About Me

I consider risk my core expertise.

Over 10 years of experience in developing companies with global reach,

currently focusing on technology start-ups.

My favorite quote is

“Luck is what happens when preparation meets opportunity”

From this point of view, I consider myself a lucky man.

I am an angel investor, an entrepreneur with multiple successful exits, and the founder and managing partner of a multinational company. I had opportunities, and a lot of preparation to get here.

Growing up in a small town, my first education was the one I received at home, as a child and teenager – and it was all about hard work and being responsible. I moved to Bucharest when I started college, I studied International Economic Relations at the Bucharest Academy of Economic Studies, complete with a Masters’, and also got a degree in Law – as I thought the two of them complete each other.

I started working early, while still studying, first with small IT projects – but the real breakthrough came when I started work for a multinational company operating globally in online trading on financial markets. For me it was fascinating – not only working in a multinational company, but especially the online trading and financial markets. Here I learned the challenges of a truly global business, how to innovate technologically and most of all what “business development” means.

Hard work always pays off, and as my results were very good for the company, “preparation met opportunity”.

I was offered a stock option plan, so when the company was acquired by one of the giants of the industry, for a deal which was substantial, that was my first successful exit.

I continued in the same industry as the CEO of the Romanian branch of a similar company. I applied all I knew from my first experience and it paid off. I developed the business, improved the technology, marketing and overall business processes. The success gave me the option to pursue my entrepreneurial dream of “having my own company”.

In parallel, I started investing in technological startups and real estate – as I’m always focused on innovation and creating “real” value. I like to invest in local startups with potential, but also in international innovative ideas.

I founded another fintech which is now a global multinational company, with hundreds of employees and offices in countries on all continents. I’m working every day on this project, mentoring and motivating my team by applying all that I’ve learned in the past.

My passion will always remain the financial markets. It’s a dynamic and engaging field, and like me, “always on”. I’m deeply connected with the markets not only through my main business, but in all my life – as I am a long-time investor, and an active trader.

3 Major Exists

Licenses & Certifications

STANFORD UNIVERSITY

Various online modules on Management and Finance

EUROPEAN INSTITUTE ON MANAGEMENT

AND FINANCE (EIMF)

International Introduction to Securities and Investment

Compliance in Marketing and Promoting of Financial Products

THE BUCHAREST UNIVERSITY OF ECONOMIC STUDIES

International Business Communication – ASE

Master in International Business Communication – ASE

HARVARD BUSINESS SCHOOL

HARVARD BUSINESS SCHOOL Online courses on different topics such as Leadership Principles,Alternative Investments etc.

CERTIFIED AGENT FOR FINANCIAL INVESTMENT SERVICES (ASIF)

Issuing authority Autoritatea de Supraveghere Financiara Issued 2009 – no expiration date

ECOLOGICAL UNIVERSITY OF BUCHAREST

Law Degree

As I transitioned from the “corporate world” to entrepreneurship and investing, my aim was always to find businesses in which I can invest not only capital, but also to provide know how and support for the entrepreneurs and their teams. I have a hands-on approach, as I want to apply all the knowledge and my experience, by mentoring and working along the team. I already have proven success in taking companies “from scratch” and growing them to successful exits, by hard work and data driven decisions, so this is a motivation that I want to bring in every team I join by investing in the business.

In the past, ideas and investments were judged by “instinct” – and I was the only deciding factor. I still trust my instincts, but with time and experience, I now choose to rely on a team of experts and data driven decisions. More about the way I invest today can be found on my dedicated TVP Family Office page.

I strongly believe in the power of the Eastern European business environment to rise above the “outsource” paradigm and become an innovation hotspot. In the last few years, we’ve seen a plethora of new ideas that shaped the innovation landscape, not only in IT or Fintech but also in many other industry fields, like E-commerce, Medical or Real Estate. The number of SMEs, successful entrepreneurs and talented people is constantly growing, so I hope I can inspire other investors to join me and strengthen our place on the world’s business map.

Pitch me

Your start-up idea

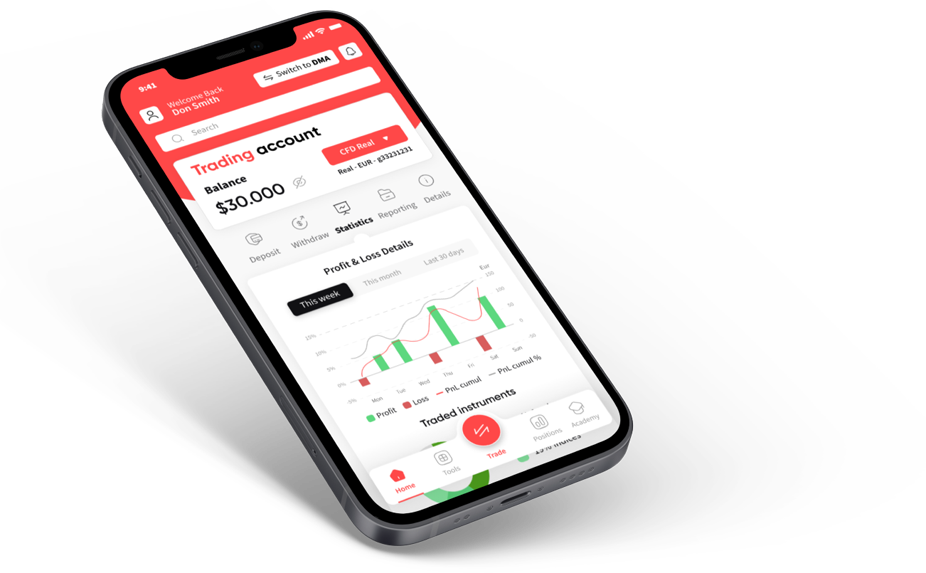

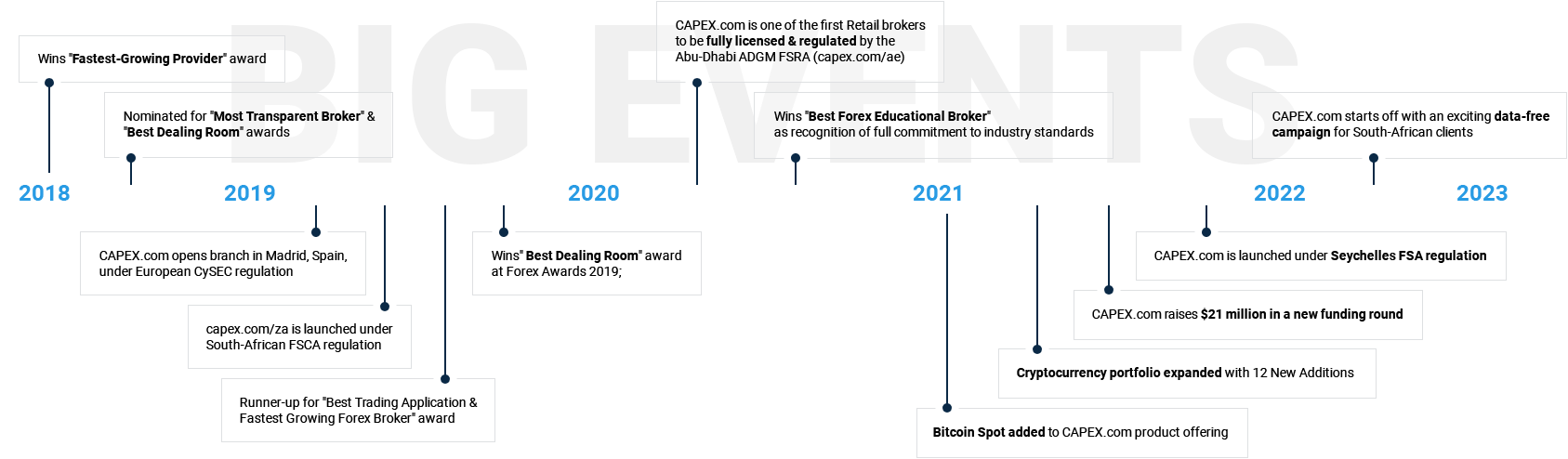

From the start we focused on providing superior customer service, so we took advantage of the latest technology to make investing simple for everyone. This approach worked – our growth was rapid, leading us to be recognized as the “Fastest-Growing Provider” right from the start.

Understanding the fintech scene well, me and my team strategized carefully. Year after year, we secured licenses from reputable regulators such as CySEC, FSCA, ADGM, and FSA, making CAPEX.com a fully regulated entity.

Since 2018 till now, CAPEX.com continually expanded its global footprint. We’ve established offices in more than seven countries across 4 continents. Our team has grown from a handful of people to over 450 dedicated professionals. We started with a few products and have now built a vast offering.

Today, CAPEX.com offers a wide range of over 2100 CFDs and more than 5000 stocks from 10 major exchanges. We are more than just a trading platform – we are a place for all traders, whether they are just starting out or have been trading for years.

Looking back, I’m proud of how far we’ve come.

But this is just the beginning.

Pitch me

Your start-up idea

Even if the concept of “giving back to the community” or “charity” (or whatever you want to call it) is not new – in fact, it’s as old as the known history, as every culture or religion known to man has a similar concept – in the modern age and especially in the last years it has gained more signification than ever.

I am dedicated to giving not only money, but also my time, each year, to support several causes, and I also try to make it as a recurrent contribution, so that the effects are compounded over time.

Pitch me

Your start-up idea