The previous article explained how to design a Minimum Viable Product, giving you a personal example with the CAPEX.com trading platform. Now I'll go one step further and talk about ways you can get traction for your startup.

What is initial traction?

Launching a business involves risks, but if you make sure it gets traction fast, the results might come in a relatively short time. Initial traction refers to the first wave of users for your product or service, and it can make the difference between a startup success or failure.

If your project gets traction from the start, people are interested in what you are offering. Although they may not know much about your business, they still give you some of their valuable time because you may have a solution to their problems. These customers will most likely be the first ambassadors of your business, urging their friends and acquaintances to try out your product.

There is no immediate solution for success, but if you choose a hot market in a high-demand industry, you could increase your chances of success. It is also essential to set your goals (long, medium and especially short term). The short-term ones will indicate the actual steps you need to take in the first days or weeks.

The good news is that you don't need a lot of money for your startup to gain traction, but you do need that traction to start making money.

Key elements that can trigger traction for your startup

Here are some of the factors that can help you form your first solid customer base:

• The product you offer

solves a problem that a particular group has. I've already explained in a previous article that startups are built around a user or customer need. For example, Uber saves you time using its ride-sharing services, and Airbnb finds you affordable accommodation.

•

The product is fantastic, and you have a "

story" that catches on. The way you manage to get your messages across and reach your target audience helps build and strengthen your brand. Branding is the experience you offer users through tone of voice, design, social media presence, etc. The best way to start gaining traction is to have a product that breaks the patterns. You're already halfway to success if you have a product so good that it practically sells itself. Just look at Elon Musk's Tesla. The American giant didn't spend much on advertising campaigns when it entered the market. Instead, word-of-mouth marketing techniques were selling. Without some truly unique products, Tesla would not be where it is today.

•

High-quality user experience. Your product is easy to use, intuitive and leaves a great first impression. All the elements of the branding process I mentioned above contribute to the user experience.

•

High-quality customer service. People prefer to fend for themselves until they need help. Customer service is often overlooked while building new features. Improve the communication with your customers and make them want more.

How to generate traction by building your own startup community

A community to interact with and increase the visibility of your business can help you throughout your company's lifecycle. It can also create traction if you give it the time it needs to grow. Who and what can you include in this community? Here are some suggestions:

1.

Influencers

Influencers, such as bloggers or vloggers, can bring clients by posting your website link on their social media channels; they can also secure a fair number of people attending your brand awareness events or guarantee you a vote of confidence through favourable reviews or testimonials of your product. You have many options at your disposal to attract them, such as cold emails, social media, or simply making them offers they can't refuse.

2.

Crowdfunding – convince the public to sponsor a good idea

The advent of crowdfunding has been a significant change in how business people bring their products to the spotlight. Platforms like IndieGoGo and Kickstarter allow users to discover new businesses and invest in bringing them into the spotlight. These are excellent opportunities to get traction, as people who choose to invest in a product must use it first, so they can become early adopters.

3.

Networking/Partnerships

Many startups have been able to gain initial traction by collaborating with other brands that have already built a reputation in the market. There are four main types of partnerships:

Integrative. This type of partnership occurs when your concept moulds to the profile of another business, so it can enhance the features and benefits of both products.

API. If you've built your own platform, you can encourage other companies to expand on your platform. Uber has done this with TripAdvisor, Starbucks, OpenTable, Hyatt Hotels & Resorts, and Expensify.

Syndication. In this case, companies team up and combine their products or expose each other to their audience. Kayak did this with AOL in 2004. More recently, cloud-based security provider SilverSky became an Office 365 partner.

Recommendation/Referral. This can be an affiliate, a reseller, or an organization that uses your product. Dropbox has one of the most popular referral programs.

Pre-launch marketing campaigns and their essential role for startups

Creating a product is a complex process that requires time, money and other resources. Such an effort for nothing would mean throwing away all the sacrifices you've made. However, many businesses launch in areas that are little explored and analyzed, resulting in significant failures.

A pre-launch campaign gives you at least three valuable opportunities:

• Get your dream in front of everyone.

• Test your target audience's level of interest in your product.

• Get valuable feedback that you can integrate into your strategy.

How to boost a pre-launch campaign and get your startup traction

From my 10+ years of expertise as an entrepreneur, I've come to the conclusion that the following steps are fundamental:

Create a pre-launch landing page

A landing page is your product's window to potential customers, which can help you convey the right message to the right audience.

Run a pre-launch campaign to get more leads

In the pre-launch stage, all you need is to get as many customer emails as possible for lead generation. Make people love you - turn your first visitors into ambassadors for your startup! When someone lands on your website, they might join a waiting list or sign up for a giveaway where they can get early access to the products you offer if they refer their friends.

Increase your traffic with ads

This is the most scalable and easiest way to test different campaigns and get quick results. Campaigns should be run on paid channels as they are highly customizable, you can target a specific audience and then quantify the results.

Use banners for every significant referral page

Customize your landing pages with banners for users coming from as many referral pages as possible*.

*A referral page is a landing page that directs visitors to make a conversion by offering them a reward or incentive.

Conclusion

Regardless of how innovative your product is, you won't get customers if you fail to make it visible to your target audience and attract the first wave of users, especially if you have a limited budget and resources.

The good news is that most startups and entrepreneurs have been in the same situation you're in now. Even better, they managed to overcome this challenge by moving to the next stage with techniques and methods proven to get the initial traction required by the 2021 business world.

You can follow me on Twitter and LinkedIn! Understanding the advantages of AI is one thing; implementing it is another. Here are the steps to consider:

Understanding the advantages of AI is one thing; implementing it is another. Here are the steps to consider:

A company is still in the startup stage until its business model is proven, works and can be applied successfully. From that moment on, the company enters the scaleup phase. While the startup is still exploring its potential and discovering how to present its product or service best, the scaleup already has the answers to the above questions.

Moreover, the product-market matching was perfected through scaleups. And when it comes to financing, scaleups can usually offer more validation than an MVP to potential investors.

This means that you can have a startup with a seemingly scalable business model but never have a scaleup due to a lack of customer growth. At the same time, you can have a startup with a revenue increase of over 20% year-over-year, but if you still do not have the infrastructure set up or a product or service with enough traction, then the business cannot ascend to the next level.

A company is still in the startup stage until its business model is proven, works and can be applied successfully. From that moment on, the company enters the scaleup phase. While the startup is still exploring its potential and discovering how to present its product or service best, the scaleup already has the answers to the above questions.

Moreover, the product-market matching was perfected through scaleups. And when it comes to financing, scaleups can usually offer more validation than an MVP to potential investors.

This means that you can have a startup with a seemingly scalable business model but never have a scaleup due to a lack of customer growth. At the same time, you can have a startup with a revenue increase of over 20% year-over-year, but if you still do not have the infrastructure set up or a product or service with enough traction, then the business cannot ascend to the next level.

To grow your business and move to the next phase of evolution, you must first establish the best methods to achieve your goals. Make sure you have a clear sense of direction and that the whole team is centred around common goals. The focus and alignment with specific standards and goals are vital for a successful scaleup. You can't have a sense of purpose without a certain amount of pressure and a sense of urgency. To get there, set clear deadlines for everything you do right from the beginning. One of the biggest mistakes companies make is not paying enough attention to the time factor. Keep in mind that you are in a marathon, but even a marathon can include several sprints.

After you manage to give a sense of purpose to your employees, you can work on perfecting the day-to-day operations through measurable and systematic processes that you can constantly replicate. You need to fully understand the things that contribute most to your impact as a leader on employees and keep doing them better and better. Having enough self-confidence will always bring out the best of you, helping you achieve more and more while being a role model for your team members at the same time.

To grow your business and move to the next phase of evolution, you must first establish the best methods to achieve your goals. Make sure you have a clear sense of direction and that the whole team is centred around common goals. The focus and alignment with specific standards and goals are vital for a successful scaleup. You can't have a sense of purpose without a certain amount of pressure and a sense of urgency. To get there, set clear deadlines for everything you do right from the beginning. One of the biggest mistakes companies make is not paying enough attention to the time factor. Keep in mind that you are in a marathon, but even a marathon can include several sprints.

After you manage to give a sense of purpose to your employees, you can work on perfecting the day-to-day operations through measurable and systematic processes that you can constantly replicate. You need to fully understand the things that contribute most to your impact as a leader on employees and keep doing them better and better. Having enough self-confidence will always bring out the best of you, helping you achieve more and more while being a role model for your team members at the same time.

Your company's culture and organizational values must embrace the spirit of personal development and transparency. Align the individual successes of the team members with the business objectives, and things will progress in the desired direction.

Success cannot be achieved without patience, resistance to stress, emotional intelligence and healthy habits reinforced daily throughout the organization. For a new employee to understand the company's mission, vision, cultural values, and processes to move to the next level of performance, he often needs to get access to intensive and well-developed courses and training.

Your startup must have a strong marketing team, separate from the sales department. This way, the business can remain focused on attracting the right customers (and the most profitable ones). Marketing is also necessary to generate enough interest and traction.

To remain competitive, scaleups must promote goods and services that can improve quality-wise, not just financially. You need to be smart in how you handle your business and create an environment where people enjoy working, implementing the latest technologies that can give you a competitive edge.

Your company's culture and organizational values must embrace the spirit of personal development and transparency. Align the individual successes of the team members with the business objectives, and things will progress in the desired direction.

Success cannot be achieved without patience, resistance to stress, emotional intelligence and healthy habits reinforced daily throughout the organization. For a new employee to understand the company's mission, vision, cultural values, and processes to move to the next level of performance, he often needs to get access to intensive and well-developed courses and training.

Your startup must have a strong marketing team, separate from the sales department. This way, the business can remain focused on attracting the right customers (and the most profitable ones). Marketing is also necessary to generate enough interest and traction.

To remain competitive, scaleups must promote goods and services that can improve quality-wise, not just financially. You need to be smart in how you handle your business and create an environment where people enjoy working, implementing the latest technologies that can give you a competitive edge.

Standardized and repeatable processes save time and resources, which are crucial for such an important process as scaling the business. Look for the best solutions to implement them by the book! Initially, it may require additional investment in systems (IT) and training, but these costs will be amortized in the long term. You will soon be able to hire faster, sell more and streamline operations for a truly scalable business model.

If every aspect of your startup requires an ever-increasing workforce, it will be difficult for you to complete an efficient scaleup. You must find ways to get the most from every process or from as many processes as possible. This includes automating the wage payments, creating training programs to get employees ready fast, finding ways to automate the marketing process of your business and so on so forth.

Where you can't automate, you can always outsource. Most of your resources should be allocated so that your core products and services can be scaled as efficiently as possible, and the business can move as smoothly as possible to the next stage of growth. Only the essential positions in the company should remain outsourced. Where possible, everything from design and copywriting to the legal part can be delegated to external contractors.

Standardized and repeatable processes save time and resources, which are crucial for such an important process as scaling the business. Look for the best solutions to implement them by the book! Initially, it may require additional investment in systems (IT) and training, but these costs will be amortized in the long term. You will soon be able to hire faster, sell more and streamline operations for a truly scalable business model.

If every aspect of your startup requires an ever-increasing workforce, it will be difficult for you to complete an efficient scaleup. You must find ways to get the most from every process or from as many processes as possible. This includes automating the wage payments, creating training programs to get employees ready fast, finding ways to automate the marketing process of your business and so on so forth.

Where you can't automate, you can always outsource. Most of your resources should be allocated so that your core products and services can be scaled as efficiently as possible, and the business can move as smoothly as possible to the next stage of growth. Only the essential positions in the company should remain outsourced. Where possible, everything from design and copywriting to the legal part can be delegated to external contractors.

Startups tend to make several common mistakes during their scaling process. These mistakes can lead to unnecessary obstacles, stagnant growth, chaos and maybe even the failure of the whole business.

Fortunately, many can be avoided with proper preparation, planning, mentoring, and strategic thinking. Here are 3 of the main challenges companies need to overcome:

Improper planning or lack of planning altogether

Scaling requires strategic planning, but the experience, know-how and resources needed to make it possible are often missing. Planning is frequently done ad-hoc and is limited to far too general goals, which is probably why your company fails to achieve their targets. Without systematic training and efficient and well-thought-out prioritization, scaling will be chaotic.

Imitation of other companies/businesses

If, for some companies, a particular model proves to be successful, this does not mean that it can be applied everywhere and to every business. The better you know your primary product and/or service and your customers and marketing channels, the clearer it will be in which direction to go.

The art of taking a step back at the right time

While many startup founders could grow their businesses and get them where they want to be, not everyone can handle the numerous challenges in the process. Knowing how to recognize your strengths and weaknesses and how to ask for help, coaching, and timely support shows strength of character. Although giving up is never easy, it can still open the door to the next fantastic opportunity and keep your business afloat, even if it means taking a small step back for a short time.

Startups tend to make several common mistakes during their scaling process. These mistakes can lead to unnecessary obstacles, stagnant growth, chaos and maybe even the failure of the whole business.

Fortunately, many can be avoided with proper preparation, planning, mentoring, and strategic thinking. Here are 3 of the main challenges companies need to overcome:

Improper planning or lack of planning altogether

Scaling requires strategic planning, but the experience, know-how and resources needed to make it possible are often missing. Planning is frequently done ad-hoc and is limited to far too general goals, which is probably why your company fails to achieve their targets. Without systematic training and efficient and well-thought-out prioritization, scaling will be chaotic.

Imitation of other companies/businesses

If, for some companies, a particular model proves to be successful, this does not mean that it can be applied everywhere and to every business. The better you know your primary product and/or service and your customers and marketing channels, the clearer it will be in which direction to go.

The art of taking a step back at the right time

While many startup founders could grow their businesses and get them where they want to be, not everyone can handle the numerous challenges in the process. Knowing how to recognize your strengths and weaknesses and how to ask for help, coaching, and timely support shows strength of character. Although giving up is never easy, it can still open the door to the next fantastic opportunity and keep your business afloat, even if it means taking a small step back for a short time.

To make your business scalable, you need to put all pieces together. Here are some things to keep in mind before moving forward from startup to scaleup.

• Automate and outsource as much as possible, especially if it is not directly related to your core qualifications.

• Be thoughtful. Don't spend money on new people or jobs until you're absolutely ready to do it.

• Make sure your business is really scalable. There is nothing wrong or shameful about keeping a company to a certain size as long as it is profitable.

To make your business scalable, you need to put all pieces together. Here are some things to keep in mind before moving forward from startup to scaleup.

• Automate and outsource as much as possible, especially if it is not directly related to your core qualifications.

• Be thoughtful. Don't spend money on new people or jobs until you're absolutely ready to do it.

• Make sure your business is really scalable. There is nothing wrong or shameful about keeping a company to a certain size as long as it is profitable.

There is no immediate solution for success, but if you choose a hot market in a high-demand industry, you could increase your chances of success. It is also essential to set your goals (long, medium and especially short term). The short-term ones will indicate the actual steps you need to take in the first days or weeks.

The good news is that you don't need a lot of money for your startup to gain traction, but you do need that traction to start making money.

There is no immediate solution for success, but if you choose a hot market in a high-demand industry, you could increase your chances of success. It is also essential to set your goals (long, medium and especially short term). The short-term ones will indicate the actual steps you need to take in the first days or weeks.

The good news is that you don't need a lot of money for your startup to gain traction, but you do need that traction to start making money.

Here are some of the factors that can help you form your first solid customer base:

• The product you offer solves a problem that a particular group has. I've already explained in a previous article that startups are built around a user or customer need. For example, Uber saves you time using its ride-sharing services, and Airbnb finds you affordable accommodation.

• The product is fantastic, and you have a "story" that catches on. The way you manage to get your messages across and reach your target audience helps build and strengthen your brand. Branding is the experience you offer users through tone of voice, design, social media presence, etc. The best way to start gaining traction is to have a product that breaks the patterns. You're already halfway to success if you have a product so good that it practically sells itself. Just look at Elon Musk's Tesla. The American giant didn't spend much on advertising campaigns when it entered the market. Instead, word-of-mouth marketing techniques were selling. Without some truly unique products, Tesla would not be where it is today.

• High-quality user experience. Your product is easy to use, intuitive and leaves a great first impression. All the elements of the branding process I mentioned above contribute to the user experience.

• High-quality customer service. People prefer to fend for themselves until they need help. Customer service is often overlooked while building new features. Improve the communication with your customers and make them want more.

Here are some of the factors that can help you form your first solid customer base:

• The product you offer solves a problem that a particular group has. I've already explained in a previous article that startups are built around a user or customer need. For example, Uber saves you time using its ride-sharing services, and Airbnb finds you affordable accommodation.

• The product is fantastic, and you have a "story" that catches on. The way you manage to get your messages across and reach your target audience helps build and strengthen your brand. Branding is the experience you offer users through tone of voice, design, social media presence, etc. The best way to start gaining traction is to have a product that breaks the patterns. You're already halfway to success if you have a product so good that it practically sells itself. Just look at Elon Musk's Tesla. The American giant didn't spend much on advertising campaigns when it entered the market. Instead, word-of-mouth marketing techniques were selling. Without some truly unique products, Tesla would not be where it is today.

• High-quality user experience. Your product is easy to use, intuitive and leaves a great first impression. All the elements of the branding process I mentioned above contribute to the user experience.

• High-quality customer service. People prefer to fend for themselves until they need help. Customer service is often overlooked while building new features. Improve the communication with your customers and make them want more.

Influencers, such as bloggers or vloggers, can bring clients by posting your website link on their social media channels; they can also secure a fair number of people attending your brand awareness events or guarantee you a vote of confidence through favourable reviews or testimonials of your product. You have many options at your disposal to attract them, such as cold emails, social media, or simply making them offers they can't refuse.

2. Crowdfunding – convince the public to sponsor a good idea

The advent of crowdfunding has been a significant change in how business people bring their products to the spotlight. Platforms like IndieGoGo and Kickstarter allow users to discover new businesses and invest in bringing them into the spotlight. These are excellent opportunities to get traction, as people who choose to invest in a product must use it first, so they can become early adopters.

3. Networking/Partnerships

Many startups have been able to gain initial traction by collaborating with other brands that have already built a reputation in the market. There are four main types of partnerships:

Integrative. This type of partnership occurs when your concept moulds to the profile of another business, so it can enhance the features and benefits of both products.

API. If you've built your own platform, you can encourage other companies to expand on your platform. Uber has done this with TripAdvisor, Starbucks, OpenTable, Hyatt Hotels & Resorts, and Expensify.

Syndication. In this case, companies team up and combine their products or expose each other to their audience. Kayak did this with AOL in 2004. More recently, cloud-based security provider SilverSky became an Office 365 partner.

Recommendation/Referral. This can be an affiliate, a reseller, or an organization that uses your product. Dropbox has one of the most popular referral programs.

Influencers, such as bloggers or vloggers, can bring clients by posting your website link on their social media channels; they can also secure a fair number of people attending your brand awareness events or guarantee you a vote of confidence through favourable reviews or testimonials of your product. You have many options at your disposal to attract them, such as cold emails, social media, or simply making them offers they can't refuse.

2. Crowdfunding – convince the public to sponsor a good idea

The advent of crowdfunding has been a significant change in how business people bring their products to the spotlight. Platforms like IndieGoGo and Kickstarter allow users to discover new businesses and invest in bringing them into the spotlight. These are excellent opportunities to get traction, as people who choose to invest in a product must use it first, so they can become early adopters.

3. Networking/Partnerships

Many startups have been able to gain initial traction by collaborating with other brands that have already built a reputation in the market. There are four main types of partnerships:

Integrative. This type of partnership occurs when your concept moulds to the profile of another business, so it can enhance the features and benefits of both products.

API. If you've built your own platform, you can encourage other companies to expand on your platform. Uber has done this with TripAdvisor, Starbucks, OpenTable, Hyatt Hotels & Resorts, and Expensify.

Syndication. In this case, companies team up and combine their products or expose each other to their audience. Kayak did this with AOL in 2004. More recently, cloud-based security provider SilverSky became an Office 365 partner.

Recommendation/Referral. This can be an affiliate, a reseller, or an organization that uses your product. Dropbox has one of the most popular referral programs.

Creating a product is a complex process that requires time, money and other resources. Such an effort for nothing would mean throwing away all the sacrifices you've made. However, many businesses launch in areas that are little explored and analyzed, resulting in significant failures.

A pre-launch campaign gives you at least three valuable opportunities:

• Get your dream in front of everyone.

• Test your target audience's level of interest in your product.

• Get valuable feedback that you can integrate into your strategy.

Creating a product is a complex process that requires time, money and other resources. Such an effort for nothing would mean throwing away all the sacrifices you've made. However, many businesses launch in areas that are little explored and analyzed, resulting in significant failures.

A pre-launch campaign gives you at least three valuable opportunities:

• Get your dream in front of everyone.

• Test your target audience's level of interest in your product.

• Get valuable feedback that you can integrate into your strategy.

Regardless of how innovative your product is, you won't get customers if you fail to make it visible to your target audience and attract the first wave of users, especially if you have a limited budget and resources.

The good news is that most startups and entrepreneurs have been in the same situation you're in now. Even better, they managed to overcome this challenge by moving to the next stage with techniques and methods proven to get the initial traction required by the 2021 business world.

Regardless of how innovative your product is, you won't get customers if you fail to make it visible to your target audience and attract the first wave of users, especially if you have a limited budget and resources.

The good news is that most startups and entrepreneurs have been in the same situation you're in now. Even better, they managed to overcome this challenge by moving to the next stage with techniques and methods proven to get the initial traction required by the 2021 business world.

The various research papers I've studied agree on the following steps:

· Identify the problem and start with the idea. I've already explained in a past article how startups are built around a problem that requires a solution or a customer's specific need. Isolate the core elements of that need and resist the urge to add additional features. Their time will come later in this process.

· Have a clear image of the target market. How many users we're talking about? Where are they located, geographically speaking? What's their purchasing power, and how much can they afford to spend on a specific product?

· What business goals did you set up for your MVP? Conquering the world would be lovely, so would a unicorn (startup over $1 billion), but such ambitions are premature, and you need to stay focused on the objectives within your reach. The MVP must be well-positioned in your business plan, primarily in your financial projections. You could either launch a product as an income-producer or get valuable feedback from end-users.

The various research papers I've studied agree on the following steps:

· Identify the problem and start with the idea. I've already explained in a past article how startups are built around a problem that requires a solution or a customer's specific need. Isolate the core elements of that need and resist the urge to add additional features. Their time will come later in this process.

· Have a clear image of the target market. How many users we're talking about? Where are they located, geographically speaking? What's their purchasing power, and how much can they afford to spend on a specific product?

· What business goals did you set up for your MVP? Conquering the world would be lovely, so would a unicorn (startup over $1 billion), but such ambitions are premature, and you need to stay focused on the objectives within your reach. The MVP must be well-positioned in your business plan, primarily in your financial projections. You could either launch a product as an income-producer or get valuable feedback from end-users.

This type of approach seems better suited for well-financed startups, but it's not. It is part of the lean startup philosophy and aims to quickly and inexpensively burn through the steps on the way to profit. Eric Ries says that a richer, multi-functional product can cost more time and money than investing in an MVP with lower revenue potential but is extremely useful in technical and market tests. Compared to an MVP, a more elaborate product cannot be tested in natural conditions and does not allow quick adjustment, which increases its chances of failure.

This type of approach seems better suited for well-financed startups, but it's not. It is part of the lean startup philosophy and aims to quickly and inexpensively burn through the steps on the way to profit. Eric Ries says that a richer, multi-functional product can cost more time and money than investing in an MVP with lower revenue potential but is extremely useful in technical and market tests. Compared to an MVP, a more elaborate product cannot be tested in natural conditions and does not allow quick adjustment, which increases its chances of failure.

• Amazon started as a physical book delivery service. In the beginning, it was a website where you ordered books; Amazon purchased them from distributors and delivered them to you by post-mail. This entire process was the predecessor of e-books, Kindle devices, and virtual stores.

• Airbnb started with the founders making their homes available to potential tourists. Because this endeavour was successful, the platform currently offers almost any services related to tourism and travel.

• Facebook initially linked Harvard students to a social network without much functionality. Later on, brand pages and ads appeared, the company acquired Whatsapp and Instagram, launched the Marketplace and everything else that Facebook offers nowadays.

• Dropbox had a far more exciting strategy: it started with a video presentation. The founders explained the functionality of a product that allowed storing documents in the cloud and could be accessed precisely like a local folder on your computer. The founders initiated the creative process only when the positive reactions of those interested validated their idea.

• Amazon started as a physical book delivery service. In the beginning, it was a website where you ordered books; Amazon purchased them from distributors and delivered them to you by post-mail. This entire process was the predecessor of e-books, Kindle devices, and virtual stores.

• Airbnb started with the founders making their homes available to potential tourists. Because this endeavour was successful, the platform currently offers almost any services related to tourism and travel.

• Facebook initially linked Harvard students to a social network without much functionality. Later on, brand pages and ads appeared, the company acquired Whatsapp and Instagram, launched the Marketplace and everything else that Facebook offers nowadays.

• Dropbox had a far more exciting strategy: it started with a video presentation. The founders explained the functionality of a product that allowed storing documents in the cloud and could be accessed precisely like a local folder on your computer. The founders initiated the creative process only when the positive reactions of those interested validated their idea.

Maybe, at some point, a global dairy company will consider buying the farm and its brands. However, the family will oppose it because they know an inclusion in a dairy conglomerate will diminish their award-winning traditional elements. They have no financial ambitions that go beyond the worry-free life they already enjoy.

It is a good thing such businesses exist and, even better, that forums like the European Union encourage local production, but startups are another breed.

Maybe, at some point, a global dairy company will consider buying the farm and its brands. However, the family will oppose it because they know an inclusion in a dairy conglomerate will diminish their award-winning traditional elements. They have no financial ambitions that go beyond the worry-free life they already enjoy.

It is a good thing such businesses exist and, even better, that forums like the European Union encourage local production, but startups are another breed.

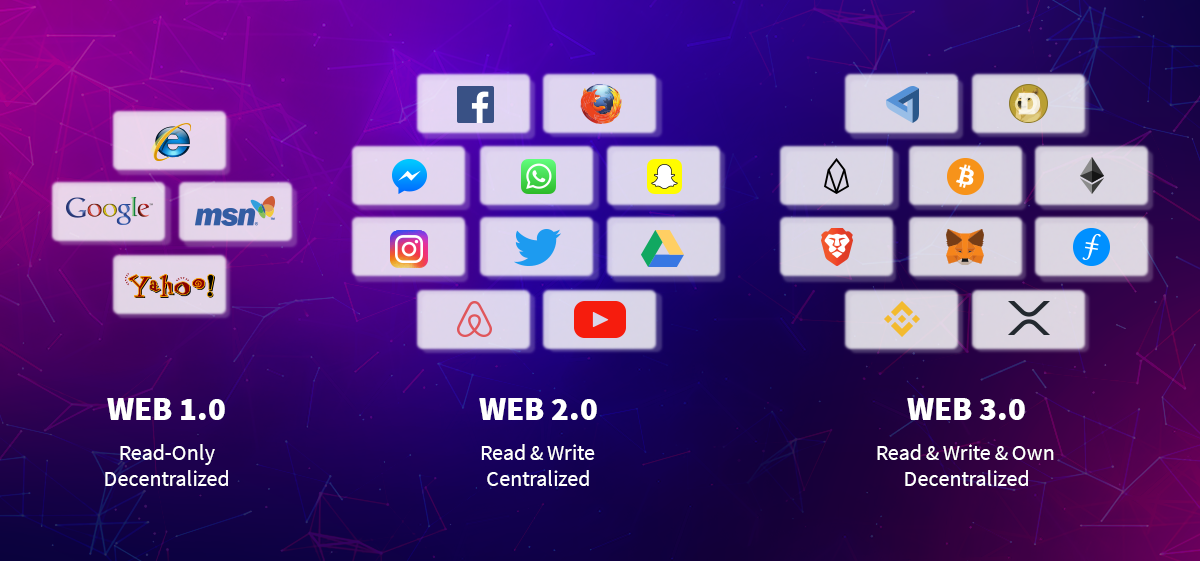

A startup is primarily defined by its technological component, now almost mandatory to be digital, generating innovation in various fields. Innovation involves creating markets or market segments, new products and services, plus disruptive business behaviour.

Getting back to the example with the family farm, they could start an exciting collaboration with a company focused on innovation that recommends product management to be handled through the Blockchain system we talked about in a previous article series. The farm would obtain an accurate track record, including monitoring each batch from any type of dairy product, tracing back to the group of animals where it started. Of course, the farm would not become disruptive, but the startup we assume is specialized in applying the Blockchain to family farming is.

A startup is primarily defined by its technological component, now almost mandatory to be digital, generating innovation in various fields. Innovation involves creating markets or market segments, new products and services, plus disruptive business behaviour.

Getting back to the example with the family farm, they could start an exciting collaboration with a company focused on innovation that recommends product management to be handled through the Blockchain system we talked about in a previous article series. The farm would obtain an accurate track record, including monitoring each batch from any type of dairy product, tracing back to the group of animals where it started. Of course, the farm would not become disruptive, but the startup we assume is specialized in applying the Blockchain to family farming is.

If the dairy business can efficiently operate at a family business level, the same cannot be said about a startup aiming to apply Blockchain principles to agriculture. The latter will need many customers and a global market to become profitable and relevant. Businesses relying on technology are the exact opposite of family businesses: an exponential growth component, which leads almost without exception to the so-called Mergers & Acquisitions, meaning that global companies acquire them. An alternative would be going public on stock exchanges.

Following the same logic, seed money is only the initial stage of financing. Once startups approach the breakeven point (when costs and revenues are equal), investment funds or Venture Capital companies aiming to take good and profitable ideas even further set their eyes on them. For these categories, seed money comes with somewhat looser obligations, based on more relaxed economic calculations and more generous terms, but also with substantial benefits if they invest early.

If the dairy business can efficiently operate at a family business level, the same cannot be said about a startup aiming to apply Blockchain principles to agriculture. The latter will need many customers and a global market to become profitable and relevant. Businesses relying on technology are the exact opposite of family businesses: an exponential growth component, which leads almost without exception to the so-called Mergers & Acquisitions, meaning that global companies acquire them. An alternative would be going public on stock exchanges.

Following the same logic, seed money is only the initial stage of financing. Once startups approach the breakeven point (when costs and revenues are equal), investment funds or Venture Capital companies aiming to take good and profitable ideas even further set their eyes on them. For these categories, seed money comes with somewhat looser obligations, based on more relaxed economic calculations and more generous terms, but also with substantial benefits if they invest early.

A business that is just moving from the pen and paper stage to real-life implementation can only benefit from lower financing than one already turned to profit. The potential investors are fewer in numbers. I would list three main categories of investors:

1. Family and friends - are you ashamed to ask for financial support? If that's the case, you may not trust your idea enough. Get rid of complexes – you are not asking them for anything for free. On the contrary, you allow them to be involved in a business out of which they will have great financial satisfaction. In addition, they get to change the world alongside you.

In any case, this type of financing is essential and must be accessed as soon as possible. If you can't get money, then get services (from car transportation to graphic design, assuming you have a close one who can help you with something like that), but not for free, but in exchange for benefits.

2. Angel Investors/Business Angels - the category where I belong. Unlike family and friends, this includes investors with a very clear specialization: evaluating and optimizing businesses in their early stages of existence. Compared to Venture Capitalists, who are mainly profit-oriented, Angel Investors are more innovation-oriented and willing to take risks. In addition to financial support, a true Angel Investor provides you with business mentoring that will help a lot, as long as he has enough experience with startups.

3. Crowdfunding and peer-to-peer lending - crowdfunding - online financing from a large number of contributors on websites such as Kickstarter or Indiegogo - is an idea that has gained plenty of momentum in recent years. Crowdfunding is suitable for projects with an artistic or social component.

The people who finance crowdfunding projects get to enjoy various benefits, going as far as the product itself or limited editions of it. For example, the Lampster project, launched by two Romanian entrepreneurs, managed to raise a $1.3 million dollar financing.

On the other hand, peer-to-peer lending is a novelty for the financial markets, helping entrepreneurs get the support of many investors in the form of loans, via fintech platforms. We're working on such a feature for CAPEX.com too.

A business that is just moving from the pen and paper stage to real-life implementation can only benefit from lower financing than one already turned to profit. The potential investors are fewer in numbers. I would list three main categories of investors:

1. Family and friends - are you ashamed to ask for financial support? If that's the case, you may not trust your idea enough. Get rid of complexes – you are not asking them for anything for free. On the contrary, you allow them to be involved in a business out of which they will have great financial satisfaction. In addition, they get to change the world alongside you.

In any case, this type of financing is essential and must be accessed as soon as possible. If you can't get money, then get services (from car transportation to graphic design, assuming you have a close one who can help you with something like that), but not for free, but in exchange for benefits.

2. Angel Investors/Business Angels - the category where I belong. Unlike family and friends, this includes investors with a very clear specialization: evaluating and optimizing businesses in their early stages of existence. Compared to Venture Capitalists, who are mainly profit-oriented, Angel Investors are more innovation-oriented and willing to take risks. In addition to financial support, a true Angel Investor provides you with business mentoring that will help a lot, as long as he has enough experience with startups.

3. Crowdfunding and peer-to-peer lending - crowdfunding - online financing from a large number of contributors on websites such as Kickstarter or Indiegogo - is an idea that has gained plenty of momentum in recent years. Crowdfunding is suitable for projects with an artistic or social component.

The people who finance crowdfunding projects get to enjoy various benefits, going as far as the product itself or limited editions of it. For example, the Lampster project, launched by two Romanian entrepreneurs, managed to raise a $1.3 million dollar financing.

On the other hand, peer-to-peer lending is a novelty for the financial markets, helping entrepreneurs get the support of many investors in the form of loans, via fintech platforms. We're working on such a feature for CAPEX.com too.

The benefits that Angel Investors or other types of investors get can be grouped into two main categories:

Shares in the company. The stakeholder status (usually minor stakeholder) will be rewarding during subsequent financing rounds, such as Venture Capital, stock exchange listings or when the business is sold to a global company.

Return of investment. It takes place after the business becomes profitable; in this system, the bonds are the ones confirming the seed funding contribution.

I do not think it is necessary to get into more details here, even though agreements between investors and entrepreneurs can be very diverse. The more important thing is for them to be clear, as financial and accounting instruments are easily identifiable later on.

The benefits that Angel Investors or other types of investors get can be grouped into two main categories:

Shares in the company. The stakeholder status (usually minor stakeholder) will be rewarding during subsequent financing rounds, such as Venture Capital, stock exchange listings or when the business is sold to a global company.

Return of investment. It takes place after the business becomes profitable; in this system, the bonds are the ones confirming the seed funding contribution.

I do not think it is necessary to get into more details here, even though agreements between investors and entrepreneurs can be very diverse. The more important thing is for them to be clear, as financial and accounting instruments are easily identifiable later on.

If you are surprised I did not make any bank references, you should know that my idea about startups began to take shape after the Dot Com bubble burst (the collapse of internet companies) around the year 2000 and after the economic crisis of 2007-2009.

Having experienced these two unfortunate events, banks have become much more reluctant to provide financing, both in terms of interest rates and legal obligations. Determined entrepreneurs turned to other categories of investors - and for a good reason, because their momentum helped create or expand innovative capital markets segments, where people with money could put their financial resources to work.

You need to think about this when you apply for a financing round: if your idea is convincing enough, you will get the money, but you will need to give something back in the long run. Also, keep in mind there are enough failing startups as well. However, seed money is part of a business area where the win-win idea (both sides win) has its place.

If you are surprised I did not make any bank references, you should know that my idea about startups began to take shape after the Dot Com bubble burst (the collapse of internet companies) around the year 2000 and after the economic crisis of 2007-2009.

Having experienced these two unfortunate events, banks have become much more reluctant to provide financing, both in terms of interest rates and legal obligations. Determined entrepreneurs turned to other categories of investors - and for a good reason, because their momentum helped create or expand innovative capital markets segments, where people with money could put their financial resources to work.

You need to think about this when you apply for a financing round: if your idea is convincing enough, you will get the money, but you will need to give something back in the long run. Also, keep in mind there are enough failing startups as well. However, seed money is part of a business area where the win-win idea (both sides win) has its place.