments via Contracts for Difference (CFDs). Others handle asset management or investment advice.

STP brokers and Market Makers - what are the differences?

According to the Legal Framework, a broker must set into place or outsource the following departments and functions to receive CySEC regulation and access to the rest of the European markets:

According to the Legal Framework, a broker must set into place or outsource the following departments and functions to receive CySEC regulation and access to the rest of the European markets:

EMI

EMI

Obtaining a brokerage license involves strict rules, significant capital requirements, and time to devote to the process. A brokerage firm can provide a good return on investment if you learn to play your cards right. Not everyone in this industry can launch a successful business. Hard & soft skills could be a plus, as well as generous investment capital and a high capacity to adapt to industry changes. I will talk about all these points and more in the next parts of the series, hoping it will help you set up an online trading company.

Obtaining a brokerage license involves strict rules, significant capital requirements, and time to devote to the process. A brokerage firm can provide a good return on investment if you learn to play your cards right. Not everyone in this industry can launch a successful business. Hard & soft skills could be a plus, as well as generous investment capital and a high capacity to adapt to industry changes. I will talk about all these points and more in the next parts of the series, hoping it will help you set up an online trading company.

The story of

The story of  Although he is the founder and CEO of a leading global player in the online trading sector,

Although he is the founder and CEO of a leading global player in the online trading sector,  With an already vast portfolio of trading instruments, covering more than 10.000 assets, CAPEX.com is far from stopping here.

A lot of companies say they want to be industry disruptors, but few actually put in the hard work needed to achieve this goal. That's where the company's CEO steps into play.

He wants CAPEX.com to promote education amongst traders, offering several learning tools, such as CAPEX Academy, online webinars with industry professionals, expert daily analysis, market insights and much more.

Through CAPEX.com, investors get to learn and to stay updated with all the latest market news, while trading through state-of-the-art trading platforms: CAPEX WebTrader and MetaTrader 5.

Democratization is a huge factor in online trading today, and Mr. Pătrașcu knows that investors are always looking for new opportunities. The current economic landscape is giving more people the chance to start investing in various types of assets that were not considered affordable just a couple of years ago.

Being an experienced investor, with over a decade in online trading, Octavian Pătrașcu knows exactly when the moment to start implementing changes has arrived. Traders should keep an eye out for all the latest releases, because CAPEX.com plans to surprise investors worldwide with a couple of new and exciting products in 2022.

With an already vast portfolio of trading instruments, covering more than 10.000 assets, CAPEX.com is far from stopping here.

A lot of companies say they want to be industry disruptors, but few actually put in the hard work needed to achieve this goal. That's where the company's CEO steps into play.

He wants CAPEX.com to promote education amongst traders, offering several learning tools, such as CAPEX Academy, online webinars with industry professionals, expert daily analysis, market insights and much more.

Through CAPEX.com, investors get to learn and to stay updated with all the latest market news, while trading through state-of-the-art trading platforms: CAPEX WebTrader and MetaTrader 5.

Democratization is a huge factor in online trading today, and Mr. Pătrașcu knows that investors are always looking for new opportunities. The current economic landscape is giving more people the chance to start investing in various types of assets that were not considered affordable just a couple of years ago.

Being an experienced investor, with over a decade in online trading, Octavian Pătrașcu knows exactly when the moment to start implementing changes has arrived. Traders should keep an eye out for all the latest releases, because CAPEX.com plans to surprise investors worldwide with a couple of new and exciting products in 2022.

Special times require special measures and adaptations, and Octavian Pătrașcu is very well aware of this aspect of the trading game. That’s why, for 2022,

Special times require special measures and adaptations, and Octavian Pătrașcu is very well aware of this aspect of the trading game. That’s why, for 2022,