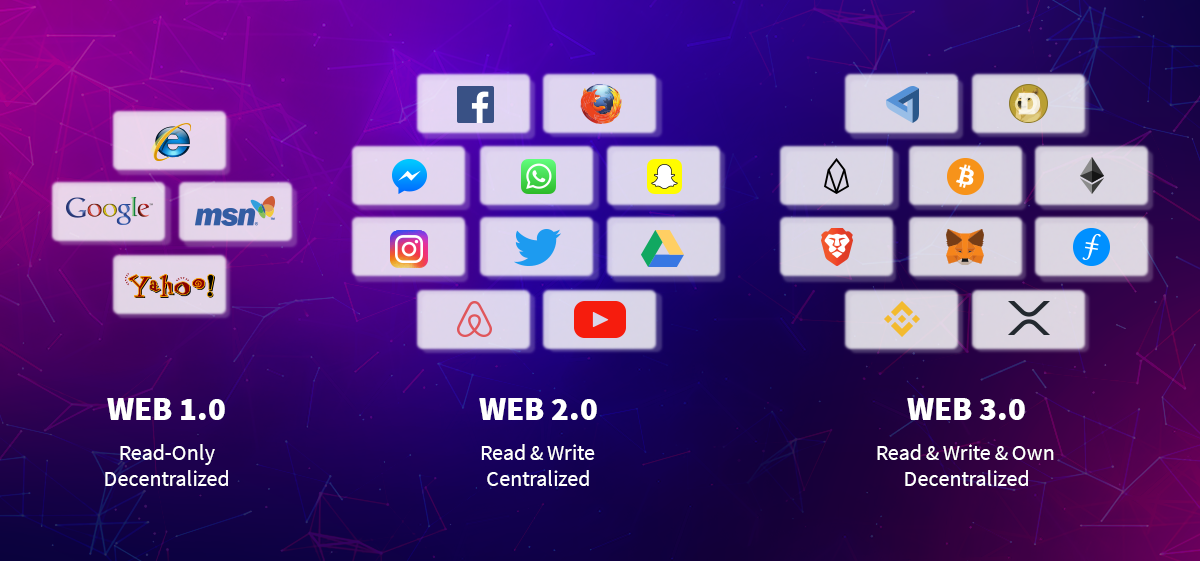

The dramatic transformation of the World Wide Web triggered web3.0 in 2021, powered by blockchain technology, artificial intelligence, and machine learning. It completely reshaped businesses and operating models, forcing traditional banking systems and financial service companies to step into uncharted territory.

Here’s my take on the challenges and opportunities of the fintech industry in the web3.0 era.

web3.0 – a game-changer for fintech companies

After Bitcoin was launched in 2009, the financial technology scene started to grow quickly. In the years that followed, we saw the rise of many new fintech companies and the development of innovative technologies that traditional financial institutions are now using.

However, the landscape is changing again with the development of web3.0. Businesses can already feel the impact of decentralized finance (DeFi), which is based on blockchain technology. We are about to witness a new wave of fintech innovation that will make the industry more efficient and accessible, bringing forth a new internet infrastructure that will change the rules of the game.

How does the fintech world benefit?

The third generation of internet services is disrupting the way people, businesses, and regulatory organizations are collaborating and planning to work together.

With the integration of DeFi at the heart of new technology, we have a completely new financial system outside of the central authorities’ control. The DeFi system’s protocols and platforms that provide financial services are decentralized and cannot be shut down by any bank.

DeFi is also more efficient than the traditional financial system. People can send money directly to someone without going through a mediator. All the transactions are recorded on the blockchain and are visible to everyone with an Internet connection, making it more transparent and accessible.

Due to the advantages of the DeFi systems, the benefits of web3.0 can be quite impressive. For example, web3.0 makes the onboarding process more user-friendly. Every single evolution of the web will ensure even more trustworthiness for businesses by eliminating security issues of storing any data.

With web3.0’s list of contributing technologies, fintech companies can automate processes to perform customer journey mapping and allocate resources more efficiently to meet client demands, facilitate better engagement, and encourage enduring loyalty.

Artificial intelligence, IoT (Internet of things), and blockchain technology – the three crucial foundations of web3.0 – ensure real-time, secure, and transparent transactions for FinTech companies worldwide.

web3.0 reduces account suspensions and denial of distributed services, helping financial technology businesses lower the cost of managing server failures or other similar issues.

What about the challenges for the fintech industry in the new digital era?

Without challenges, there would be no opportunity to evolve. The new technologies have many benefits, but they also pose some challenges.

• Firstly, DeFi is still in the early stages of development. This means that some bugs and glitches need to be fixed.

• Secondly, blockchain technology is constantly evolving. This means the protocols and platforms that provide financial services can change quickly, taking businesses and entrepreneurs by surprise.

• Thirdly, Defi is a global system, so the rules and regulations that apply to the traditional financial system do not necessarily apply to the DeFi system. For example, in the conventional financial system, there are KYC (know your customer) and AML (anti-money laundering) regulations that banks must follow. However, in the DeFi system, these regulations do not necessarily apply.

What does the future of fintech hold under web3.0?

With the arrival of decentralized finance (DeFi), we see a new wave of financial applications and services built on the Ethereum blockchain, leading to many fresh possibilities for interacting with and using financial services. Under web3.0, we see the shift changing from traditional financial infrastructure, centralized and controlled by a few institutions, towards a more decentralized and open system. This will provide more opportunities for innovation and ultimately pave the way for a more inclusive and democratic financial system to emerge.

We are only just scratching what is possible now with these technologies. In the future, I believe they will become the primary way that people interact with financial services. Traditional infrastructure will become increasingly obsolete, and we will see a change towards a more open, inclusive, and democratic financial system.

What is CAPEX.com’s position on early web3.0 technology adoption?

Democratization is a significant component in trading nowadays, and I know that investors are frequently looking for new prospects. The 2022 economic outlook allows more people to start investing in assets that were not considered feasible just a few years ago. As one of the leading global fintech companies, it’s only natural for us to look into the future to offer new types of services related to DeFi.

You can follow me on Twitter and LinkedIn!